1st Source Corporation (NASDAQ:SRCE) will increase its dividend on the 13th of August to US$0.31. Based on the announced payment, the dividend yield for the company will be 2.8%, which is fairly typical for the industry.

See our latest analysis for 1st Source

1st Source's Payment Has Solid Earnings Coverage

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. Before making this announcement, 1st Source was easily earning enough to cover the dividend. This means that most of what the business earns is being used to help it grow.

Over the next year, EPS is forecast to expand by 5.2%. Assuming the dividend continues along recent trends, we think the payout ratio could be 34% by next year, which is in a pretty sustainable range.

1st Source Has A Solid Track Record

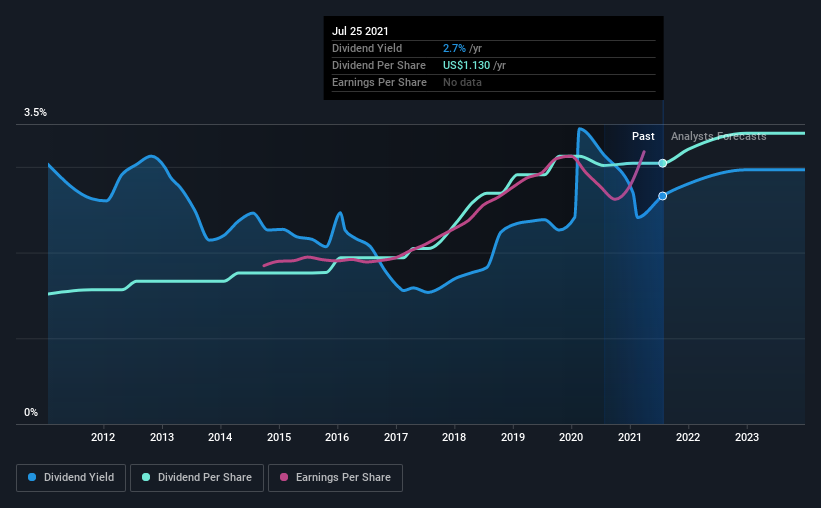

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The first annual payment during the last 10 years was US$0.56 in 2011, and the most recent fiscal year payment was US$1.13. This means that it has been growing its distributions at 7.2% per annum over that time. The dividend has been growing very nicely for a number of years, and has given its shareholders some nice income in their portfolios.

The Dividend Looks Likely To Grow

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. It's encouraging to see 1st Source has been growing its earnings per share at 11% a year over the past five years. A low payout ratio and decent growth suggests that the company is reinvesting well, and it also has plenty of room to increase the dividend over time.

1st Source Looks Like A Great Dividend Stock

In summary, it is always positive to see the dividend being increased, and we are particularly pleased with its overall sustainability. Earnings are easily covering distributions, and the company is generating plenty of cash. All of these factors considered, we think this has solid potential as a dividend stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've identified 2 warning signs for 1st Source (1 is potentially serious!) that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you’re looking to trade 1st Source, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:SRCE

1st Source

Operates as the bank holding company for 1st Source Bank that provides commercial and consumer banking services, trust and wealth advisory services, and insurance products to individual and business clients in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives