- United States

- /

- Banks

- /

- NasdaqGS:UBSI

United Bankshares (UBSI) Net Profit Margins Widen, Reinforcing Defensive Narrative After Strong Earnings Growth

Reviewed by Simply Wall St

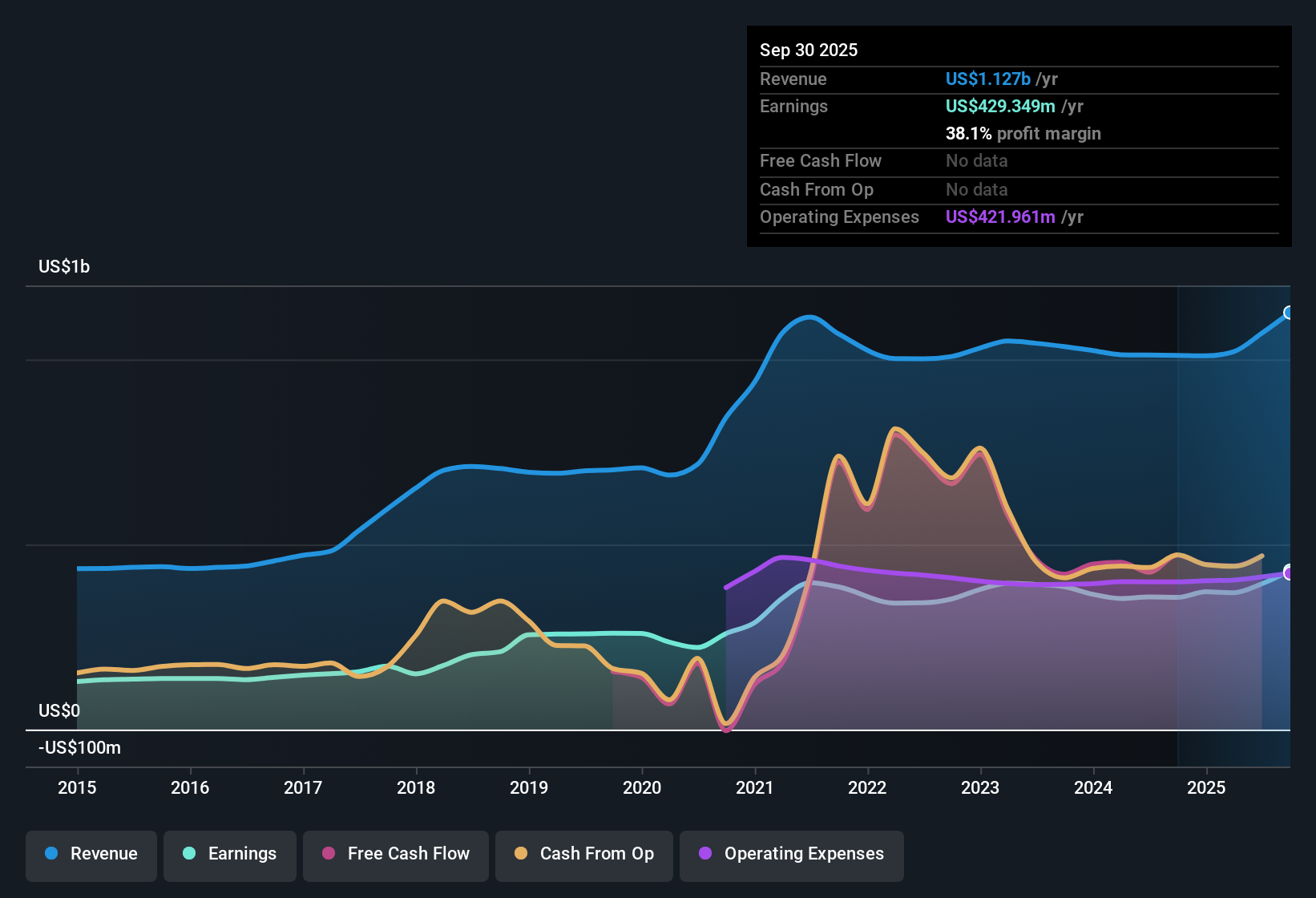

United Bankshares (UBSI) reported earnings growth of 20.2% over the past year, beating its five-year average growth rate of 3.8% annually. Net profit margins also improved to 38.1% from last year’s 35.3%, underscoring consistent profitability. With revenue anticipated to grow 7.4% per year and EPS expected to rise at 6.2% per year, investors are weighing a forecast that is somewhat behind the broader US market. However, the absence of notable risks, along with attractive dividends and stable growth, continue to support a positive view.

See our full analysis for United Bankshares.Now let's see how these latest numbers stack up against the prevailing narratives around UBSI. Which storyline gets confirmed, and which ones might face new scrutiny?

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margins Widen to 38.1%

- Net profit margins rose to 38.1%, up from last year’s 35.3%. This sets UBSI apart from other regional banks for its efficiency in delivering more profit for every revenue dollar.

- Analysts agree that this margin strength heavily supports the view of UBSI as a stable, defensive bank. What stands out is that, even against the backdrop of slower anticipated top-line growth (7.4% vs. US market 10%), the company’s ability to preserve and even boost profitability points to resilient core operations.

- This performance directly aligns with market perceptions favoring UBSI’s consistent cost discipline during volatile sector conditions.

- Margins holding higher than peer averages reinforces the narrative that UBSI remains attractive for conservative investors seeking predictable returns.

Share Price Lags DCF Fair Value by Wide Margin

- With shares trading at $36.43, UBSI sits more than 39% below its DCF fair value estimate of $60.61. This creates a sizable valuation gap for income-oriented investors to weigh.

- The prevailing market view highlights that, despite UBSI’s lower-than-average revenue growth outlook (7.4% vs. US market’s 10%), the current price-to-earnings ratio of 12x is cheaper than peer averages and could attract buyers focused on value. However, the lack of headline growth drivers means upside may require patience.

- This discount to intrinsic value may support a constructive stance for those prioritizing value over momentum plays.

- However, with forecasted earnings growth of just 6.2% annually, some may question whether the market's cautious pricing reflects rightly modest near-term catalysts.

Dividend Reliability Stands Out

- UBSI is recognized for sustained, attractive dividends, regularly highlighted by commentators as a core part of the stock’s investor appeal.

- There is strong emphasis that, even as revenue projections trail the broader market, the durability of UBSI’s dividend payout and profit margins creates a compelling option in a sector marked by volatility.

- This narrative is reinforced by UBSI’s prudent capital management and the absence of identified material risks in filings, both of which underpin its consistent cash returns to shareholders.

- Unsurprisingly, “reliability” and “income stability” emerge as repeating themes among industry observers when describing UBSI’s long-term shareholder proposition.

See what the community is saying about United Bankshares

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on United Bankshares's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While UBSI’s profit margins and dividends impress, its slower forecasted revenue and earnings growth highlight a lack of strong upside catalysts compared to peers.

If you want companies combining reliable performance with more consistent long-term expansion, check out stable growth stocks screener (2098 results) that showcase steady growth and resilient fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UBSI

United Bankshares

Through its subsidiaries, provides commercial and retail banking products and services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives