- United States

- /

- Banks

- /

- NasdaqGS:TRMK

Trustmark (TRMK): Assessing Valuation After Recent 3% Stock Price Gain

Reviewed by Kshitija Bhandaru

See our latest analysis for Trustmark.

This latest bump in Trustmark’s share price continues a solid run for shareholders, with the stock up 14.45% on a year-to-date basis and delivering a notable 17.75% total shareholder return over the past year. While daily moves can reflect market sentiment shifts or sector news, the broader performance suggests momentum is steady. This trend appears to be supported by both improving fundamentals and investor confidence.

If you’re curious about where else to spot strong performance, it might be the perfect moment to broaden your search and uncover fast growing stocks with high insider ownership

The key question for investors now is whether Trustmark’s positive run represents untapped value or if the bank’s solid fundamentals and growth prospects are already fully reflected in the current share price. Is there still a buying opportunity, or has the market moved ahead and priced in the future growth?

Most Popular Narrative: 9% Undervalued

With Trustmark’s last close at $39.61 and the most-followed narrative pointing to a fair value of $43.60, the market appears to be pricing in some, but not all, of the company's expected upside. Investors are weighing the impact of regional expansion and digital innovation on the bank’s future earnings against its current valuation.

Trustmark’s presence and targeted expansion in high-growth Sun Belt and Southeastern U.S. markets position it to harness above-average population and business growth. This directly supports sustained loan and deposit growth and boosts future revenue. The ongoing generational wealth transfer and increasing affluence among younger cohorts is opening up opportunities for fee-based wealth management and financial planning services, which are likely to drive increases in noninterest income and diversify earnings streams.

Curious what powers this bullish outlook? Analysts in the narrative are modeling bold revenue ramp-ups fueled by demographic shifts and new business lines. The real eye-opener is how their future profit projections and ambitious assumptions combine to justify that higher price target. Want the full story? Only the complete narrative reveals exactly what underpins this valuation.

Result: Fair Value of $43.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Trustmark’s concentration in Southeastern markets and slower digital transformation could challenge its growth outlook if economic headwinds or tech disruptors become more significant.

Find out about the key risks to this Trustmark narrative.

Another View: Discounted Cash Flow Perspective

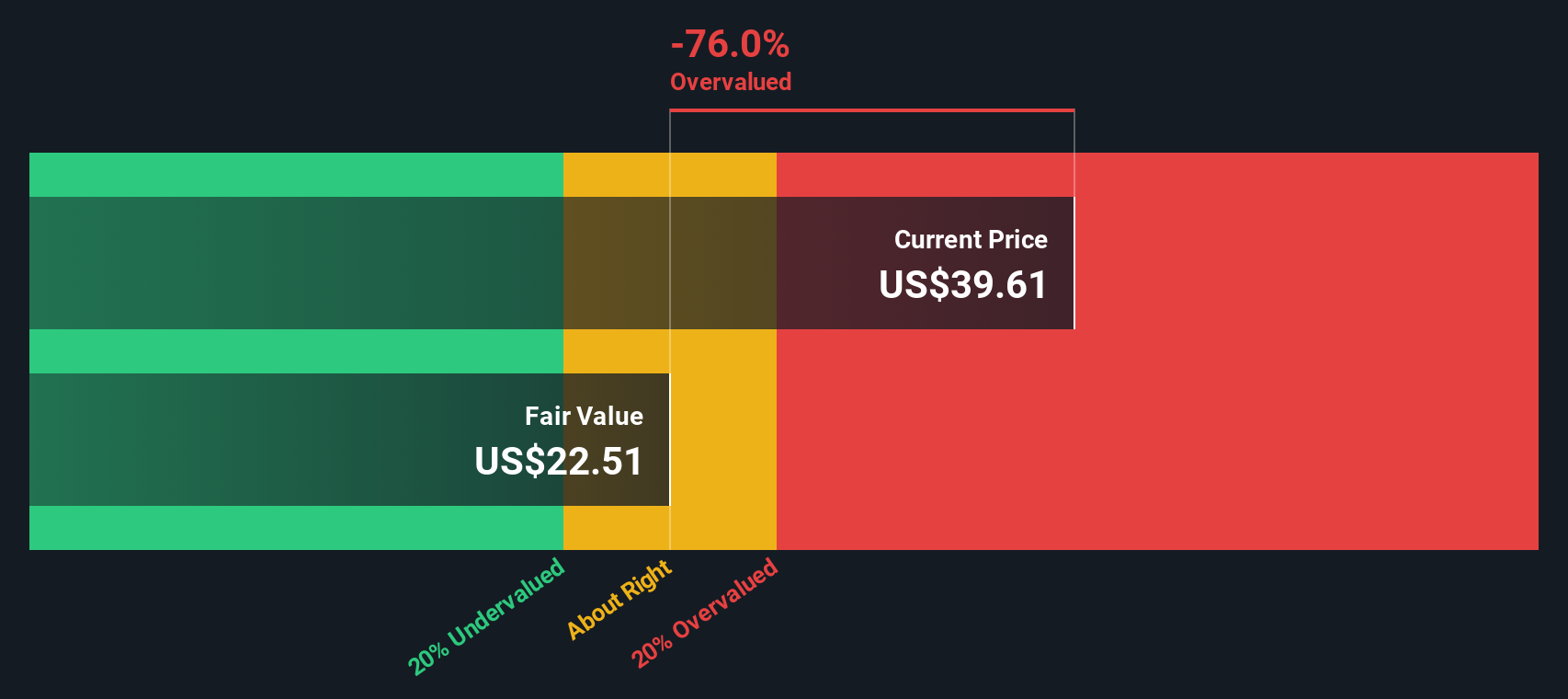

While analysts see Trustmark as undervalued based on future earnings growth and price targets, our SWS DCF model presents a more cautious picture. The model suggests the current share price is higher than its estimated fair value. Could this mean the market is already factoring in more optimism than the fundamentals support?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Trustmark for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Trustmark Narrative

If you see things differently or would rather dig into the numbers yourself, you can easily build your own perspective in just a few minutes, then Do it your way

A great starting point for your Trustmark research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stop searching for their next edge. Give yourself a real chance to unlock smarter opportunities and make sure you aren’t missing out on today’s most promising trends.

- Capitalize on a new wave of innovation by checking out these 24 AI penny stocks, where technology leaders are shaping the fast-moving world of artificial intelligence.

- Turn your attention to income and stability as you assess these 18 dividend stocks with yields > 3%, which offers strong yields that can help boost your portfolio’s long-term return.

- Go beyond the market headlines and spot value plays with these 877 undervalued stocks based on cash flows, a selection of stocks trading under their fair worth based on robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trustmark might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRMK

Trustmark

Operates as the bank holding company for Trustmark National Bank that provides banking and other financial solutions to individuals and corporate institutions in the United States.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives