- United States

- /

- Banks

- /

- NasdaqGS:TCBK

Does TriCo Bancshares' (TCBK) Dividend Hike Signal a Stronger Focus on Shareholder Value?

Reviewed by Simply Wall St

- TriCo Bancshares recently announced an increase in its quarterly dividend, with shareholders set to receive the higher payout on September 19, 2025.

- This move, along with several analyst outlook upgrades, highlights growing confidence in the company's direction and potential for shareholder returns.

- We'll explore how the dividend increase strengthens TriCo Bancshares' investment narrative and highlights its shareholder-focused approach.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is TriCo Bancshares' Investment Narrative?

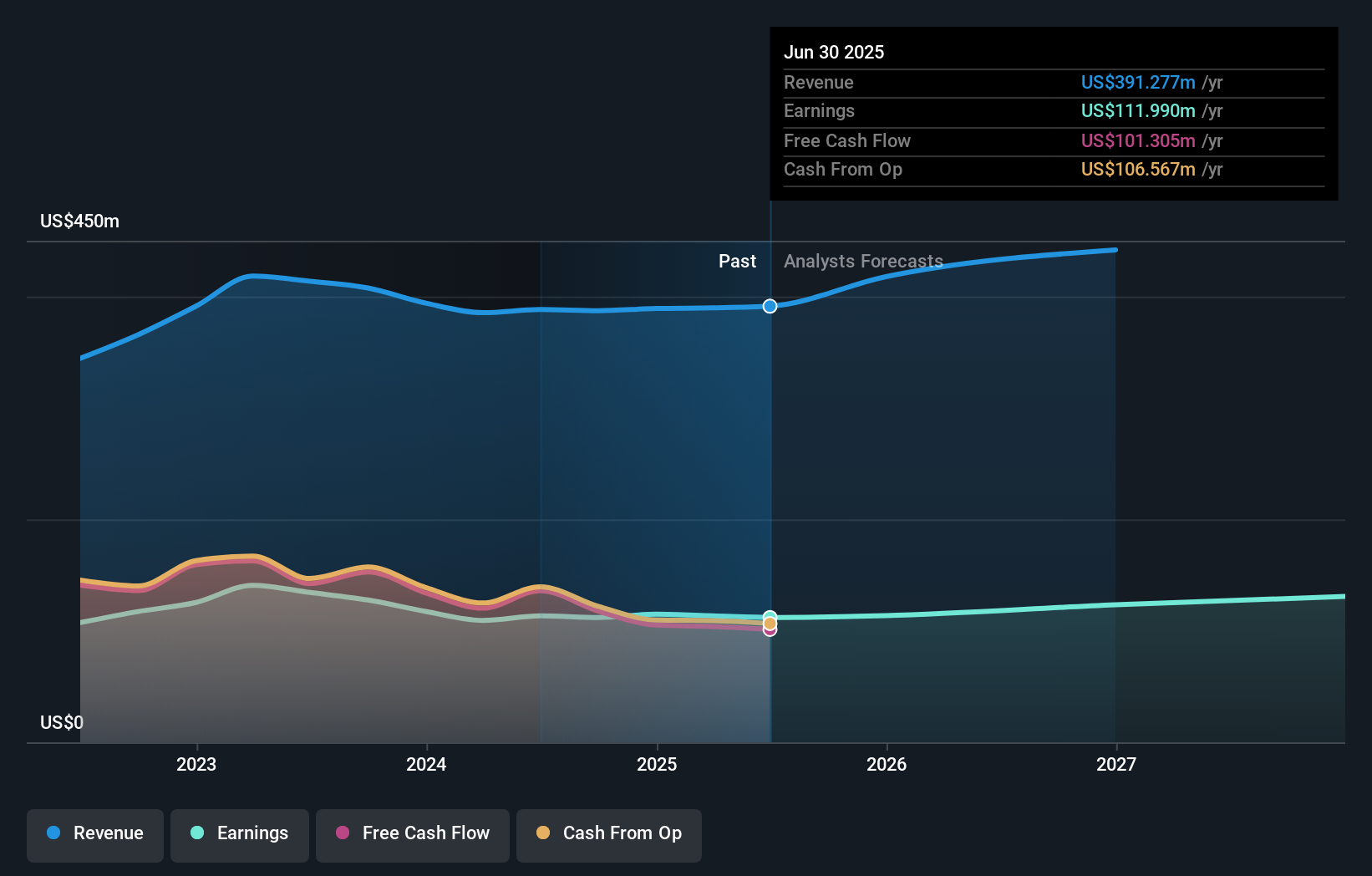

For those considering TriCo Bancshares as an investment, the key thesis to believe in is the stability and steady income orientation typified by the recent dividend hike. A continuous 144-quarter dividend streak, now with a higher payout, reflects a consistent focus on shareholder returns, which resonates with investors looking for reliability rather than rapid growth. The news of the increased dividend, supported by analyst upgrades, could bring renewed near-term attention to the stock, reinforcing its appeal to income-focused investors and potentially acting as a minor positive catalyst. However, given the company’s low return on equity, modest profit forecasts, and underperformance compared to industry benchmarks, the broader risk remains that earnings growth may lag sector peers. This latest news doesn’t eliminate concerns around slow earnings momentum and comparatively high valuation, but it may slightly lessen the weight of those risks short-term.

Yet, investors should still be cautious about the company’s below-average return on equity. Despite retreating, TriCo Bancshares' shares might still be trading 31% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 3 other fair value estimates on TriCo Bancshares - why the stock might be worth 38% less than the current price!

Build Your Own TriCo Bancshares Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TriCo Bancshares research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free TriCo Bancshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TriCo Bancshares' overall financial health at a glance.

No Opportunity In TriCo Bancshares?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TriCo Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TCBK

TriCo Bancshares

Operates as a bank holding company for Tri Counties Bank that provides commercial banking services to individual and corporate customers.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives