- United States

- /

- Banks

- /

- NasdaqGS:NBTB

3 Stocks Including Extreme Networks Estimated Below Fair Value

Reviewed by Simply Wall St

As the U.S. stock market experiences gains across major indices, with the Dow Jones, S&P 500, and Nasdaq all showing positive momentum, investors are keenly observing corporate earnings reports and inflation data that could influence future interest rate decisions. In this environment of cautious optimism and strategic positioning, identifying undervalued stocks like Extreme Networks can offer potential opportunities for those looking to invest in equities estimated below their fair value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wix.com (WIX) | $130.82 | $258.91 | 49.5% |

| Trade Desk (TTD) | $49.98 | $96.49 | 48.2% |

| Rush Street Interactive (RSI) | $17.30 | $33.40 | 48.2% |

| Phibro Animal Health (PAHC) | $39.72 | $77.67 | 48.9% |

| Old National Bancorp (ONB) | $19.85 | $37.97 | 47.7% |

| NeuroPace (NPCE) | $10.41 | $20.08 | 48.2% |

| Midland States Bancorp (MSBI) | $15.83 | $30.62 | 48.3% |

| First Advantage (FA) | $14.01 | $27.13 | 48.4% |

| Corpay (CPAY) | $285.46 | $549.18 | 48% |

| ChoiceOne Financial Services (COFS) | $26.36 | $51.63 | 48.9% |

Here's a peek at a few of the choices from the screener.

Extreme Networks (EXTR)

Overview: Extreme Networks, Inc. develops, markets, and sells network infrastructure equipment and related software globally, with a market cap of approximately $2.69 billion.

Operations: The company's revenue is primarily derived from the development and marketing of network infrastructure equipment and related software, totaling $1.14 billion.

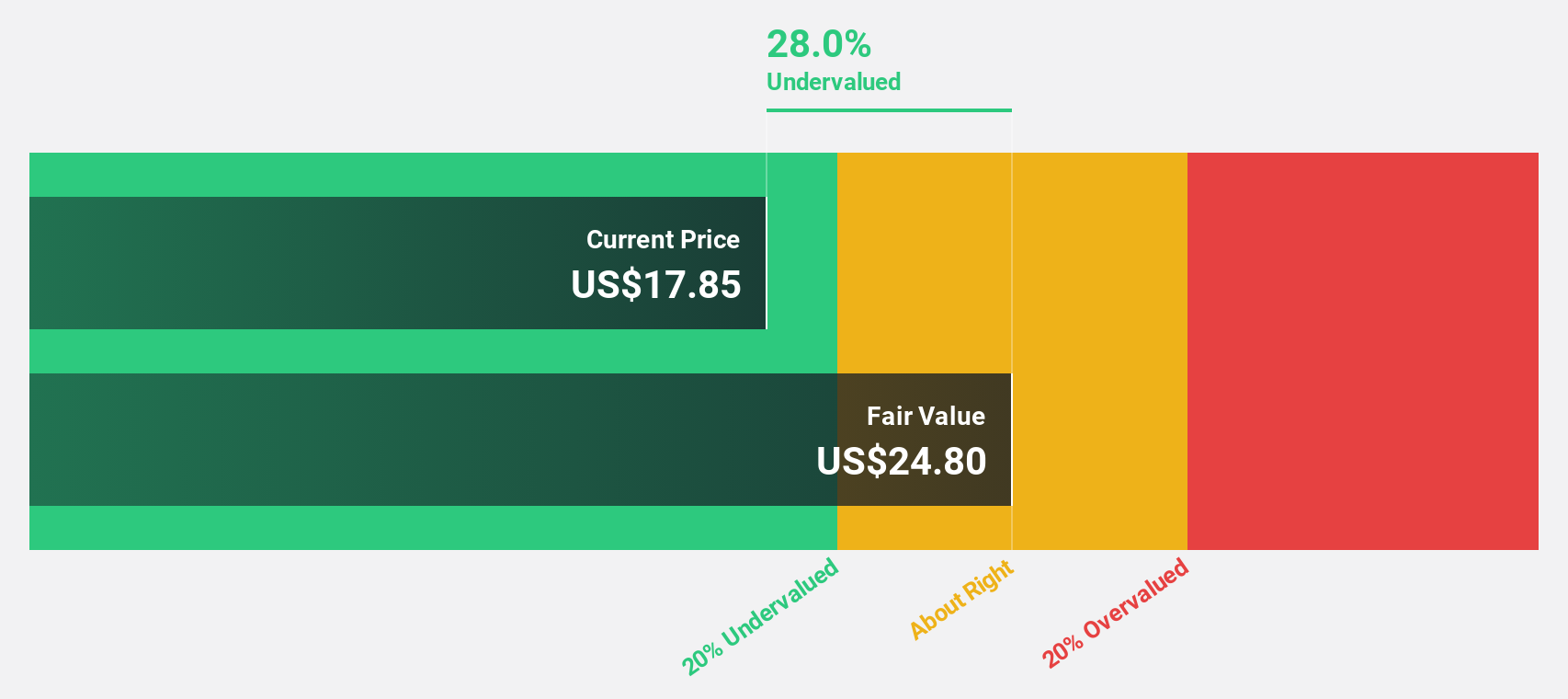

Estimated Discount To Fair Value: 23.5%

Extreme Networks is trading 23.5% below its estimated fair value, presenting potential undervaluation based on cash flows. The company forecasts a significant increase in profitability over the next three years, despite revenue growth trailing the broader market. Recent developments include an extended partnership with the NFL to enhance Wi-Fi solutions, which could bolster future revenue streams. However, notable insider selling raises some caution about internal confidence in sustained growth or valuation stability.

- Insights from our recent growth report point to a promising forecast for Extreme Networks' business outlook.

- Take a closer look at Extreme Networks' balance sheet health here in our report.

NBT Bancorp (NBTB)

Overview: NBT Bancorp Inc. is a financial holding company offering commercial banking, retail banking, and wealth management services, with a market cap of $2.10 billion.

Operations: The company's revenue segments include commercial banking, retail banking, and wealth management services.

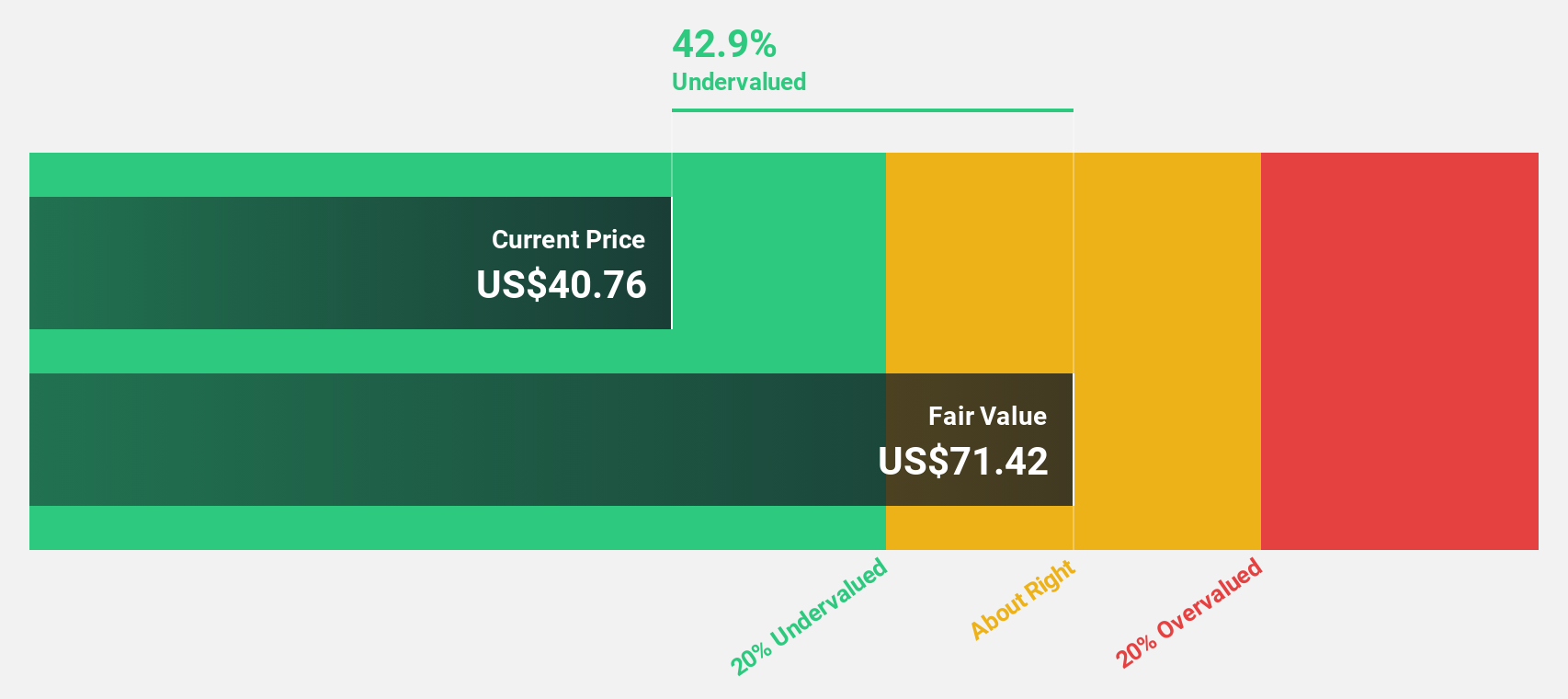

Estimated Discount To Fair Value: 43.8%

NBT Bancorp is trading at US$40.15, significantly below its estimated fair value of US$71.42, highlighting potential undervaluation based on cash flows. While earnings are forecasted to grow substantially at 34.8% annually, recent insider selling could be a concern for investors assessing long-term confidence. The company reported decreased net income for the second quarter and has consistently increased dividends over thirteen years, with the latest dividend set at US$0.37 per share.

- The growth report we've compiled suggests that NBT Bancorp's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in NBT Bancorp's balance sheet health report.

TowneBank (TOWN)

Overview: TowneBank offers retail and commercial banking services to individuals, businesses, and professionals in Virginia and North Carolina, with a market cap of $2.71 billion.

Operations: The company's revenue segments include $531.53 million from banking and $102.60 million from insurance services.

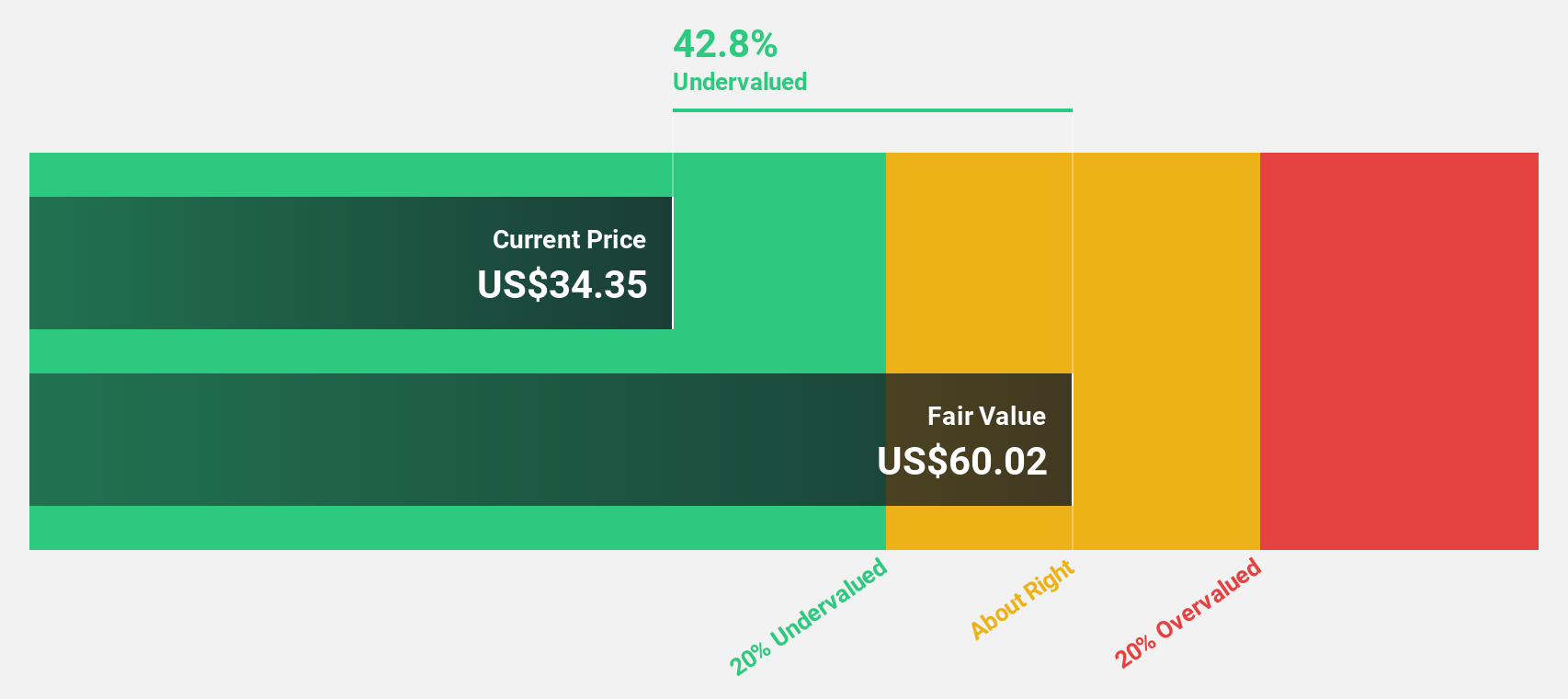

Estimated Discount To Fair Value: 46.3%

TowneBank is trading at US$33.76, substantially below its estimated fair value of US$62.93, suggesting undervaluation based on cash flows. Despite a slight decrease in second-quarter net income to US$38.84 million from the previous year, earnings are projected to grow significantly at 34.2% annually over the next three years, outpacing market averages. The bank maintains a steady dividend of $0.27 per share and has low net loan charge-offs, reflecting financial stability.

- Our growth report here indicates TowneBank may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of TowneBank.

Where To Now?

- Take a closer look at our Undervalued US Stocks Based On Cash Flows list of 176 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NBT Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NBTB

NBT Bancorp

A financial holding company, provides commercial banking, retail banking, and wealth management services.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives