- United States

- /

- Auto Components

- /

- NYSE:LCII

3 Top Dividend Stocks In US Yielding Over 3.4%

Reviewed by Simply Wall St

As the S&P 500 extends its winning streak amid anticipation of the Federal Reserve's interest rate decision, investors are increasingly looking for stable income sources in a fluctuating market. In this environment, dividend stocks yielding over 3.4% can provide both income and potential growth, making them an attractive option for those seeking reliable returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.79% | ★★★★★★ |

| WesBanco (NasdaqGS:WSBC) | 4.62% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.82% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.05% | ★★★★★★ |

| Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.80% | ★★★★★★ |

| OceanFirst Financial (NasdaqGS:OCFC) | 4.41% | ★★★★★★ |

| OTC Markets Group (OTCPK:OTCM) | 4.72% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.55% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 4.44% | ★★★★★★ |

| Virtus Investment Partners (NYSE:VRTS) | 4.36% | ★★★★★★ |

Click here to see the full list of 174 stocks from our Top US Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

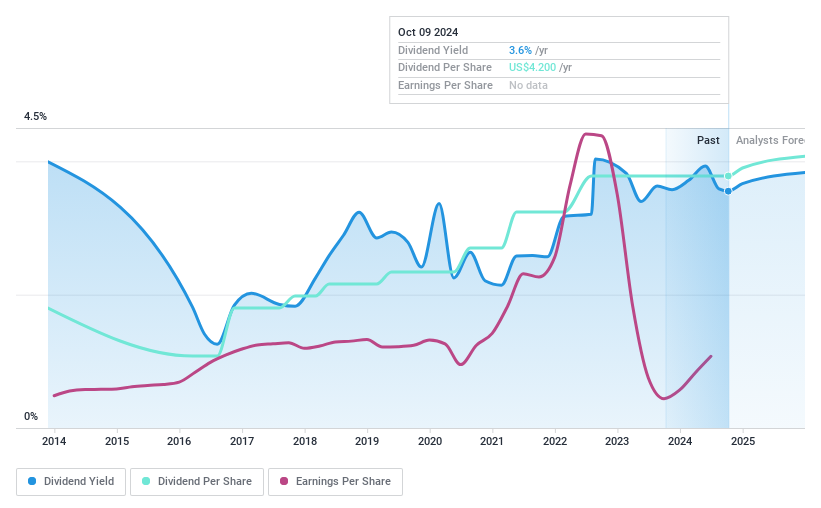

Dime Community Bancshares (NasdaqGS:DCOM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dime Community Bancshares, Inc., with a market cap of $1.02 billion, operates as the holding company for Dime Community Bank, providing various commercial banking and financial services.

Operations: Dime Community Bancshares, Inc. generates $320.39 million in revenue from its Community Banking segment.

Dividend Yield: 3.5%

Dime Community Bancshares offers a stable dividend yield of 3.48%, supported by a reasonable payout ratio of 64.6%. The company has consistently increased its dividends over the past decade, making it reliable for income investors. However, recent financial results show declining net income and profit margins, which could impact future payouts. Despite these challenges, earnings are forecast to grow annually by 37.01%, suggesting potential for sustained dividend coverage in the long term.

- Dive into the specifics of Dime Community Bancshares here with our thorough dividend report.

- The analysis detailed in our Dime Community Bancshares valuation report hints at an deflated share price compared to its estimated value.

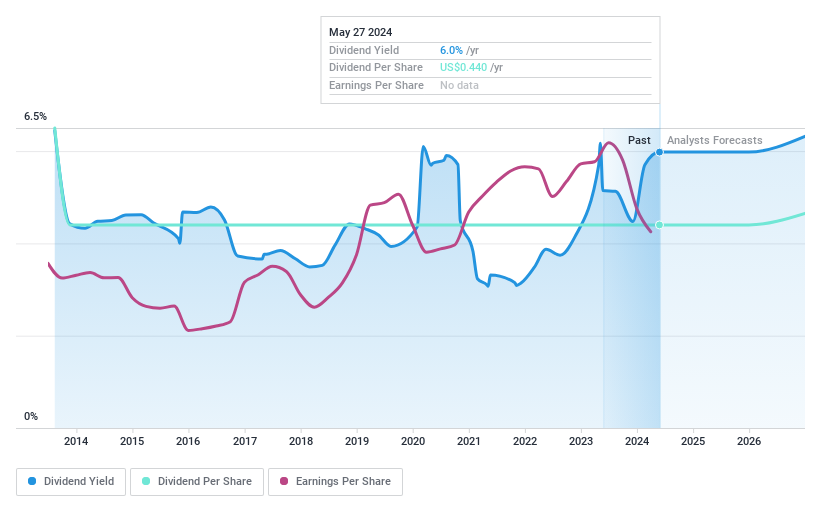

Valley National Bancorp (NasdaqGS:VLY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Valley National Bancorp, with a market cap of $4.44 billion, operates as the holding company for Valley National Bank offering commercial, private banking, retail, insurance and wealth management financial services.

Operations: Valley National Bancorp's revenue is primarily derived from Consumer Banking ($233.51 million), Commercial Banking ($1.37 billion), and Treasury and Corporate Other ($66.27 million).

Dividend Yield: 4.9%

Valley National Bancorp's dividend stability is notable, with a consistent payout of $0.11 per share recently affirmed for October 2024. Despite no growth in dividends over the past decade, the current yield of 4.93% places it among the top 25% in the U.S. market. The payout ratio of 61.6% indicates dividends are well-covered by earnings and forecasted to remain sustainable at a lower ratio in three years, despite recent declines in net income and profit margins.

- Click to explore a detailed breakdown of our findings in Valley National Bancorp's dividend report.

- Our expertly prepared valuation report Valley National Bancorp implies its share price may be lower than expected.

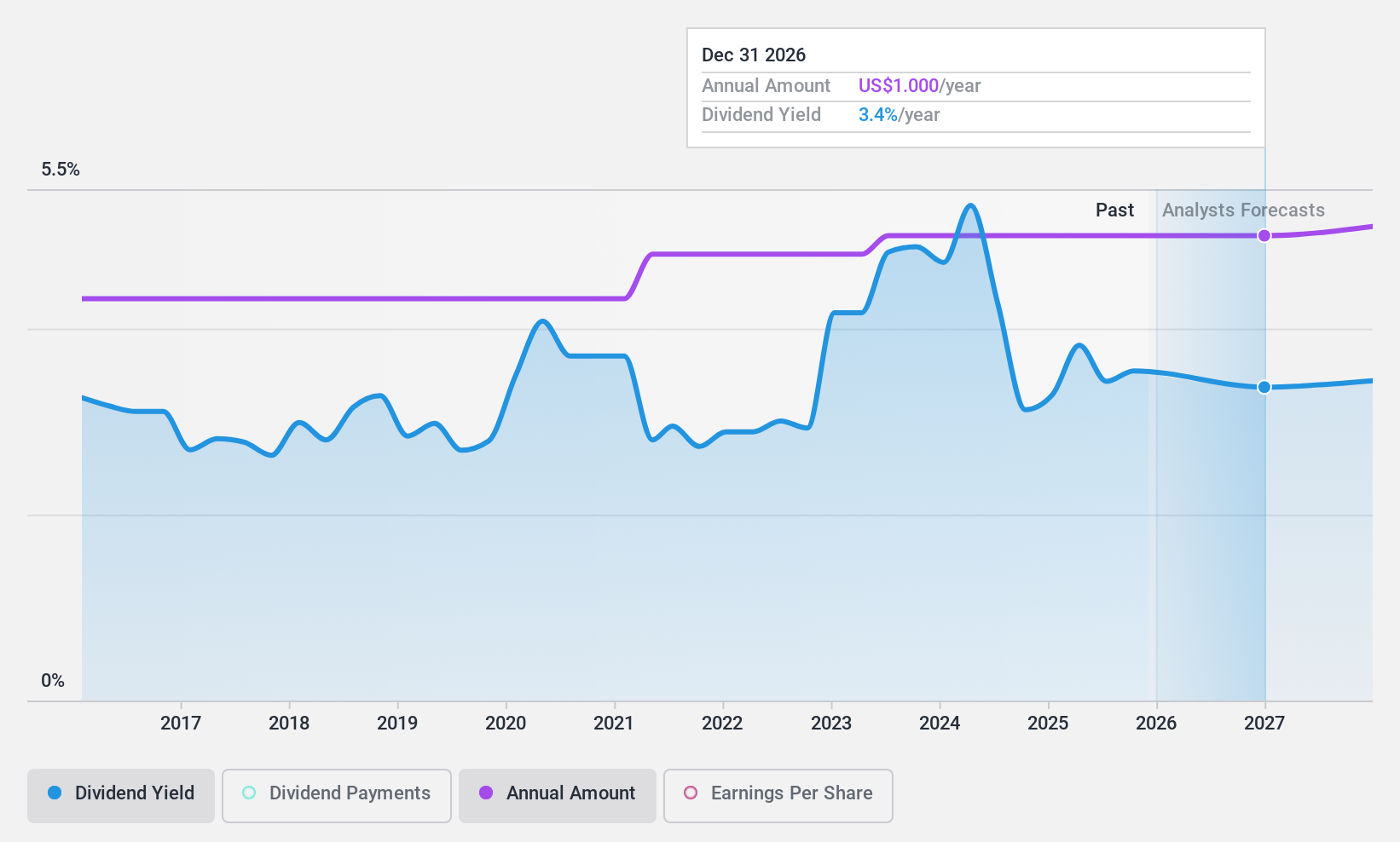

LCI Industries (NYSE:LCII)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: LCI Industries, with a market cap of $3.01 billion, manufactures and supplies engineered components for recreational vehicles (RVs) and adjacent industries both in the United States and internationally.

Operations: LCI Industries generates revenue from two primary segments: Aftermarket, which contributes $878.43 million, and Original Equipment Manufacturer (OEM), accounting for $2.94 billion.

Dividend Yield: 3.5%

LCI Industries has a stable dividend history over the past decade, with recent affirmations of a US$1.05 per share quarterly payout. The dividends are well-covered by both earnings (payout ratio: 87.8%) and cash flows (cash payout ratio: 27.5%). While the current yield of 3.47% is below the top tier in the U.S., earnings growth of 42.7% last year and forecasted annual growth of 27.39% support potential future increases despite high debt levels and recent index exclusions.

- Take a closer look at LCI Industries' potential here in our dividend report.

- Upon reviewing our latest valuation report, LCI Industries' share price might be too optimistic.

Where To Now?

- Discover the full array of 174 Top US Dividend Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LCII

LCI Industries

Manufactures and supplies engineered components for the manufacturers of recreational vehicles (RVs) and adjacent industries in the United States and internationally.

Proven track record with adequate balance sheet.