- United States

- /

- Banks

- /

- NasdaqCM:RMBI

If You Had Bought Richmond Mutual Bancorporation's (NASDAQ:RMBI) Shares A Year Ago You Would Be Down 11%

It is doubtless a positive to see that the Richmond Mutual Bancorporation, Inc. (NASDAQ:RMBI) share price has gained some 30% in the last three months. But that is minimal compensation for the share price under-performance over the last year. In fact the stock is down 11% in the last year, well below the market return.

Check out our latest analysis for Richmond Mutual Bancorporation

Because Richmond Mutual Bancorporation made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last twelve months, Richmond Mutual Bancorporation increased its revenue by 7.3%. That's not a very high growth rate considering it doesn't make profits. Given this lacklustre revenue growth, the share price drop of 11% seems pretty appropriate. It's important not to lose sight of the fact that profitless companies must grow. But if you buy a loss making company then you could become a loss making investor.

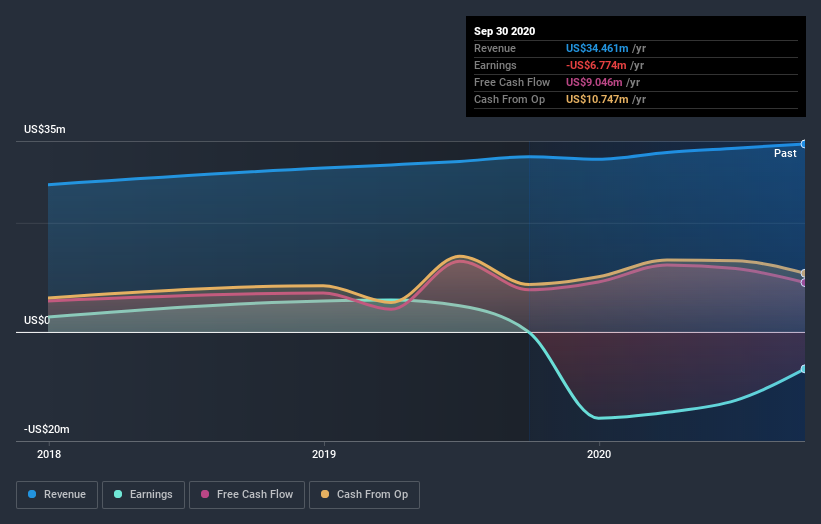

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. It might be well worthwhile taking a look at our free report on Richmond Mutual Bancorporation's earnings, revenue and cash flow.

A Different Perspective

Given that the market gained 23% in the last year, Richmond Mutual Bancorporation shareholders might be miffed that they lost 9.9% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Putting aside the last twelve months, it's good to see the share price has rebounded by 30%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 1 warning sign for Richmond Mutual Bancorporation you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade Richmond Mutual Bancorporation, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:RMBI

Richmond Mutual Bancorporation

Operates as the bank holding company for First Bank Richmond that provides various banking services.

Flawless balance sheet and slightly overvalued.