- United States

- /

- Medical Equipment

- /

- NasdaqGM:IRMD

Discovering Undiscovered Gems In The US Market This October 2024

Reviewed by Simply Wall St

In the last week, the United States market has stayed flat, yet it has experienced a remarkable 37% increase over the past year with earnings forecast to grow by 15% annually. In such an environment, identifying stocks that are not only poised for growth but also remain underappreciated can offer unique opportunities for investors seeking potential in undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 169.49% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| First Ottawa Bancshares | 85.49% | 7.25% | 25.81% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

IRADIMED (NasdaqGM:IRMD)

Simply Wall St Value Rating: ★★★★★★

Overview: IRADIMED CORPORATION specializes in the development, manufacturing, marketing, and distribution of MRI-compatible medical devices and related accessories, disposables, and services both domestically and internationally with a market cap of $665.80 million.

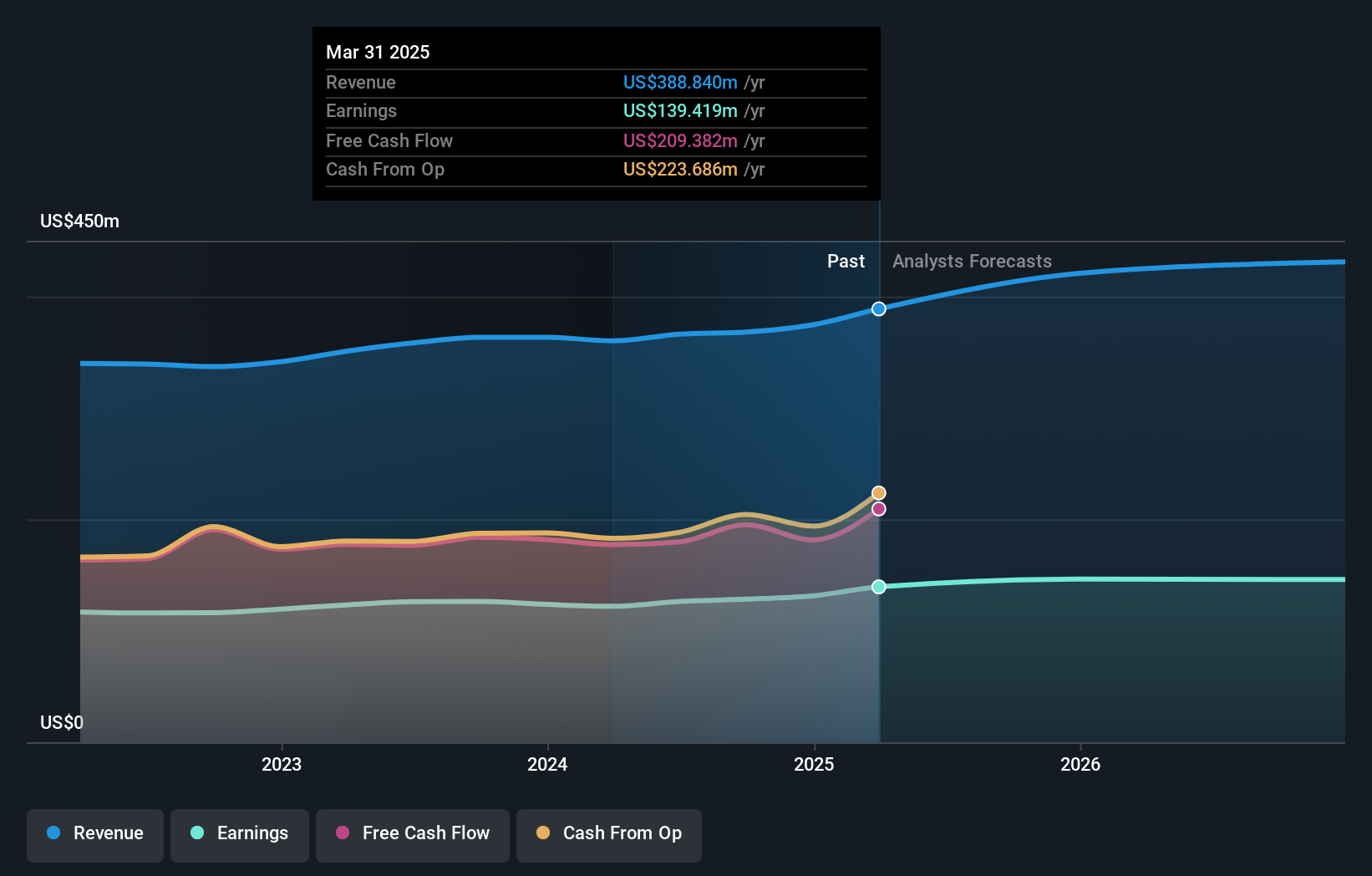

Operations: IRADIMED generates revenue primarily from its patient monitoring equipment segment, totaling $69.48 million. The company operates with a market cap of approximately $665.80 million.

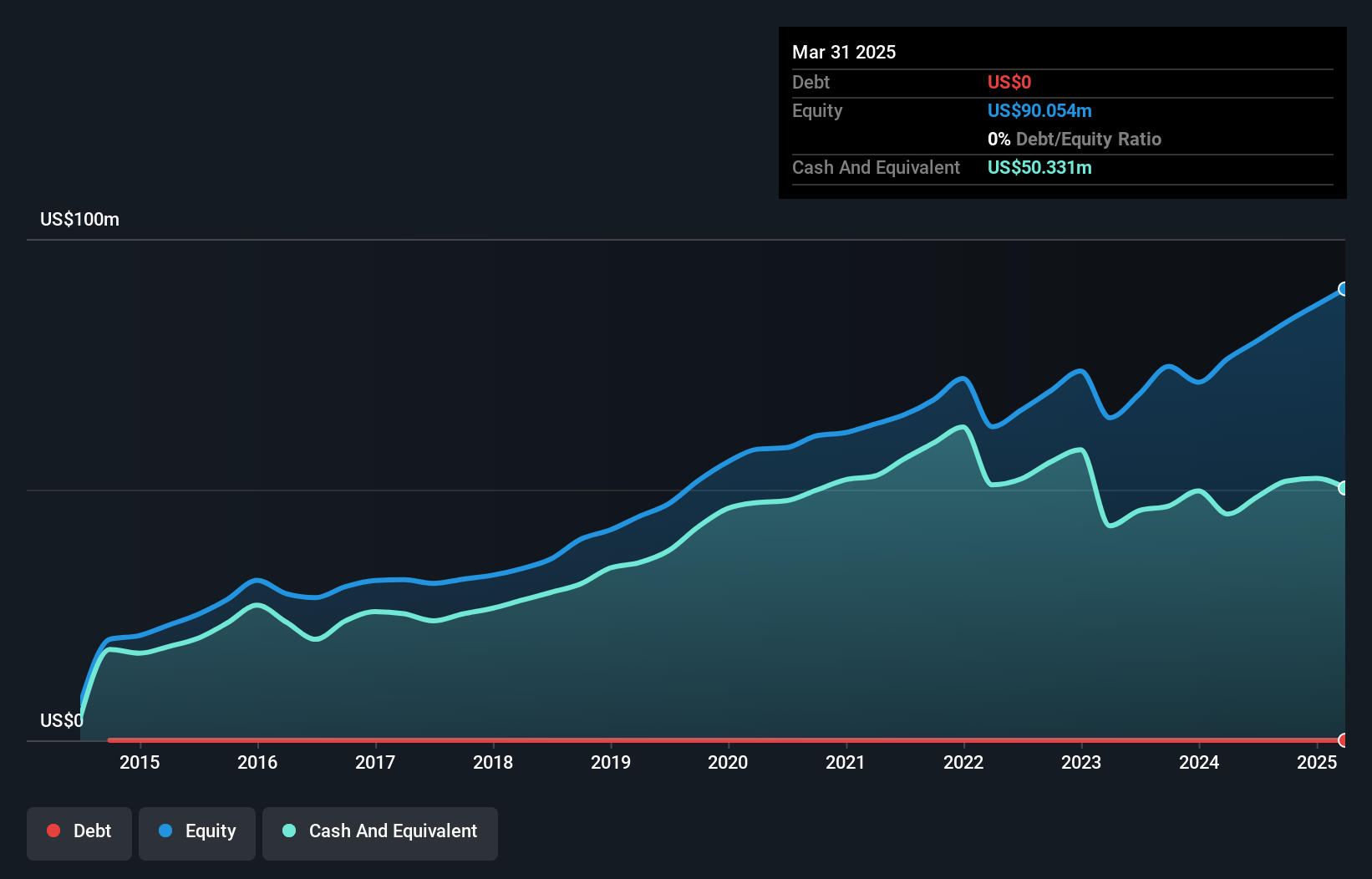

IRADIMED, a nimble player in the medical equipment sector, has shown impressive growth with earnings up 26.9% over the past year, outpacing industry averages. The company boasts a debt-free balance sheet and a price-to-earnings ratio of 36x, slightly below the sector's average of 36.7x. Recent developments include an anticipated revenue boost from its new IV pump and Monitor business expansion. Despite these positives, challenges such as reliance on domestic markets and potential FDA delays could impact future performance. With shares currently priced at US$52.55, analysts see potential upside to US$60 based on projected growth trends.

Southern Missouri Bancorp (NasdaqGM:SMBC)

Simply Wall St Value Rating: ★★★★★★

Overview: Southern Missouri Bancorp, Inc. serves as the bank holding company for Southern Bank, offering a range of banking and financial services to individuals and corporate clients in the United States, with a market capitalization of $672.34 million.

Operations: Southern Missouri Bancorp generates revenue primarily through interest income from loans and investments, supplemented by non-interest income such as fees for services. The company focuses on managing its net profit margin, which is currently at 28.5%.

Southern Missouri Bancorp, with assets totaling $4.7 billion and equity of $505.6 million, stands out for its robust financial health. The company has total deposits of $4 billion against loans of $3.9 billion, showcasing a solid balance sheet structure. Its allowance for bad loans is sufficient at 0.2% of total loans, indicating prudent risk management practices. Despite significant insider selling recently, the stock trades at 37% below its estimated fair value, suggesting potential undervaluation in the market. With earnings growth surpassing industry averages and primarily low-risk funding sources comprising 96% of liabilities, Southern Missouri Bancorp presents an intriguing investment opportunity amidst recent challenges like increased credit loss provisions and noninterest expenses.

1st Source (NasdaqGS:SRCE)

Simply Wall St Value Rating: ★★★★★★

Overview: 1st Source Corporation is a bank holding company for 1st Source Bank, offering commercial and consumer banking, trust and wealth advisory services, and insurance products to individual and business clients, with a market cap of $1.48 billion.

Operations: 1st Source generates revenue primarily through its commercial banking segment, which accounts for $369.01 million.

1st Source, a financial entity with total assets of US$8.8 billion and equity of US$1.2 billion, demonstrates robust health with deposits at US$7.1 billion and loans totaling US$6.5 billion. The bank's allowance for bad loans is sufficient at 0.5%, indicating prudent risk management practices within the industry context where its earnings growth of 1.6% outpaces the broader sector's -13.8%. Despite forecasts suggesting a potential average earnings dip of 0.9% over the next three years, it trades significantly below estimated fair value by 61%, providing an attractive valuation proposition for investors considering its primarily low-risk funding structure and high-quality past earnings performance.

- Delve into the full analysis health report here for a deeper understanding of 1st Source.

Assess 1st Source's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Reveal the 227 hidden gems among our US Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:IRMD

IRADIMED

Develops, manufactures, markets, and distributes magnetic resonance imaging (MRI) compatible medical devices and related accessories, and disposables and services in the United States and internationally.

Flawless balance sheet with solid track record.