- United States

- /

- Banks

- /

- NasdaqGS:WABC

Revenue Beat: Westamerica Bancorporation Exceeded Revenue Forecasts By 9.7% And Analysts Are Updating Their Estimates

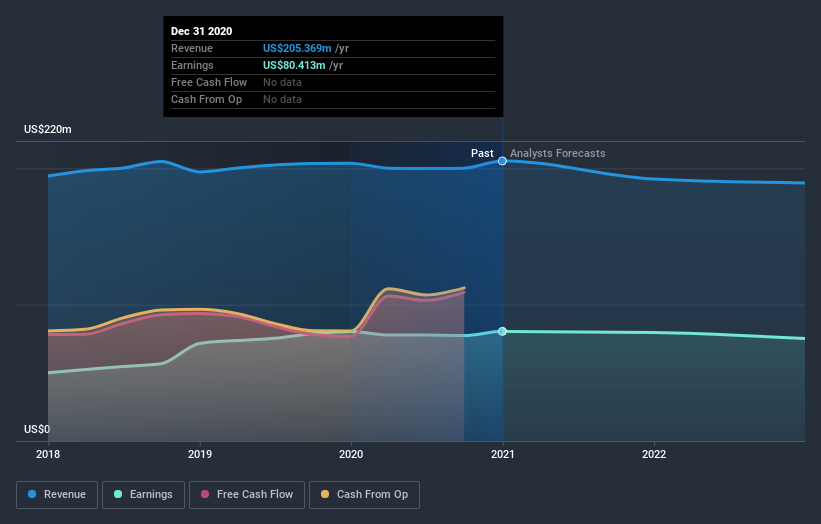

Westamerica Bancorporation (NASDAQ:WABC) just released its latest yearly results and things are looking bullish. Results were good overall, with revenues beating analyst predictions by 9.7% to hit US$205m. Statutory earnings per share (EPS) came in at US$2.98, some 5.3% above whatthe analysts had expected. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

Check out our latest analysis for Westamerica Bancorporation

Taking into account the latest results, the current consensus, from the three analysts covering Westamerica Bancorporation, is for revenues of US$192.1m in 2021, which would reflect a measurable 6.4% reduction in Westamerica Bancorporation's sales over the past 12 months. Statutory per-share earnings are expected to be US$2.95, roughly flat on the last 12 months. Yet prior to the latest earnings, the analysts had been anticipated revenues of US$192.4m and earnings per share (EPS) of US$2.87 in 2021. The analysts seems to have become more bullish on the business, judging by their new earnings per share estimates.

There's been no major changes to the consensus price target of US$67.33, suggesting that the improved earnings per share outlook is not enough to have a long-term positive impact on the stock's valuation. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. Currently, the most bullish analyst values Westamerica Bancorporation at US$72.00 per share, while the most bearish prices it at US$64.00. The narrow spread of estimates could suggest that the business' future is relatively easy to value, or thatthe analysts have a strong view on its prospects.

Of course, another way to look at these forecasts is to place them into context against the industry itself. These estimates imply that sales are expected to slow, with a forecast revenue decline of 6.4%, a significant reduction from annual growth of 2.9% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 6.2% next year. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Westamerica Bancorporation is expected to lag the wider industry.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards Westamerica Bancorporation following these results. Fortunately, the analysts also reconfirmed their revenue estimates, suggesting sales are tracking in line with expectations - although our data does suggest that Westamerica Bancorporation's revenues are expected to perform worse than the wider industry. The consensus price target held steady at US$67.33, with the latest estimates not enough to have an impact on their price targets.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have forecasts for Westamerica Bancorporation going out to 2022, and you can see them free on our platform here.

Plus, you should also learn about the 1 warning sign we've spotted with Westamerica Bancorporation .

When trading Westamerica Bancorporation or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Westamerica Bancorporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:WABC

Westamerica Bancorporation

Operates as a bank holding company for the Westamerica Bank that provides various banking products and services to individual and commercial customers.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives