- United States

- /

- Banks

- /

- NasdaqGS:TCBI

Did Analyst Scrutiny on Mortgage and Deposit Costs Just Shift Texas Capital Bancshares' (TCBI) Investment Narrative?

Reviewed by Sasha Jovanovic

- In recent news, Texas Capital Bancshares was flagged by JPMorgan as a short opportunity due to concerns about mortgage loan activity and deposit costs, with additional cautious analyst commentary regarding its near-term outlook. The company also plans to announce its third quarter 2025 financial results after the market close on October 22, 2025, followed by a webcast with executive management.

- This round of analyst skepticism highlights how worries over high funding costs and reduced mortgage activity are challenging earlier expectations about the company’s potential earnings drivers.

- We'll now explore how these analyst concerns about mortgage activity and deposit costs may reshape the broader investment narrative for Texas Capital Bancshares.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Texas Capital Bancshares Investment Narrative Recap

To be a shareholder in Texas Capital Bancshares, you need to believe that the company’s focus on commercial loan growth, non-interest income expansion, and Texas’s economic resilience can outweigh risks from market concentration and the increasingly competitive cost of deposits. JPMorgan's recent downgrade, driven by concerns about shrinking mortgage activity and higher funding costs, brings the immediate earnings outlook into sharper focus but does not fundamentally alter the primary risk: ongoing margin pressure from elevated deposit costs.

Among recent developments, the scheduled release of third quarter 2025 financial results on October 22, 2025, stands out as directly relevant. This upcoming earnings report will offer timely insight into the extent to which mortgage and deposit market headwinds are affecting net interest margins and the bank’s ability to deliver on its growth strategy.

By contrast, there is another critical risk investors should be watching, how rising funding costs could continue to...

Read the full narrative on Texas Capital Bancshares (it's free!)

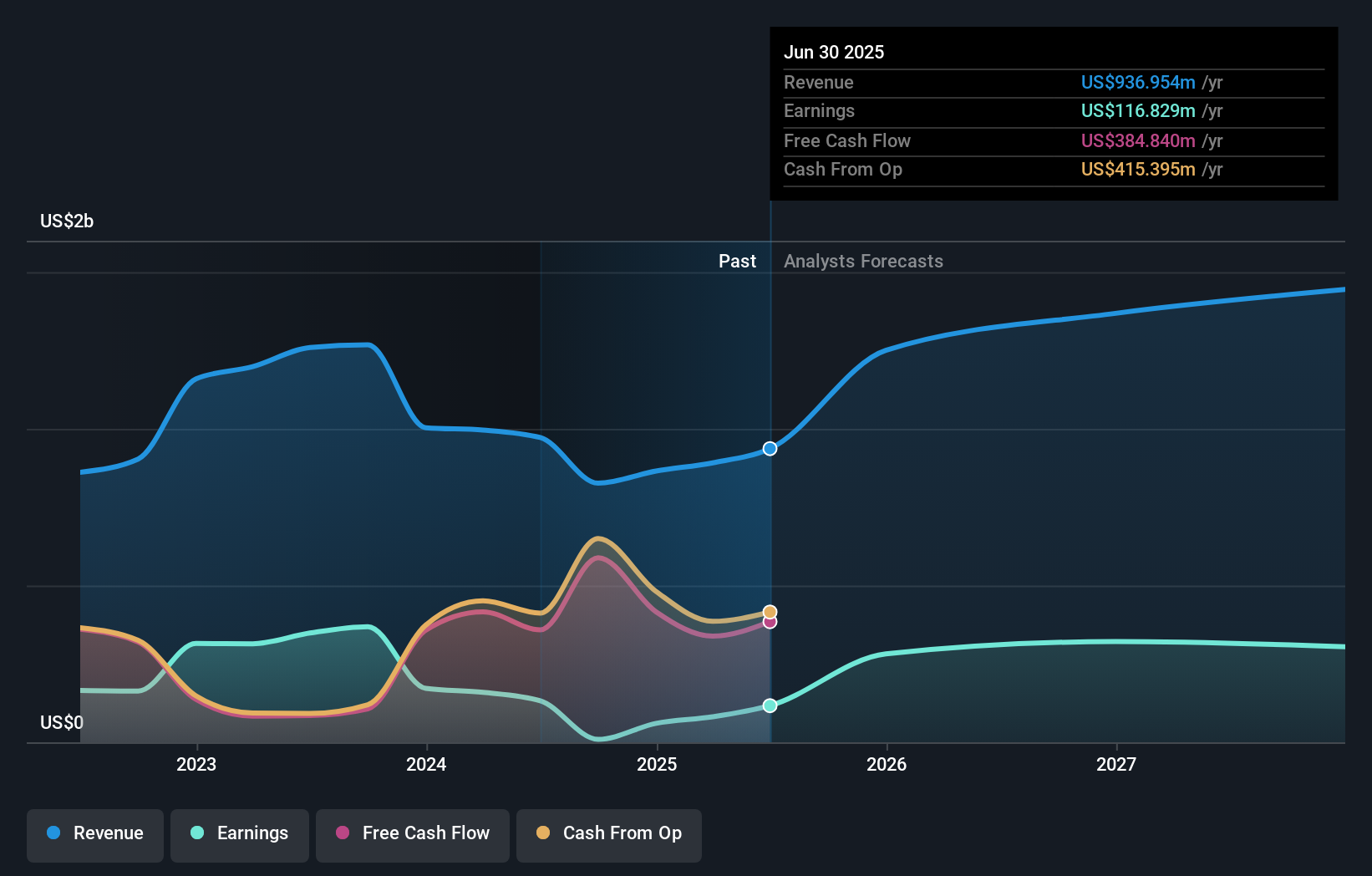

Texas Capital Bancshares is projected to reach $1.6 billion in revenue and $438.9 million in earnings by 2028. This outlook requires an annual revenue growth rate of 20.6% and a $322.1 million increase in earnings from the current level of $116.8 million.

Uncover how Texas Capital Bancshares' forecasts yield a $92.00 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Only one fair value estimate of US$92 was contributed by the Simply Wall St Community prior to these latest developments. While this shows consensus among community participants, analyst concerns about margin pressure still pose a challenge for the company’s future performance. Review more perspectives to see how your view compares.

Explore another fair value estimate on Texas Capital Bancshares - why the stock might be worth as much as 7% more than the current price!

Build Your Own Texas Capital Bancshares Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Texas Capital Bancshares research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Texas Capital Bancshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Texas Capital Bancshares' overall financial health at a glance.

No Opportunity In Texas Capital Bancshares?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texas Capital Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TCBI

Texas Capital Bancshares

Operates as the bank holding company for Texas Capital Bank, is a full-service financial services firm that delivers customized solutions to businesses, entrepreneurs, and individual customers.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives