- United States

- /

- Banks

- /

- NasdaqGS:RBB

Undervalued Small Caps With Insider Action To Watch In February 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 4.8% drop, despite having risen by 15% over the past year and with earnings forecasted to grow by 14% annually. In this fluctuating environment, identifying small-cap stocks that are currently undervalued yet show promising insider activity could present intriguing opportunities for investors seeking potential growth.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| First Mid Bancshares | 11.4x | 2.8x | 48.13% | ★★★★★★ |

| First United | 11.2x | 3.0x | 39.99% | ★★★★★☆ |

| OptimizeRx | NA | 1.1x | 42.08% | ★★★★★☆ |

| German American Bancorp | 14.0x | 4.7x | 47.16% | ★★★★☆☆ |

| Quanex Building Products | 28.0x | 0.7x | 43.31% | ★★★★☆☆ |

| Eagle Financial Services | 7.4x | 1.6x | 38.01% | ★★★★☆☆ |

| S&T Bancorp | 11.6x | 4.0x | 38.35% | ★★★★☆☆ |

| Alpha Metallurgical Resources | 5.3x | 0.6x | -438.08% | ★★★☆☆☆ |

| Franklin Financial Services | 15.0x | 2.4x | 23.28% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -54.66% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

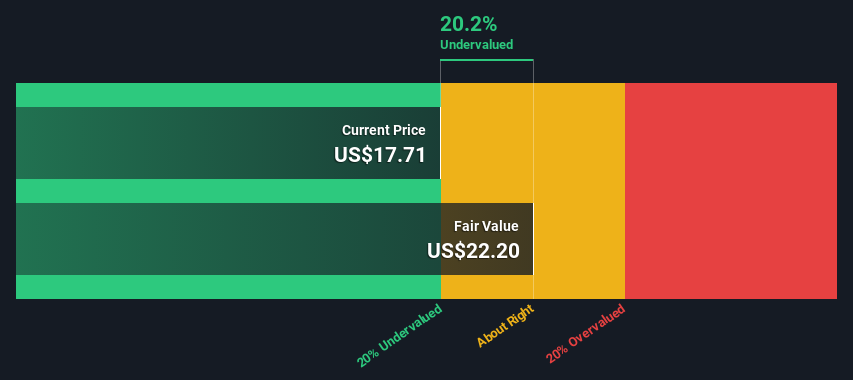

RBB Bancorp (NasdaqGS:RBB)

Simply Wall St Value Rating: ★★★★★★

Overview: RBB Bancorp operates as a bank holding company providing commercial banking services, with a market capitalization of approximately $0.34 billion.

Operations: RBB Bancorp generates its revenue primarily from banking activities, with a reported revenue of $104.84 million as of the latest period. The company consistently achieves a gross profit margin of 100%, indicating no cost of goods sold is recorded in the financials provided. Operating expenses, including general and administrative costs, are significant components impacting net income margins, which have varied over time but were last noted at 25.43%.

PE: 11.6x

RBB Bancorp, a smaller player in the U.S. banking sector, recently reported net interest income of US$25.98 million for Q4 2024, slightly up from the previous year, though net income fell to US$4.39 million from US$12.07 million due to increased charge-offs of US$2 million compared to US$109,000 a year ago. Insider confidence is evident with recent share purchases by company executives in early 2025. Leadership changes bring experienced hands like Johnny Lee as CEO from May 2025, potentially steering growth amid high non-performing loans at 2.7%.

- Click to explore a detailed breakdown of our findings in RBB Bancorp's valuation report.

Examine RBB Bancorp's past performance report to understand how it has performed in the past.

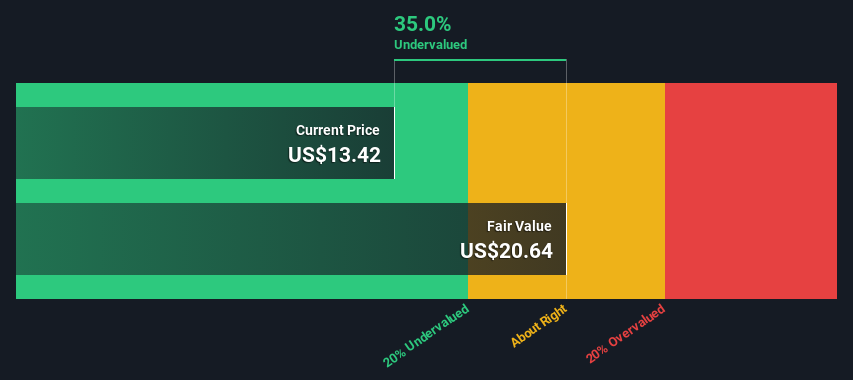

BrightView Holdings (NYSE:BV)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: BrightView Holdings operates as a commercial landscaping services provider, focusing on maintenance and development services, with a market cap of approximately $1.24 billion.

Operations: BrightView Holdings generates revenue primarily from Maintenance Services and Development Services, with the former contributing significantly more. Over recent years, the company's gross profit margin has shown a declining trend, reaching 23.31% by the end of 2024. Operating expenses have consistently been a substantial part of their cost structure, with General & Administrative Expenses forming a significant portion.

PE: 49.5x

BrightView Holdings, a player in the landscaping services industry, has shown insider confidence with recent share purchases. Despite reporting a net loss of US$10.4 million in Q1 2025, an improvement from last year's US$16.4 million loss suggests progress. They expect fiscal year revenue between US$2.75 billion and US$2.84 billion, indicating growth potential. A successful repricing of their $738 million term loan will save approximately $7.5 million annually in interest expenses, enhancing financial stability amidst reliance on external borrowing for funding needs.

- Get an in-depth perspective on BrightView Holdings' performance by reading our valuation report here.

Gain insights into BrightView Holdings' past trends and performance with our Past report.

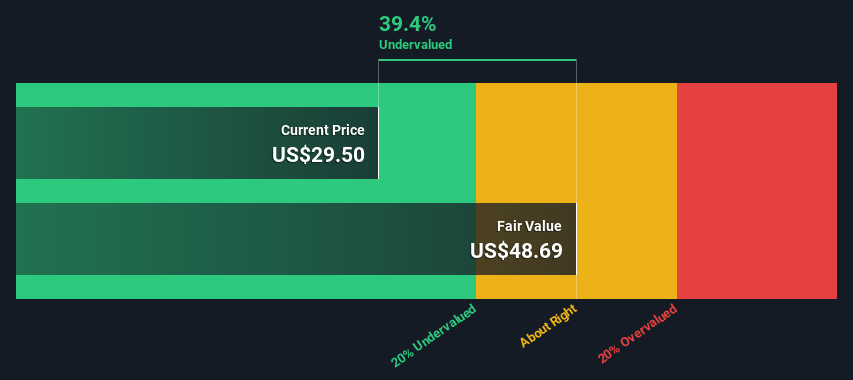

Thermon Group Holdings (NYSE:THR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Thermon Group Holdings is a company that specializes in providing thermal solutions for industrial process heating, with a focus on electronic components and parts, and has a market capitalization of approximately $1.4 billion.

Operations: The company generates revenue primarily from Electronic Components & Parts, with a notable gross profit margin of 43.89% as of the latest period. Over time, the gross profit margin has shown fluctuations, reflecting changes in cost management and pricing strategies. Operating expenses are significant, including General & Administrative Expenses which reached $128.62 million recently. Net income margins have varied across periods, with a recent figure at 9.48%.

PE: 21.2x

Thermon Group Holdings, a smaller company in the U.S., shows potential for value with insider confidence reflected in recent share purchases. From October to December 2024, they repurchased 85,763 shares for US$2.4 million. Despite slightly declining sales of US$134 million in Q3 2024 compared to the previous year, net income rose to US$18.54 million from US$15.84 million. With projected earnings growth and new guidance estimating revenues between US$495-515 million for 2025, Thermon remains an intriguing prospect amidst executive transitions and higher-risk funding strategies focused on external borrowing rather than customer deposits.

- Click here to discover the nuances of Thermon Group Holdings with our detailed analytical valuation report.

Evaluate Thermon Group Holdings' historical performance by accessing our past performance report.

Make It Happen

- Explore the 53 names from our Undervalued US Small Caps With Insider Buying screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RBB

RBB Bancorp

Operates as the bank holding company for Royal Business Bank that provides various banking products and services to the Chinese-American, Korean-American, and other Asian-American communities.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026