- United States

- /

- Banks

- /

- NasdaqGS:UMBF

Is UMB Financial a Bargain After Recent Five-Year Share Price Surge?

Reviewed by Bailey Pemberton

Thinking about what to do with your UMB Financial shares or considering a move? It is a classic crossroads moment for investors, especially with the market’s mood swings in the last month. UMB Financial’s stock has slipped by 5.4% over the past week and dipped 7.4% for the month. But step back, and the year-to-date gain edges positive at 1.1%. Even more impressive, the stock has climbed 5.2% in the last year and soared 120% over the past five years. Those kinds of returns do not just happen by chance. They typically signal shifting perceptions about a company’s risk level or growth prospects.

When you zoom in on what is driving these moves, wider market trends such as sector rotation and changes in interest rate sentiment have definitely played a part. Recent resilience in the financial sector, paired with investor appetite for banks with diversified business models, has helped UMB stay in the conversation for long-term growth. That said, anytime a stock posts both resilience and short-term pullbacks, it raises the question of value: is UMB Financial priced attractively for new buyers and current holders alike?

To find out, let’s dig into its valuation. By running UMB Financial through six classic valuation checks, the company scores a 4. That means UMB Financial is undervalued by four separate measures, a solid signal for value-seekers. Of course, some methods are better than others when it comes to really understanding a stock’s worth. Next, we will break down those valuation approaches, and at the end, reveal the most insightful way to get to the heart of what UMB is truly worth today.

Why UMB Financial is lagging behind its peers

Approach 1: UMB Financial Excess Returns Analysis

The Excess Returns valuation model helps determine a company's intrinsic value by evaluating how much return it generates above the cost of its equity capital. In simple terms, it asks: "How much is UMB Financial really earning, after covering what shareholders expect as a reasonable return?"

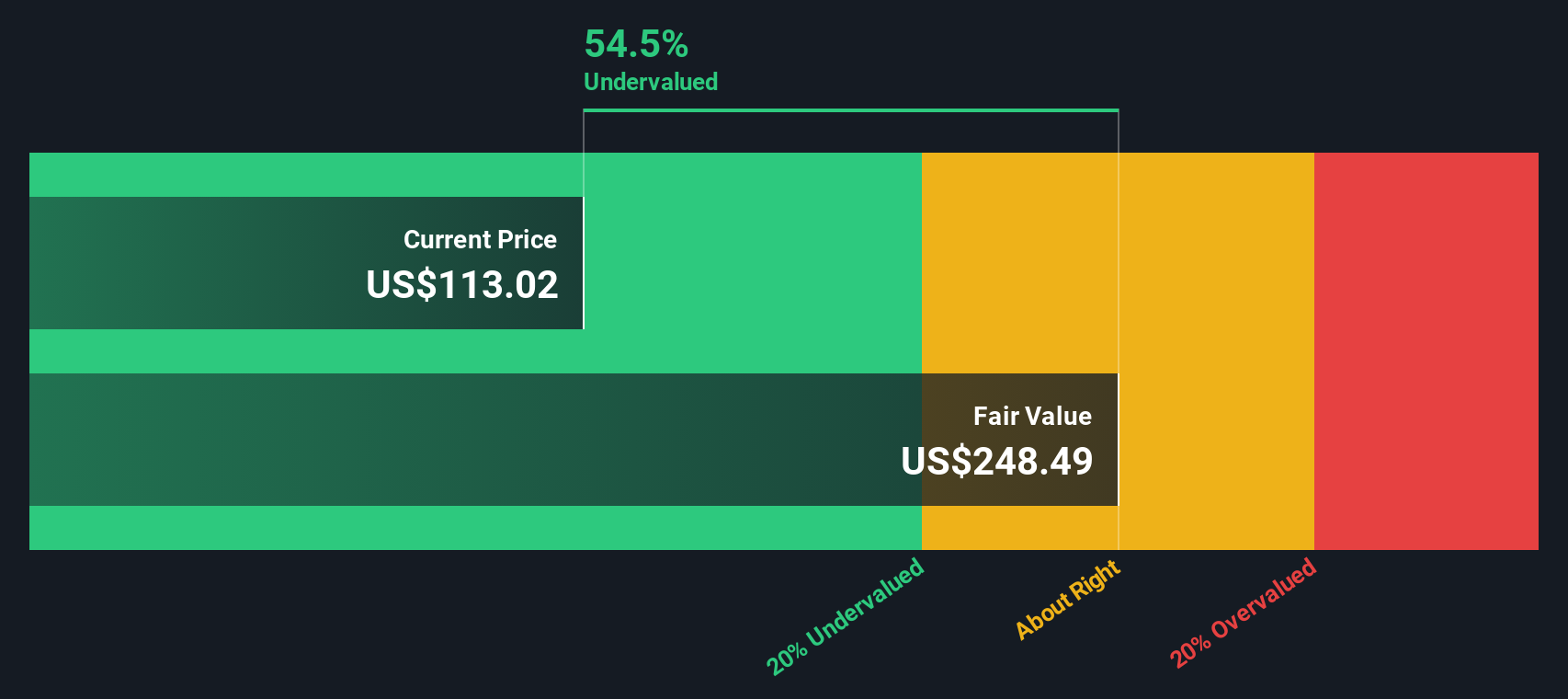

Currently, UMB Financial has a Book Value of $90.63 per share and a Stable Earnings Per Share (EPS) of $12.52, calculated from weighted future Return on Equity projections by nine analysts. The company's Cost of Equity is $7.13 per share, resulting in an Excess Return of $5.39 per share. This means UMB is producing profit well above its capital costs, with an average Return on Equity of 11.97%. Analysts expect its Stable Book Value to rise to $104.58 per share in future years, which signals confidence in continued growth.

Based on these calculations, the Excess Returns model estimates UMB Financial’s intrinsic value at $248.65 per share. When compared to its current market price, this suggests the stock is trading at a 54.5% discount to its fair value. In other words, UMB Financial appears to be significantly undervalued by this approach.

Result: UNDERVALUED

Our Excess Returns analysis suggests UMB Financial is undervalued by 54.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: UMB Financial Price vs Earnings

The price-to-earnings (PE) ratio is one of the most widely respected ways to value profitable companies like UMB Financial. It links the company’s current share price to its actual earnings power. In simple terms, it shows how much investors are willing to pay for each dollar of the company’s profits.

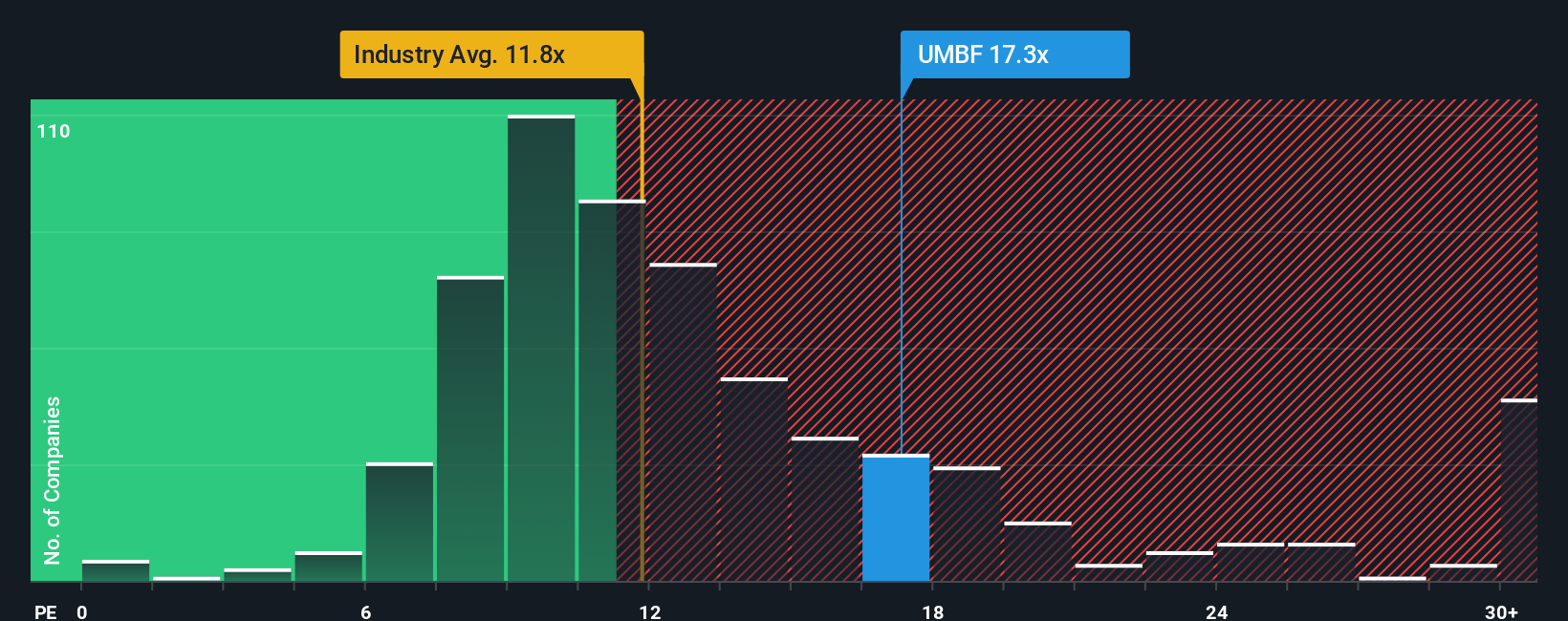

What counts as a "fair" PE ratio depends on factors such as how fast the company is expected to grow and how risky its business is compared to others. Faster-growing or lower-risk companies generally command a higher PE multiple, while those with slower expected growth or higher risk may see lower multiples assigned by the market.

UMB Financial currently trades at a PE ratio of 16.4x. For context, the average PE among its banking peers is 11.8x and the industry average sits at 11.3x. On face value, this suggests investors are willing to pay a premium for UMB, perhaps due to its growth track record or perceived quality. However, Simply Wall St’s Fair Ratio, which factors in the company’s unique earnings growth prospects, profit margins, risk, market cap, and industry trends, is 17.0x. This Fair Ratio is a more holistic metric as it goes beyond simple comparisons by incorporating the broader picture of what makes UMB Financial distinct.

Comparing UMB's current PE of 16.4x to the Fair Ratio of 17.0x, the difference is minimal. This suggests the stock is trading right around its calculated fair value based on fundamental factors.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your UMB Financial Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story for a company, letting you connect your assumptions about UMB Financial’s future, such as expected revenue growth and profit margins, with your view of fair value. It bridges the gap between the company’s big picture and the financial details, combining them into a single, actionable investment case.

Narratives are simple yet powerful: you outline your forecast, the tool instantly works out the fair value, and you can see how your view compares to others in the Community page on Simply Wall St, a platform trusted by millions of investors. This lets you check whether your Narrative implies UMB Financial is a buy or a sell by comparing your fair value to the live share price. Your investment decisions are always anchored in your own perspective, not just consensus estimates.

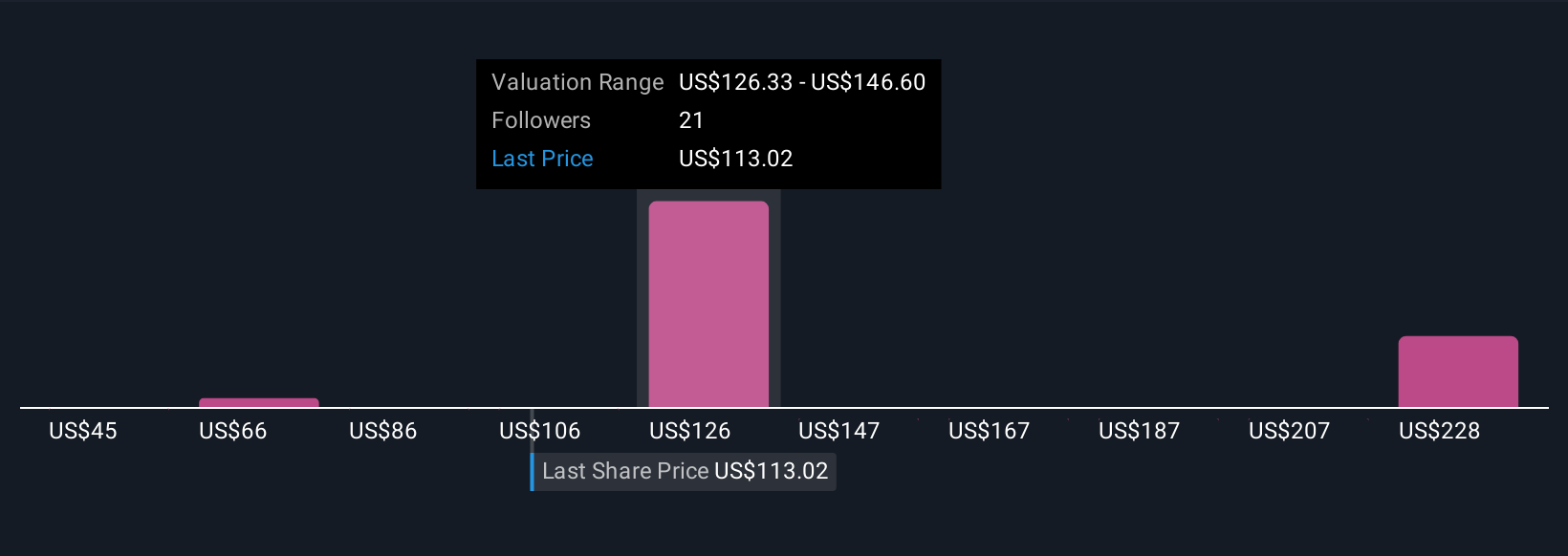

Most importantly, Narratives update as new earnings reports or key news breaks, keeping your view relevant. For example, some investors currently have a bullish Narrative on UMB Financial, seeing fair value at $150 per share based on strong operational improvements, while others are cautious, setting fair value closer to $120 due to regional and integration risks. Narratives let investors clearly see and test both sides of the story, so you can make smarter, more confident decisions for yourself.

Do you think there's more to the story for UMB Financial? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UMBF

UMB Financial

Operates as the bank holding company that provides banking services and asset servicing in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives