- United States

- /

- Banks

- /

- NasdaqGS:WABC

We Discuss Why Westamerica Bancorporation's (NASDAQ:WABC) CEO May Deserve A Higher Pay Packet

Shareholders will be pleased by the robust performance of Westamerica Bancorporation (NASDAQ:WABC) recently and this will be kept in mind in the upcoming AGM on 22 April 2021. This would also be a chance for them to hear the board review the financial results, discuss future company strategy to further improve the business and vote on any resolutions such as executive remuneration. Here is our take on why we think CEO compensation is fair and may even warrant a raise.

Check out our latest analysis for Westamerica Bancorporation

Comparing Westamerica Bancorporation's CEO Compensation With the industry

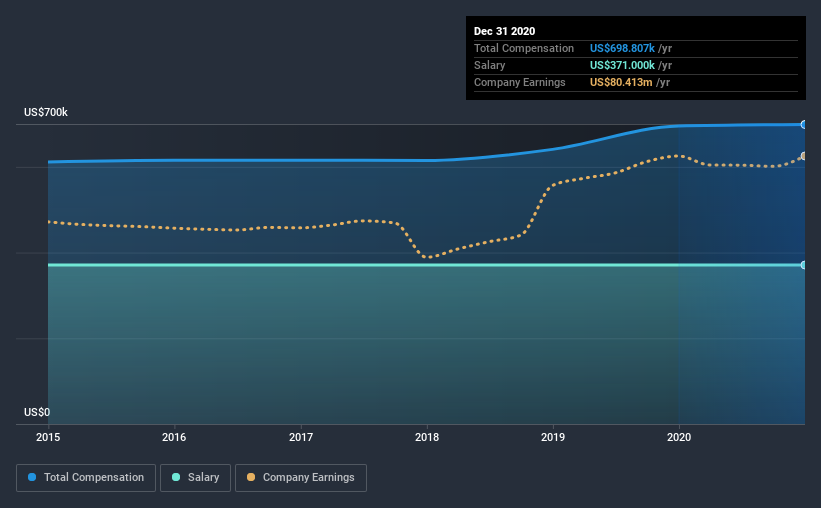

According to our data, Westamerica Bancorporation has a market capitalization of US$1.7b, and paid its CEO total annual compensation worth US$699k over the year to December 2020. That's mostly flat as compared to the prior year's compensation. We note that the salary of US$371.0k makes up a sizeable portion of the total compensation received by the CEO.

On comparing similar companies from the same industry with market caps ranging from US$1.0b to US$3.2b, we found that the median CEO total compensation was US$2.3m. This suggests that David Payne is paid below the industry median. Moreover, David Payne also holds US$57m worth of Westamerica Bancorporation stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$371k | US$371k | 53% |

| Other | US$328k | US$324k | 47% |

| Total Compensation | US$699k | US$695k | 100% |

Talking in terms of the industry, salary represented approximately 42% of total compensation out of all the companies we analyzed, while other remuneration made up 58% of the pie. Westamerica Bancorporation pays out 53% of remuneration in the form of a salary, significantly higher than the industry average. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Westamerica Bancorporation's Growth

Over the past three years, Westamerica Bancorporation has seen its earnings per share (EPS) grow by 16% per year. In the last year, its revenue changed by just 0.8%.

Shareholders would be glad to know that the company has improved itself over the last few years. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Westamerica Bancorporation Been A Good Investment?

Westamerica Bancorporation has generated a total shareholder return of 20% over three years, so most shareholders would be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

In Summary...

The company's overall performance, while not bad, could be better. If it manages to keep up the current streak, CEO remuneration could well be one of shareholders' least concerns. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 1 warning sign for Westamerica Bancorporation that investors should look into moving forward.

Important note: Westamerica Bancorporation is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade Westamerica Bancorporation, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Westamerica Bancorporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:WABC

Westamerica Bancorporation

Operates as a bank holding company for the Westamerica Bank that provides various banking products and services to individual and commercial customers.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives