- United States

- /

- Banks

- /

- NasdaqCM:WMPN

William Penn Bancorporation (NASDAQ:WMPN) Will Pay A Dividend Of $0.03

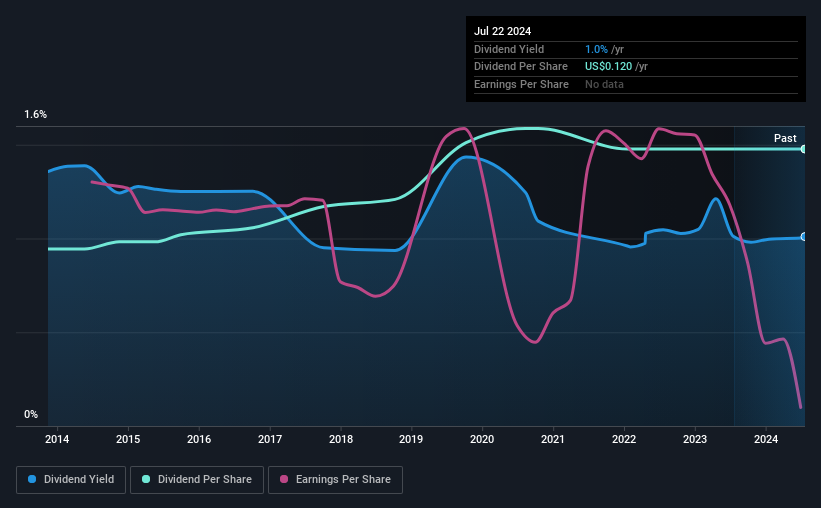

William Penn Bancorporation (NASDAQ:WMPN) has announced that it will pay a dividend of $0.03 per share on the 8th of August. This payment means the dividend yield will be 1.0%, which is below the average for the industry.

See our latest analysis for William Penn Bancorporation

William Penn Bancorporation Will Pay Out More Than It Is Earning

If it is predictable over a long period, even low dividend yields can be attractive.

William Penn Bancorporation has established itself as a dividend paying company with over 10 years history of distributing earnings to shareholders. Past distributions unfortunately do not guarantee future ones, and William Penn Bancorporation's last earnings report actually showed that the company went over its net earnings in its total dividend distribution. This is an alarming sign that could mean that William Penn Bancorporation's dividend at its current rate may no longer be sustainable for longer.

EPS is set to fall by 42.6% over the next 12 months if recent trends continue. If the dividend continues along the path it has been on recently, the payout ratio in 12 months could be 1,065%, which is definitely a bit high to be sustainable going forward.

William Penn Bancorporation Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The annual payment during the last 10 years was $0.0767 in 2014, and the most recent fiscal year payment was $0.12. This implies that the company grew its distributions at a yearly rate of about 4.6% over that duration. Slow and steady dividend growth might not sound that exciting, but dividends have been stable for ten years, which we think makes this a fairly attractive offer.

The Dividend Has Limited Growth Potential

Investors could be attracted to the stock based on the quality of its payment history. Unfortunately things aren't as good as they seem. William Penn Bancorporation's EPS has fallen by approximately 43% per year during the past five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough.

William Penn Bancorporation's Dividend Doesn't Look Sustainable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about William Penn Bancorporation's payments, as there could be some issues with sustaining them into the future. We can't deny that the payments have been very stable, but we are a little bit worried about the very high payout ratio. Overall, we don't think this company has the makings of a good income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. For example, we've identified 2 warning signs for William Penn Bancorporation (1 is potentially serious!) that you should be aware of before investing. Is William Penn Bancorporation not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if William Penn Bancorporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:WMPN

William Penn Bancorporation

Operates as the holding company for William Penn Bank that provides retail and commercial banking products and related financial services in the United States.

Flawless balance sheet unattractive dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)