- United States

- /

- Banks

- /

- NasdaqGS:SFNC

Early Net Interest Margin Milestone Might Change the Case for Investing in Simmons First National (SFNC)

Reviewed by Sasha Jovanovic

- Simmons First National Corporation recently reported strong Q2 2025 results, with growth in net interest income and net interest margin exceeding 3% ahead of schedule, driven by selective lending and a focus on credit quality.

- A key insight is that management's confidence in meeting performance targets and an optimistic outlook for loan growth are supported by ongoing investments in talent and technology.

- We'll explore how the early achievement of net interest margin milestones shapes Simmons First National's broader investment narrative and future prospects.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Simmons First National Investment Narrative Recap

Being a shareholder in Simmons First National means believing in disciplined, profitable loan growth supported by prudent credit practices and timely investments in technology and talent. The recent Q2 2025 results, with net interest margin exceeding 3% ahead of schedule, reinforce confidence in near-term margin expansion as a key catalyst. However, the most immediate risk, volatility in loan balances driven by paydowns and seasonality in agri lending, remains, and the news does not eliminate this concern.

Of the recent company announcements, the upcoming CEO transition stands out as most relevant in context. As Simmons First National prepares to navigate continued margin improvement and loan growth targets, stable and experienced leadership under incoming CEO Jay Brogdon may provide important continuity during a period of both opportunity and lingering risks.

But despite these positive developments, investors should also remain mindful of how potential volatility in loan balances and paydowns could impact near-term revenue growth…

Read the full narrative on Simmons First National (it's free!)

Simmons First National's narrative projects $1.3 billion revenue and $354.8 million earnings by 2028. This requires 19.7% yearly revenue growth and a $194.6 million earnings increase from $160.2 million currently.

Uncover how Simmons First National's forecasts yield a $22.80 fair value, a 20% upside to its current price.

Exploring Other Perspectives

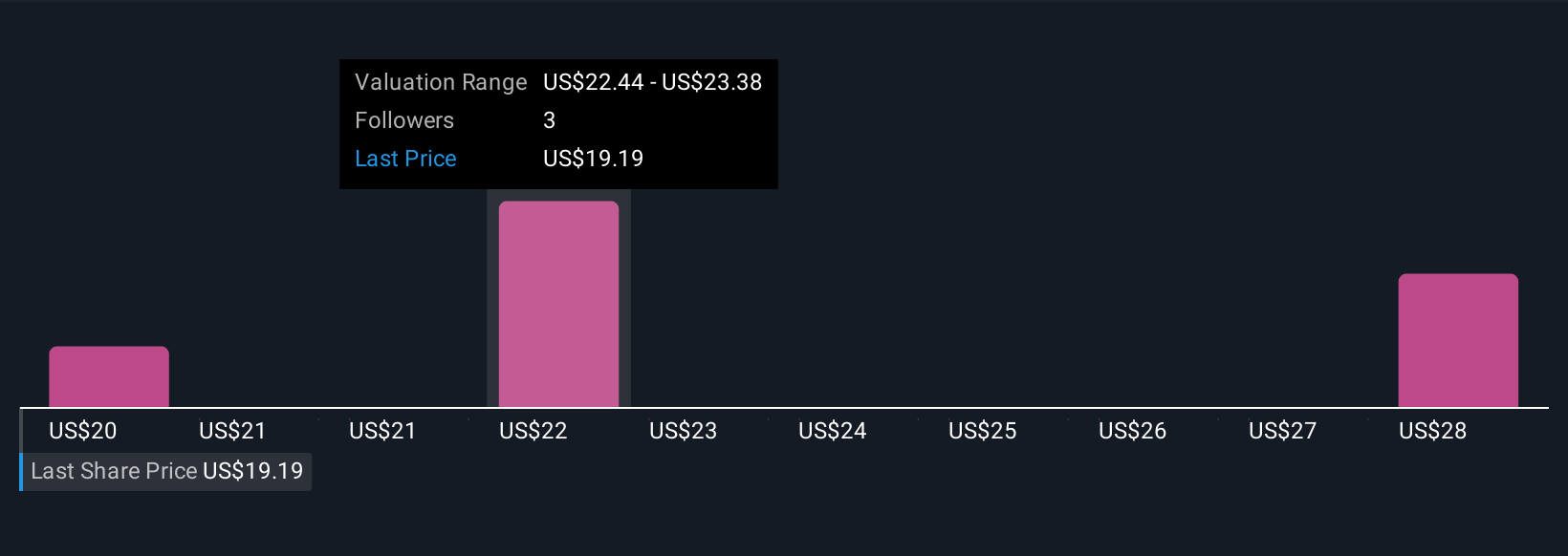

Community fair value estimates for Simmons First National range from US$19.59 to US$30.18 based on three individual forecasts shared by the Simply Wall St Community. While margin improvements excite many, some participants remain cautious about the unpredictability surrounding future loan growth and its effect on earnings potential, so be sure to compare several viewpoints before making up your mind.

Explore 3 other fair value estimates on Simmons First National - why the stock might be worth just $19.59!

Build Your Own Simmons First National Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Simmons First National research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Simmons First National research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Simmons First National's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 39 stocks are leading the charge.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SFNC

Simmons First National

Operates as the bank holding company for Simmons Bank that provides banking and other financial products and services to individuals and businesses.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives