- United States

- /

- Banks

- /

- NasdaqGS:UBSI

How Record Net Interest Income at United Bankshares (UBSI) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

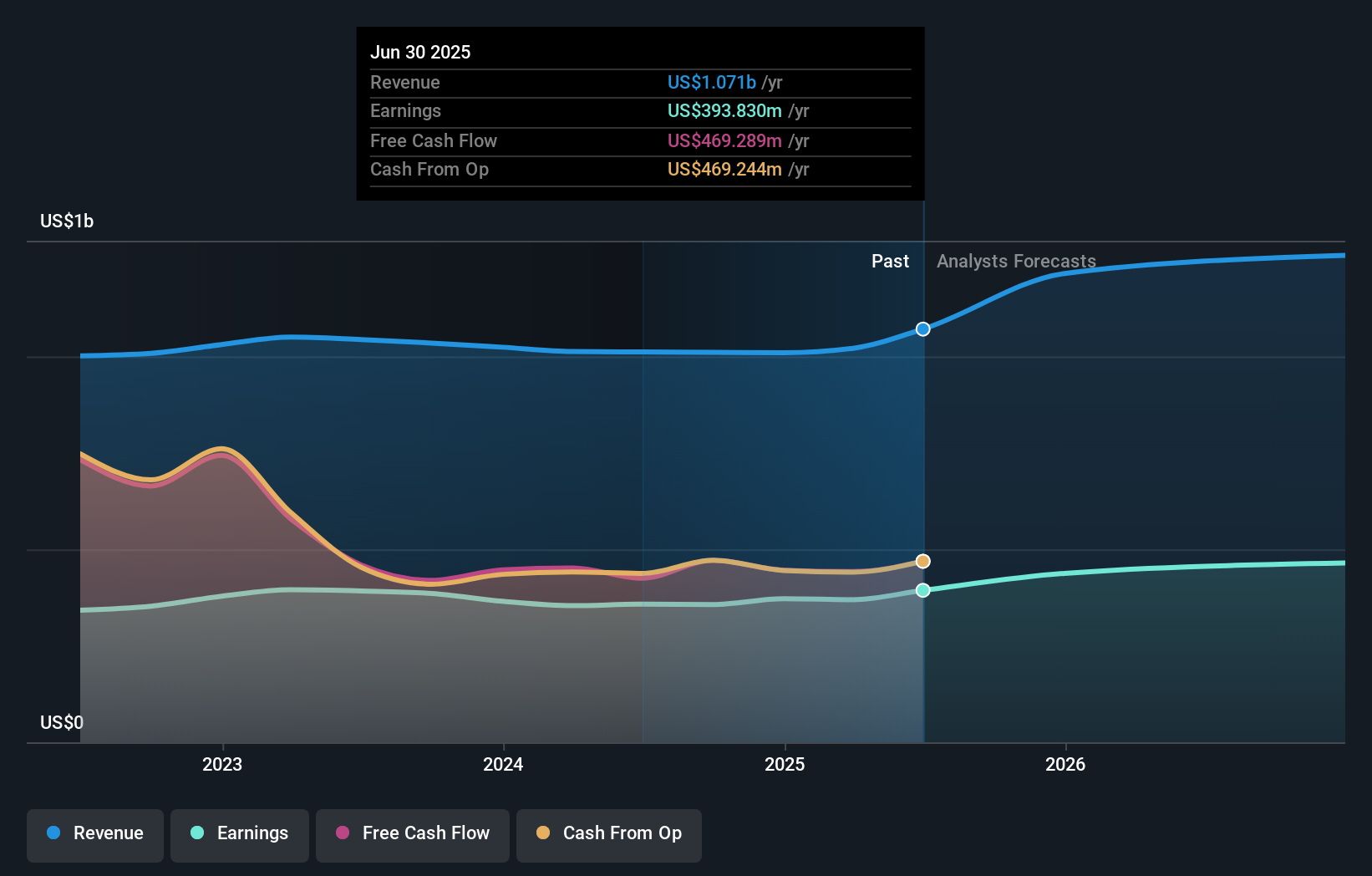

- United Bankshares, Inc. recently reported record third-quarter earnings, with net income rising to US$130.75 million and net interest income reaching US$280.12 million, both exceeding analyst expectations and last year's results.

- The bank’s performance was further highlighted by strong organic growth, effective expense management, and share repurchases, which contributed to a positive market response and an analyst upgrade.

- We’ll explore how United Bankshares’ sharp rise in net interest income underscores the company’s evolving investment appeal for shareholders.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is United Bankshares' Investment Narrative?

Looking at the big picture for United Bankshares, being a shareholder means having confidence in the company's ability to maintain steady revenue growth, reliable dividends, and prudent cost control, even when faced with emerging risks. The recent record earnings and stronger-than-expected net interest income reinforce the short-term catalyst of solid profitability and effective management. However, the latest spike in net charge-offs, up to US$20.0 million, or 0.33 percent of average loans this quarter, marks a rapid increase from prior periods, making credit quality and potential loan losses more prominent risks than they appeared in past analysis. While the market responded positively after earnings, thanks in part to ongoing share repurchases and analyst upgrades, the new charge-off figures now add a material consideration that could temper bullish sentiment if this trend continues. In contrast, the uptick in charge-offs could impact loan performance and warrants investor attention.

United Bankshares' shares have been on the rise but are still potentially undervalued by 40%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on United Bankshares - why the stock might be worth just $34.72!

Build Your Own United Bankshares Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Bankshares research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free United Bankshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Bankshares' overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UBSI

United Bankshares

Through its subsidiaries, provides commercial and retail banking products and services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives