- United States

- /

- Banks

- /

- NasdaqGS:RRBI

Trade Alert: The Independent Director Of Red River Bancshares, Inc. (NASDAQ:RRBI), Barry Hines, Has Sold Some Shares Recently

We'd be surprised if Red River Bancshares, Inc. (NASDAQ:RRBI) shareholders haven't noticed that the Independent Director, Barry Hines, recently sold US$375k worth of stock at US$50.00 per share. The eyebrow raising move amounted to a reduction of 37% in their holding.

Check out our latest analysis for Red River Bancshares

Red River Bancshares Insider Transactions Over The Last Year

In fact, the recent sale by Barry Hines was the biggest sale of Red River Bancshares shares made by an insider individual in the last twelve months, according to our records. So we know that an insider sold shares at around the present share price of US$49.81. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. In this case, the big sale took place at around the current price, so it's not too bad (but it's still not a positive).

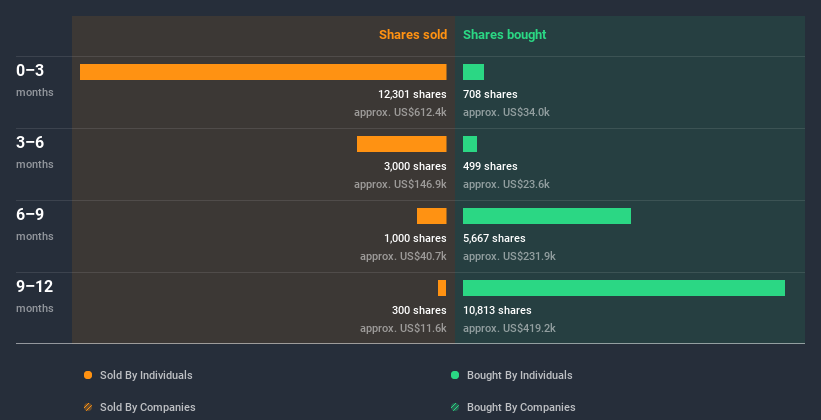

In the last twelve months insiders purchased 17.69k shares for US$720k. But they sold 24.10k shares for US$1.2m. In total, Red River Bancshares insiders sold more than they bought over the last year. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Does Red River Bancshares Boast High Insider Ownership?

Many investors like to check how much of a company is owned by insiders. We usually like to see fairly high levels of insider ownership. Red River Bancshares insiders own about US$117m worth of shares (which is 32% of the company). This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Does This Data Suggest About Red River Bancshares Insiders?

The stark truth for Red River Bancshares is that there has been more insider selling than insider buying in the last three months. Zooming out, the longer term picture doesn't give us much comfort. But since Red River Bancshares is profitable and growing, we're not too worried by this. The company boasts high insider ownership, but we're a little hesitant, given the history of share sales. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. Case in point: We've spotted 2 warning signs for Red River Bancshares you should be aware of, and 1 of these is potentially serious.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading Red River Bancshares or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Red River Bancshares, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:RRBI

Red River Bancshares

Operates as a bank holding company for Red River Bank that provides banking products and services to commercial and retail customers in the United States.

Flawless balance sheet and undervalued.