- United States

- /

- Banks

- /

- NasdaqCM:UBCP

If You Like EPS Growth Then Check Out United Bancorp (NASDAQ:UBCP) Before It's Too Late

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like United Bancorp (NASDAQ:UBCP), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for United Bancorp

How Fast Is United Bancorp Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. Impressively, United Bancorp has grown EPS by 28% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

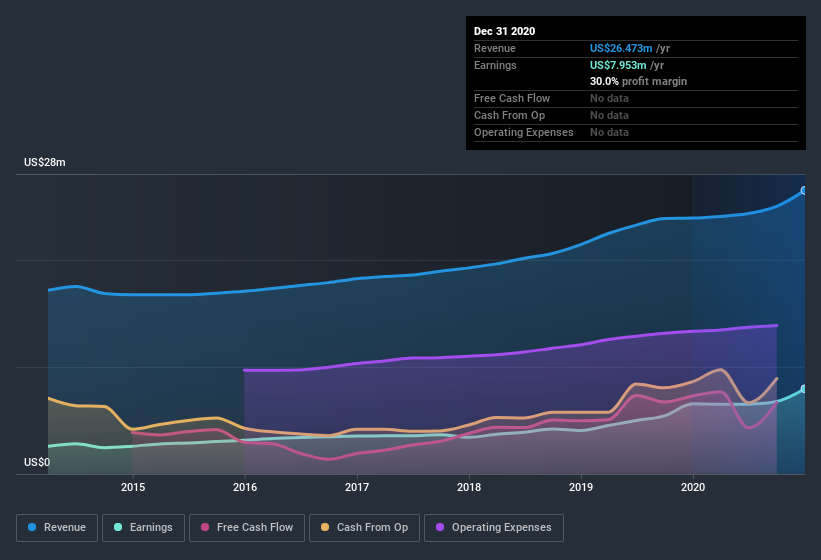

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Not all of United Bancorp's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. United Bancorp maintained stable EBIT margins over the last year, all while growing revenue 11% to US$26m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since United Bancorp is no giant, with a market capitalization of US$74m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are United Bancorp Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Not only did United Bancorp insiders refrain from selling stock during the year, but they also spent US$81k buying it. That's nice to see, because it suggests insiders are optimistic. Zooming in, we can see that the biggest insider purchase was by Independent Director Gary Glessner for US$39k worth of shares, at about US$12.32 per share.

Does United Bancorp Deserve A Spot On Your Watchlist?

For growth investors like me, United Bancorp's raw rate of earnings growth is a beacon in the night. The growth rate whets my appetite for research, and the insider buying only increases my interest in the stock. To put it succinctly; United Bancorp is a strong candidate for your watchlist. Even so, be aware that United Bancorp is showing 2 warning signs in our investment analysis , you should know about...

As a growth investor I do like to see insider buying. But United Bancorp isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade United Bancorp, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:UBCP

United Bancorp

Operates as the bank holding company for Unified Bank that provides commercial and retail banking services in Ohio.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives