- United States

- /

- Banks

- /

- NasdaqGS:ZION

Zions Bancorporation (ZION) Profit Margin Improvement Reinforces Value Story Despite Modest Growth Outlook

Reviewed by Simply Wall St

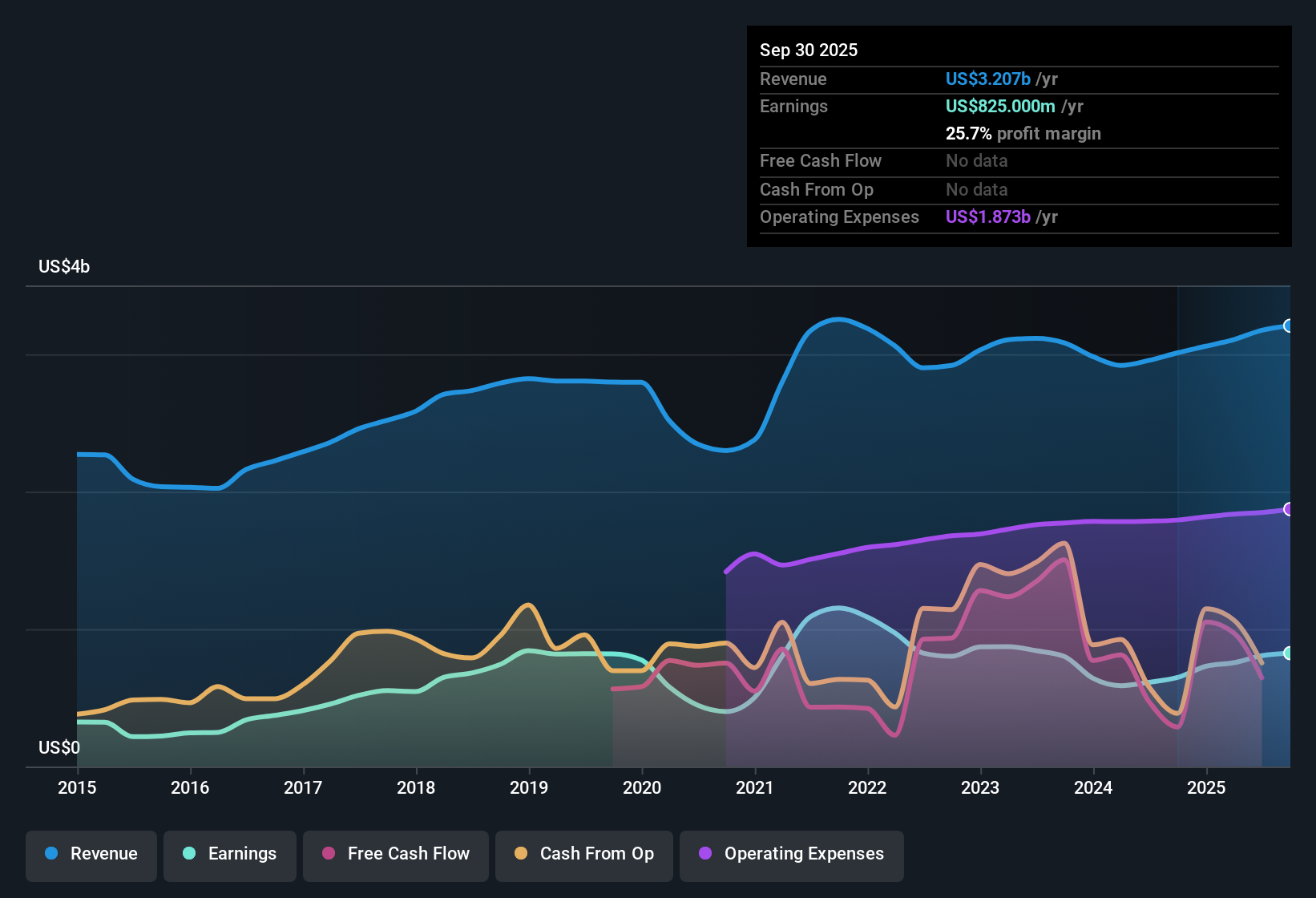

Zions Bancorporation National Association (ZION) posted a striking turnaround in earnings, with year-over-year profit growth of 27.3% reversing its five-year average annual decline of 2.3%. Net profit margins climbed to 25.7% from 21.5% the previous year, underscoring stronger profitability. While earnings quality and valuation look attractive, growth forecasts for both revenue (4.3% per year) and earnings (2.7% per year) remain below the wider US market’s pace. This suggests future outperformance may be modest and dependent on its relative value and dividend story.

See our full analysis for Zions Bancorporation National Association.Next, we will see how these performance figures hold up against the broader narratives in the market. Sometimes the headlines are reinforced, and in other cases, expectations might need to be recalibrated.

See what the community is saying about Zions Bancorporation National Association

Digital Investments Fuel Noninterest Income

- Noninterest income streams are rising as Zions deepens investment in digital banking platforms and advisory services, helping reduce over-reliance on traditional lending and mitigate cyclical risks inherent to classic bank models.

- Analysts' consensus view notes that targeted growth across commercial segments and new digital products is expanding and diversifying fee-based revenues.

- Recent platform upgrades and advisory offerings provide a scalable source of higher-margin, recurring income.

- Efficiency gains from technology investments are likely supporting margin stability even as revenue growth lags industry peers.

- Consensus narrative argues these shifts stabilize long-term earnings, suggesting less volatility ahead for the bottom line. 📊 Read the full Zions Bancorporation National Association Consensus Narrative.

Commercial Real Estate Exposure Remains a Watchpoint

- Commercial real estate (CRE) loans make up 22% of total lending, exposing Zions to sector risks should property values in core regions like Nevada, California, Texas, or Utah decline significantly.

- Analysts’ consensus maintains that while the portfolio is granular and performing well now.

- A widespread CRE downturn could elevate loan losses and pressure capital ratios.

- Regional economic dips or increased regulatory costs could further add to earnings volatility despite recent stability.

Valuation Still Discounts Modest Growth Prospects

- The share price of $52.70 is below both the internally estimated DCF fair value ($117.31) and the analyst target price ($61.68), while the 9.4x price-to-earnings ratio remains below peers and the industry, reinforcing that the market is pricing in only muted future growth despite recent profitability gains.

- Analysts' consensus perspective highlights that for the stock to reach the consensus target, investors would need to believe in revenue reaching $3.5 billion and a PE multiple of 13.8x by 2028.

- A significant gap remains between current and target valuations given Zions’ lower-than-market expected growth of 4.3% per year for revenue and 2.7% per year for earnings.

- The value case leans more on relative peer and sector positioning than on expectations of significant upward revisions to growth outlooks.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Zions Bancorporation National Association on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you interpret the figures through a different lens? Share your viewpoint and craft your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Zions Bancorporation National Association.

See What Else Is Out There

Despite recent profitability gains, Zions’ slower projected revenue and earnings growth compared to peers signals its future performance may remain subdued.

If you want to focus on companies showing steady progress and more consistent upside, look for healthier growth rates and proven stability among stable growth stocks screener (2088 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zions Bancorporation National Association might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZION

Zions Bancorporation National Association

Provides various banking products and related services primarily in the states of Arizona, California, Colorado, Idaho, Nevada, New Mexico, Oregon, Texas, Utah, Washington, and Wyoming.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives