- United States

- /

- Auto Components

- /

- NasdaqGS:MPAA

US Undiscovered Gems in October 2025

Reviewed by Simply Wall St

In October 2025, the U.S. market is navigating a complex landscape with recent volatility in major indices like the Nasdaq and S&P 500, influenced by ongoing U.S.-China trade tensions and robust bank earnings. Amidst these fluctuations, small-cap stocks often present unique opportunities for investors seeking growth potential, as they can be less impacted by global events and more driven by domestic economic factors.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Southern Michigan Bancorp | 117.38% | 8.87% | 4.89% | ★★★★★★ |

| Tri-County Financial Group | 82.51% | 3.15% | -17.04% | ★★★★★★ |

| Morris State Bancshares | 9.38% | 4.01% | 3.59% | ★★★★★★ |

| SUI Group Holdings | NA | 16.40% | -30.66% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| Valhi | 44.30% | 1.10% | -1.40% | ★★★★★☆ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| NameSilo Technologies | 14.73% | 14.50% | -1.32% | ★★★★★☆ |

| Greenfire Resources | 35.48% | -1.31% | -25.79% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Motorcar Parts of America (MPAA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Motorcar Parts of America, Inc. focuses on manufacturing, remanufacturing, and distributing replacement parts for heavy-duty trucks, industrial, marine, and agricultural applications in the United States with a market cap of $297.64 million.

Operations: The company generates revenue primarily from its Hard Parts segment, amounting to $725.15 million.

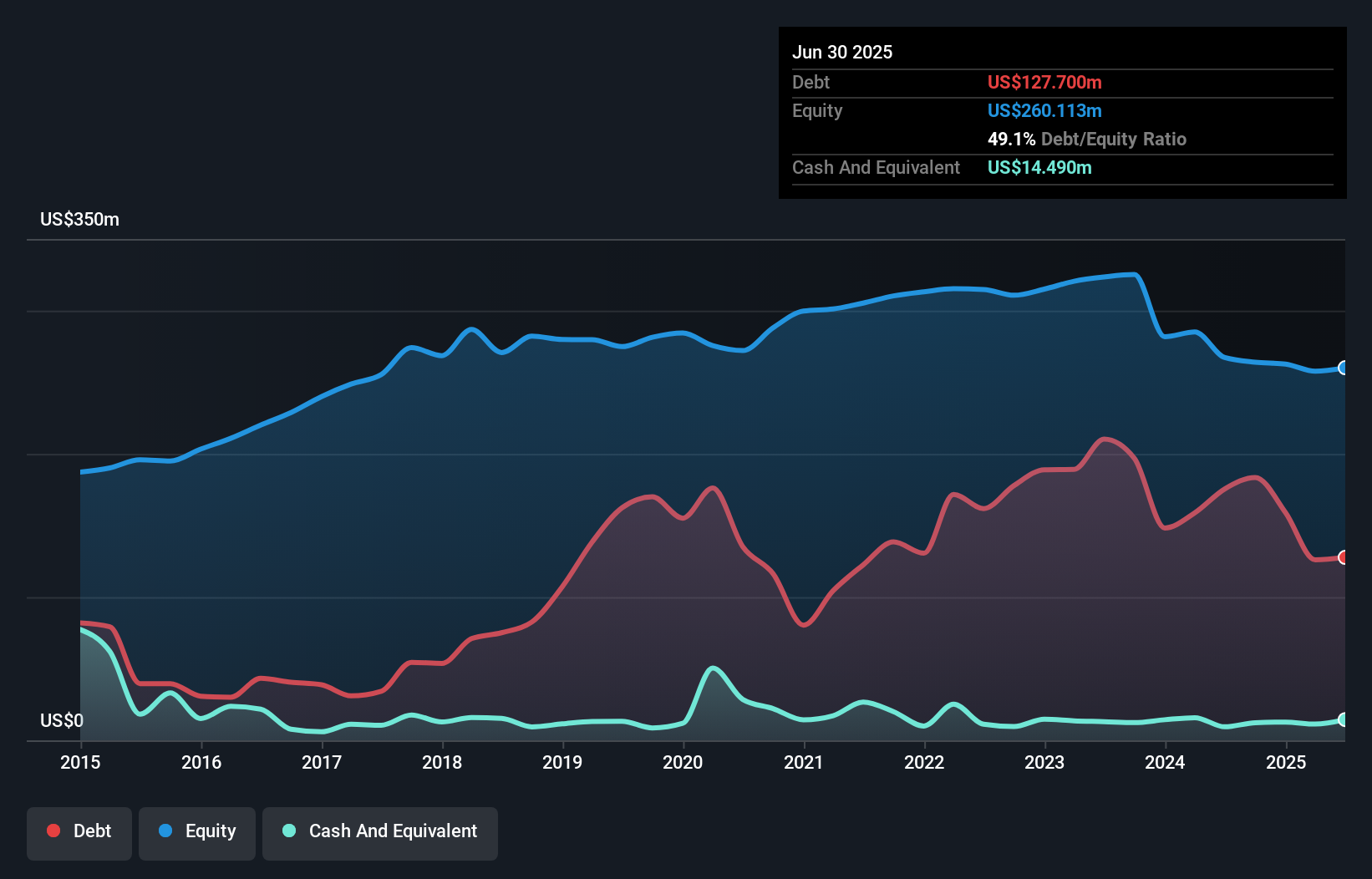

Motorcar Parts of America (MPAA) has shown notable progress, becoming profitable in the past year with a reported net income of US$3.04 million for the first quarter of 2025, compared to a loss of US$18.09 million a year prior. The company has repurchased 197,796 shares, reflecting a commitment to shareholder value. However, MPAA's net debt to equity ratio is high at 43.5%, and its interest payments are not well covered by EBIT, with a coverage of only 1.2 times. Despite these challenges, the company is trading at 91.2% below its estimated fair value, indicating potential for growth.

Republic Bancorp (RBCA.A)

Simply Wall St Value Rating: ★★★★★★

Overview: Republic Bancorp, Inc. is a bank holding company for Republic Bank & Trust Company, offering a range of banking products and services across the United States, with a market capitalization of approximately $1.37 billion.

Operations: Republic Bancorp generates revenue primarily from its Core Banking segment, with Traditional Banking contributing $259.50 million and Warehouse Lending $13.65 million. The Republic Processing Group also adds to the revenue through Tax Refund Solutions at $33.11 million, Republic Credit Solutions at $46.79 million, and Republic Payment Solutions at $16.17 million.

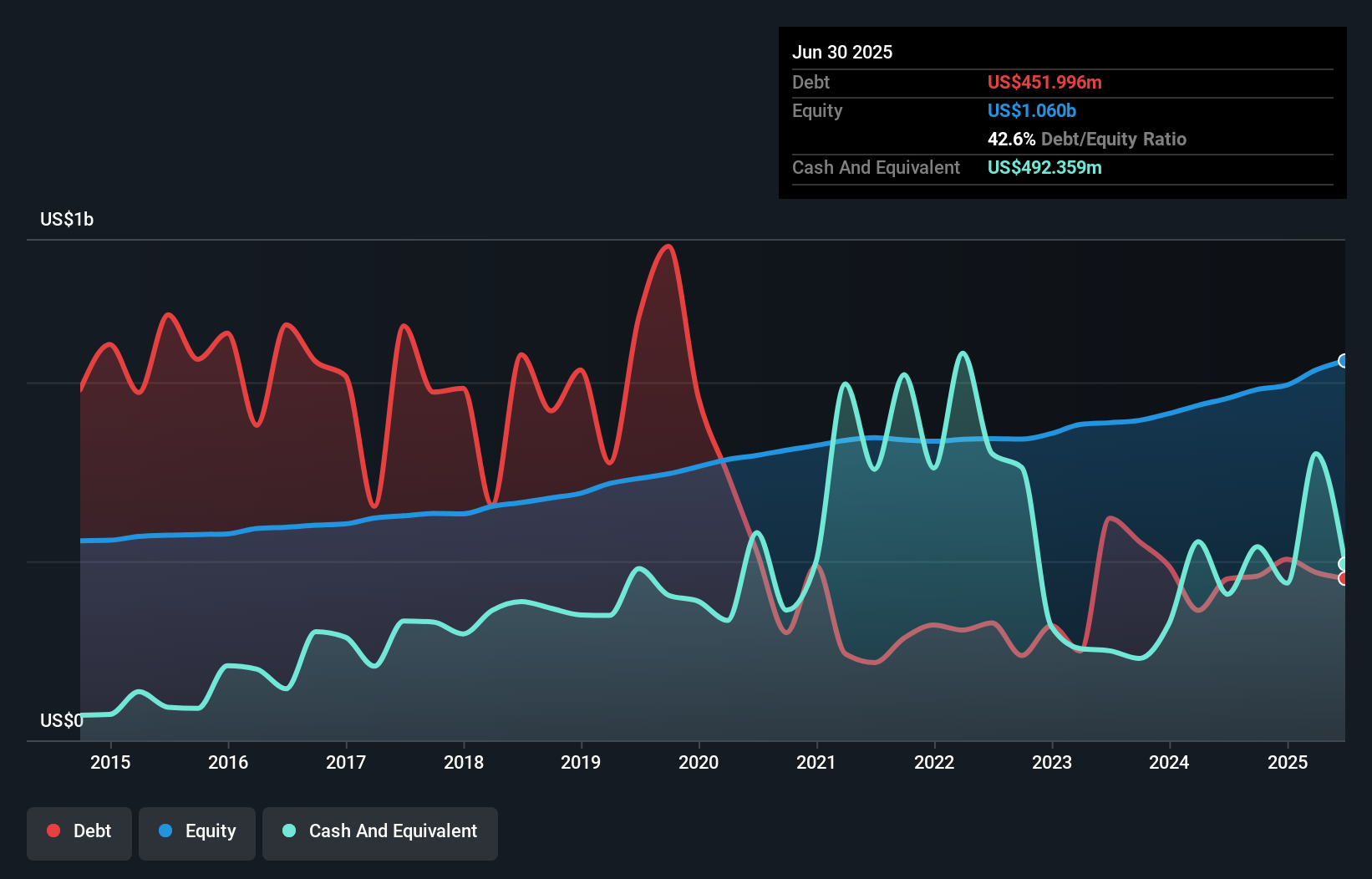

Republic Bancorp, with assets totaling US$7 billion and equity of US$1.1 billion, stands out for its robust financial health. The company has total deposits and loans each at US$5.3 billion, supported by a net interest margin of 4.9%. It boasts a sufficient allowance for bad loans at 0.4% of total loans, reflecting prudent risk management. Recent earnings growth of 28.1% surpasses the industry average, highlighting strong performance. Despite a forecasted earnings decline of 4.3% annually over the next three years, Republic Bancorp trades at a 34.3% discount to its estimated fair value, suggesting potential upside.

Gibraltar Industries (ROCK)

Simply Wall St Value Rating: ★★★★★★

Overview: Gibraltar Industries, Inc. is a company that manufactures and provides products and services for the residential, renewable energy, agtech, and infrastructure markets in the United States and internationally, with a market cap of approximately $1.88 billion.

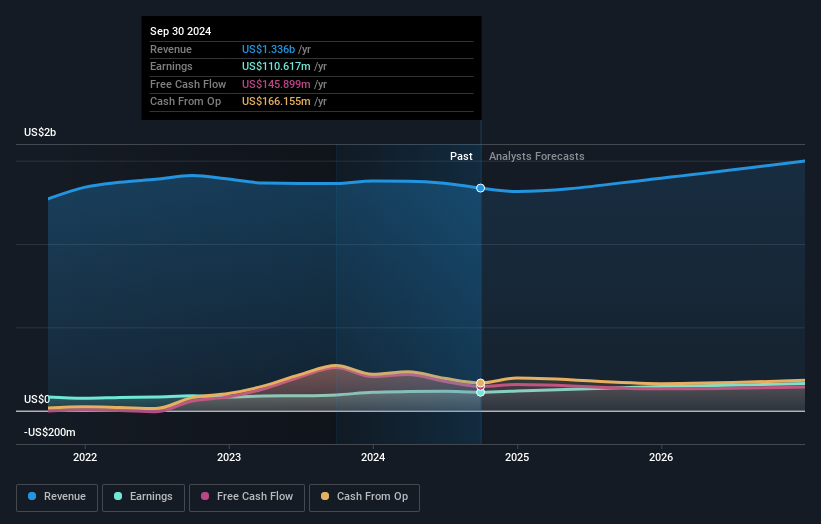

Operations: Gibraltar Industries generates revenue primarily from its residential segment, contributing $793.34 million, and its agtech segment, which brings in $183.41 million. The infrastructure market adds $87.85 million to the total revenue stream.

Gibraltar Industries, a nimble player in the infrastructure and Agtech sectors, is strategically realigning its focus on core businesses while enhancing operational efficiencies. The company reported a second-quarter sales increase to US$309.52 million from US$273.62 million last year, though net income fell to US$26 million from US$32.2 million. Earnings per share dropped slightly to US$0.87 from US$1.05 a year ago. Despite challenges like reliance on mature markets and margin compression, Gibraltar's debt-free status and 14x P/E ratio offer value compared to the broader market, with analysts setting an $85 price target amidst ongoing M&A activities and federal infrastructure investments.

Where To Now?

- Unlock our comprehensive list of 290 US Undiscovered Gems With Strong Fundamentals by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MPAA

Motorcar Parts of America

Manufactures, remanufactures, and distributes heavy-duty truck, industrial, marine, and agricultural application replacement parts in the United States.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026