- United States

- /

- Banks

- /

- NasdaqGS:UMBF

Assessing UMB Financial (UMBF): Is the Stock Undervalued After Recent Share Price Dip?

Reviewed by Kshitija Bhandaru

UMB Financial (UMBF) shares have dipped by almost 2% over the past day, stirring up questions about what is driving the movement. Investors may be watching recent market trends closely, looking for any developments around the regional banking sector that could offer some context.

See our latest analysis for UMB Financial.

With UMB Financial’s share price ticking down 1.83% today and slightly lower over the past month, it’s worth noting that the stock has shown more strength over the longer run. Despite recent softness, the overall momentum remains intact as seen in its year-to-date share price return of 3.99% and a solid 1-year total shareholder return of 6.05%. In addition, a standout 121.68% total return over five years highlights sustained value creation for investors.

If you’re curious where else strong growth and investor alignment are showing up, now’s a perfect moment to broaden your view and discover fast growing stocks with high insider ownership

But with shares still well below the average analyst target and fundamentals showing double-digit revenue growth, should investors see UMB Financial as undervalued? Or is the market accurately anticipating the company's future trajectory?

Most Popular Narrative: 15.6% Undervalued

UMB Financial’s fair value, according to the most widely followed narrative, is estimated at $137.75, which is substantially higher than the last close of $116.25. This suggests forward-looking optimism by analysts who see more upside in the shares given the company’s current execution and future growth strategy.

The successful integration of the Heartland (HTLF) acquisition, including vendor consolidation and conversion to the UMB platform, is expected to unlock substantial cost savings ($124 million targeted, most of which will be realized by early 2026). This should materially improve operating leverage and expand net margins.

Curious what bold projections are embedded in this valuation? The narrative hinges on ambitious growth and margin expansion assumptions. Can the bank pull off this operational leap? Dive in to see what underpins the analysts’ optimistic scenario.

Result: Fair Value of $137.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained regional economic weakness or setbacks in integrating Heartland could challenge UMB Financial’s bullish outlook and keep margins under pressure.

Find out about the key risks to this UMB Financial narrative.

Another View: Our DCF Model Sees Even More Upside

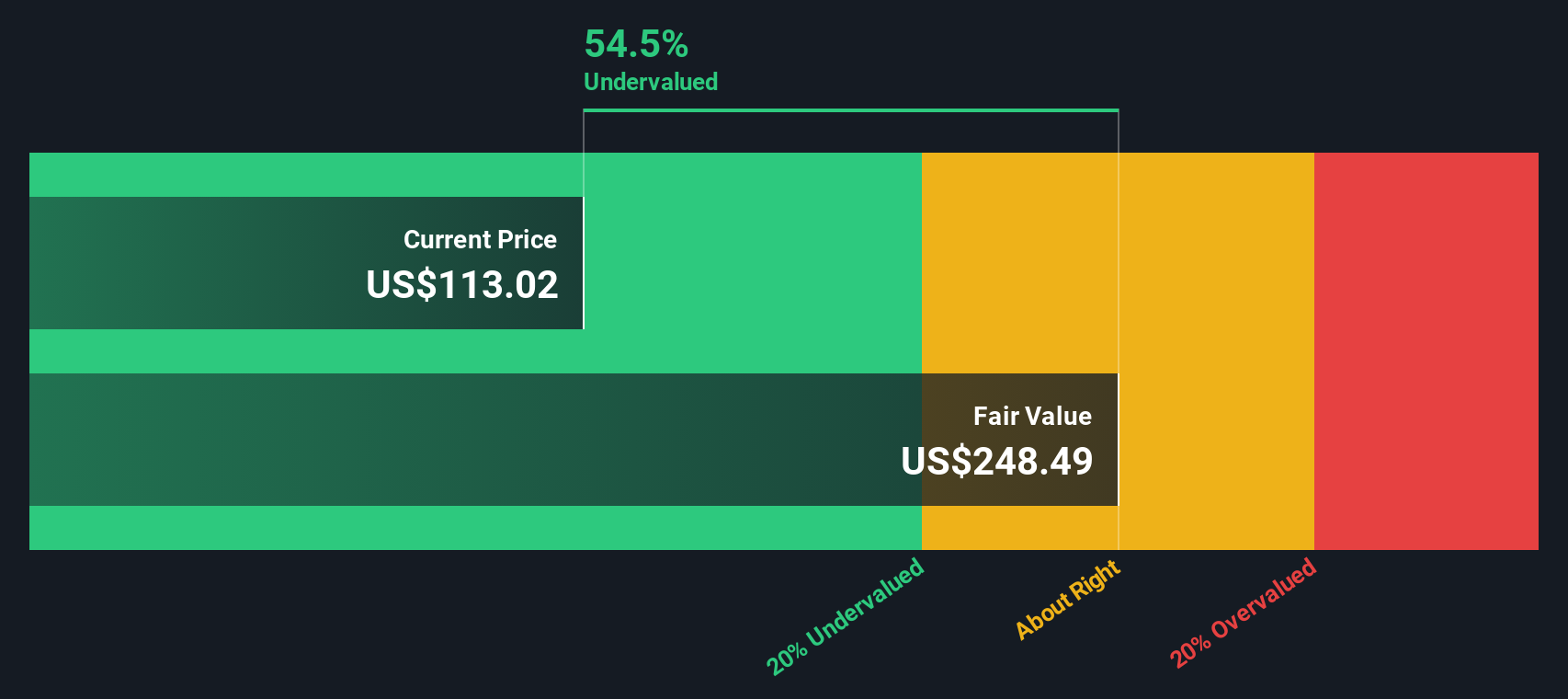

While the analyst consensus values UMB Financial close to its current trading range, our SWS DCF model presents a more dramatic picture of undervaluation. According to the DCF approach, the stock’s fair value is a striking $247.65, which is more than double its current trading price. Could the market be overlooking the long-term cash flow strength just below the surface?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own UMB Financial Narrative

If you’re not convinced by these conclusions or want to dig deeper, you can use the available data and craft your own perspective in just a few minutes. Do it your way

A great starting point for your UMB Financial research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock new opportunities now and get ahead of emerging trends before they hit the mainstream. Your perfect stock could be waiting just one click away.

- Capture recurring income and stability by exploring these 18 dividend stocks with yields > 3%, where you will find the market’s most promising high-yield payers above 3%.

- Spot breakthrough innovation early by checking out these 24 AI penny stocks, which are powering the future with advancements in artificial intelligence.

- Benefit from market mispricings and strong fundamentals by reviewing these 874 undervalued stocks based on cash flows, featuring stocks that are trading below their intrinsic value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UMBF

UMB Financial

Operates as the bank holding company that provides banking services and asset servicing in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives