- United States

- /

- Banks

- /

- NasdaqGS:KRNY

Undervalued Small Caps With Insider Activity To Watch In April 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates a tumultuous period marked by tariff uncertainties and volatile trading sessions, small-cap stocks, represented by indices like the S&P 600, are experiencing unique pressures and opportunities. Amid this backdrop of economic shifts and broader market sentiment challenges, identifying promising small-cap stocks with notable insider activity can provide valuable insights for investors seeking potential growth in an unpredictable environment.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| S&T Bancorp | 9.8x | 3.3x | 48.11% | ★★★★★★ |

| Shore Bancshares | 9.1x | 2.0x | 19.51% | ★★★★★☆ |

| MVB Financial | 10.4x | 1.4x | 39.12% | ★★★★★☆ |

| Flowco Holdings | 6.1x | 0.9x | 40.72% | ★★★★★☆ |

| Thryv Holdings | NA | 0.6x | 37.06% | ★★★★★☆ |

| PDF Solutions | 165.2x | 3.7x | 26.22% | ★★★★☆☆ |

| Franklin Financial Services | 13.5x | 2.2x | 42.02% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -179.18% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.1x | -278.29% | ★★★☆☆☆ |

| Claritev | NA | 0.3x | -6097.39% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

MasterCraft Boat Holdings (NasdaqGM:MCFT)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: MasterCraft Boat Holdings is a manufacturer of recreational powerboats, focusing on brands like Mastercraft and Aviara, with a market cap of approximately $0.46 billion.

Operations: MasterCraft Boat Holdings generates revenue primarily through its Mastercraft segment, with additional contributions from the Pontoon segment. The company's cost of goods sold (COGS) significantly impacts its gross profit, which has shown variability over time. Notably, the gross profit margin peaked at 27.96% in October 2023 before declining to 14.90% by December 2024.

PE: -36.5x

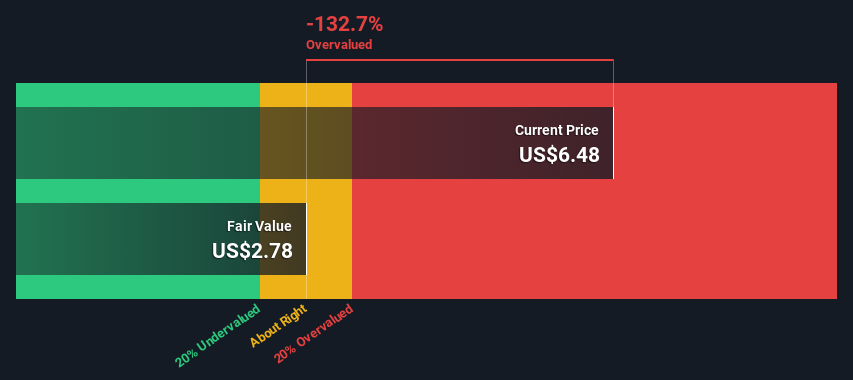

MasterCraft Boat Holdings, a player in the marine industry, is catching attention with its potential for growth despite recent financial challenges. The company reported a dip in sales and net income for the second quarter of 2024, but earnings are projected to grow significantly by 145% annually. Insider confidence is evident with share repurchases amounting to US$18.84 million since July 2023. Leadership transitions are underway, with seasoned professionals stepping into key roles, potentially steering MasterCraft towards improved performance amidst its small-cap status.

Kearny Financial (NasdaqGS:KRNY)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Kearny Financial operates as a thrift and savings and loan institution, with a market cap of approximately $0.53 billion.

Operations: Kearny Financial's primary revenue stream is derived from its operations in thrift, savings, and loan institutions. The company has consistently reported a gross profit margin of 100% over the periods reviewed. Operating expenses are predominantly driven by general and administrative costs, which reached $97.29 million in the most recent period. Recent data indicates a significant shift with net income margins turning negative, highlighting potential challenges in profitability.

PE: -5.2x

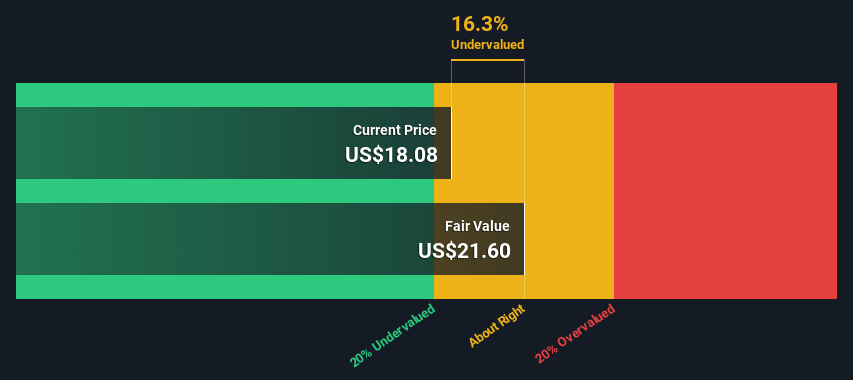

Kearny Financial, a smaller company in the financial sector, shows potential with an impressive forecast of 145.76% annual earnings growth. Recent insider confidence is evident as they increased their share purchases over the past year. For Q2 ending December 31, 2024, Kearny reported a net income of US$6.57 million—an improvement from a US$13.83 million loss previously—alongside stable dividends at US$0.11 per share. Despite board changes due to retirements and passing, the company's strategic direction remains steady with promising future prospects for growth and value realization.

- Get an in-depth perspective on Kearny Financial's performance by reading our valuation report here.

Explore historical data to track Kearny Financial's performance over time in our Past section.

Shore Bancshares (NasdaqGS:SHBI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shore Bancshares operates as a financial holding company primarily engaged in community banking services, with a market cap of approximately $0.21 billion.

Operations: The company's revenue model is driven by community banking, with recent revenue reaching $196.96 million. Operating expenses are significant, with general and administrative expenses accounting for a substantial portion at $99.45 million. The net income margin has shown variability, most recently recorded at 22.28%.

PE: 9.1x

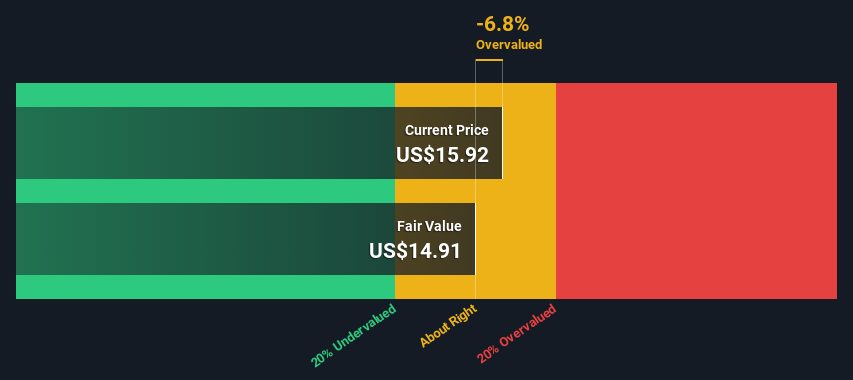

Shore Bancshares, a small cap in the U.S., shows potential with its forecasted 13.5% annual earnings growth. Their recent financials reveal strong performance, with Q4 net income rising to US$13.28 million from US$10.49 million last year, and full-year net income reaching US$43.89 million from US$11.23 million previously. Insider confidence is evident as insiders increased their holdings over the past months, suggesting belief in future prospects amid consistent dividend payments of $0.12 per share this February 2025.

- Dive into the specifics of Shore Bancshares here with our thorough valuation report.

Understand Shore Bancshares' track record by examining our Past report.

Make It Happen

- Dive into all 77 of the Undervalued US Small Caps With Insider Buying we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Kearny Financial, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kearny Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KRNY

Kearny Financial

Operates as the holding company for Kearny Bank that provides various banking products and services in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives