- United States

- /

- Banks

- /

- NasdaqGS:TCBI

Should You Be Adding Texas Capital Bancshares (NASDAQ:TCBI) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Texas Capital Bancshares (NASDAQ:TCBI), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Texas Capital Bancshares

How Quickly Is Texas Capital Bancshares Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. Impressively, Texas Capital Bancshares has grown EPS by 17% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

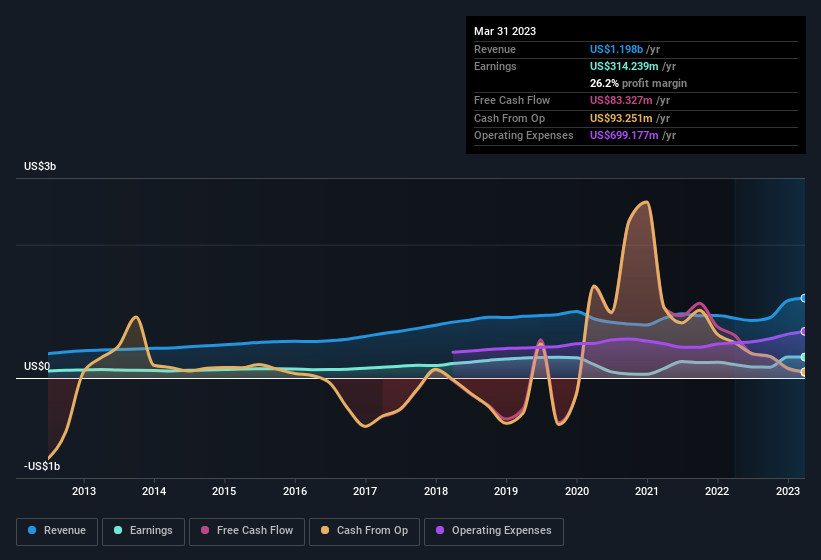

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. It's noted that Texas Capital Bancshares' revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. EBIT margins for Texas Capital Bancshares remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 33% to US$1.2b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Texas Capital Bancshares' future profits.

Are Texas Capital Bancshares Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's pleasing to note that insiders spent US$11m buying Texas Capital Bancshares shares, over the last year, without reporting any share sales whatsoever. Knowing this, Texas Capital Bancshares will have have all eyes on them in anticipation for the what could happen in the near future. It is also worth noting that it was Independent Chairman Robert Stallings who made the biggest single purchase, worth US$2.4m, paying US$56.57 per share.

The good news, alongside the insider buying, for Texas Capital Bancshares bulls is that insiders (collectively) have a meaningful investment in the stock. As a matter of fact, their holding is valued at US$26m. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 1.0% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add Texas Capital Bancshares To Your Watchlist?

You can't deny that Texas Capital Bancshares has grown its earnings per share at a very impressive rate. That's attractive. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. Astute investors will want to keep this stock on watch. Before you take the next step you should know about the 1 warning sign for Texas Capital Bancshares that we have uncovered.

Keen growth investors love to see insider buying. Thankfully, Texas Capital Bancshares isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Texas Capital Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TCBI

Texas Capital Bancshares

Operates as the bank holding company for Texas Capital Bank, is a full-service financial services firm that delivers customized solutions to businesses, entrepreneurs, and individual customers.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives