- United States

- /

- Banks

- /

- NasdaqGS:NRIM

Exploring May 2025's Undervalued Small Caps With Insider Action Across Regions

Reviewed by Simply Wall St

The United States market has shown resilience with a 1.6% increase over the last week and a notable 12% climb over the past year, while earnings are projected to grow by 14% annually in the coming years. In this context, identifying small-cap stocks that exhibit strong fundamentals and insider activity can offer intriguing opportunities for investors seeking potential growth amid current market dynamics.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| PCB Bancorp | 10.6x | 3.0x | 46.62% | ★★★★★☆ |

| Flowco Holdings | 7.1x | 0.7x | 49.44% | ★★★★★☆ |

| Citizens & Northern | 11.3x | 2.8x | 48.62% | ★★★★☆☆ |

| S&T Bancorp | 11.0x | 3.8x | 43.77% | ★★★★☆☆ |

| Columbus McKinnon | 54.7x | 0.5x | 31.80% | ★★★☆☆☆ |

| MVB Financial | 12.8x | 1.7x | 42.34% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -47.95% | ★★★☆☆☆ |

| Tandem Diabetes Care | NA | 1.5x | -2990.44% | ★★★☆☆☆ |

| Montrose Environmental Group | NA | 0.9x | 7.44% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.2x | -436.18% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

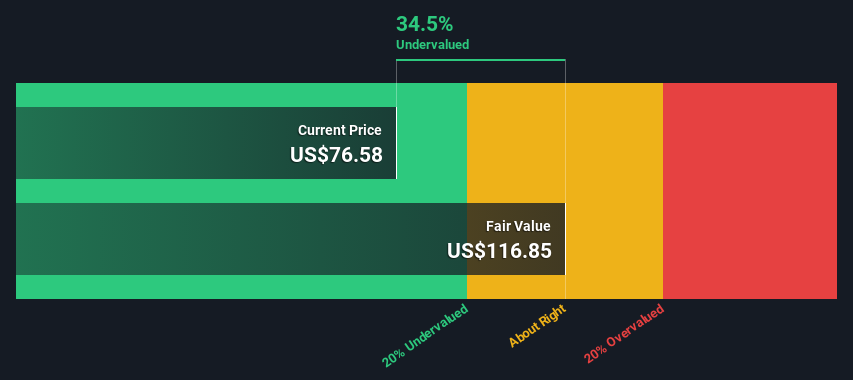

QCR Holdings (NasdaqGM:QCRH)

Simply Wall St Value Rating: ★★★★☆☆

Overview: QCR Holdings operates as a multi-bank holding company providing commercial banking services through its subsidiaries, with a market capitalization of approximately $0.91 billion.

Operations: QCR Holdings generates revenue primarily through its commercial banking operations across multiple subsidiaries, with the Cedar Rapids Bank & Trust Company contributing significantly. The company's gross profit margin consistently stands at 100%, indicating no reported cost of goods sold. Operating expenses are largely driven by general and administrative costs. Net income margin has shown variability, reaching a high of 37.25% in March 2022 and more recently standing at 34.82% as of March 2025.

PE: 10.6x

QCR Holdings, a small company in the financial sector, reported US$59.99 million in net interest income for Q1 2025, up from US$54.7 million the previous year, though net income slightly decreased to US$25.8 million. Insider confidence is evident with recent insider purchases through March 2025. The leadership transition sees Todd Gipple stepping into the CEO role post-May 22, 2025, potentially influencing future growth as earnings are projected to grow by 4.47% annually despite recent charge-offs of US$4.2 million for Q1 2025.

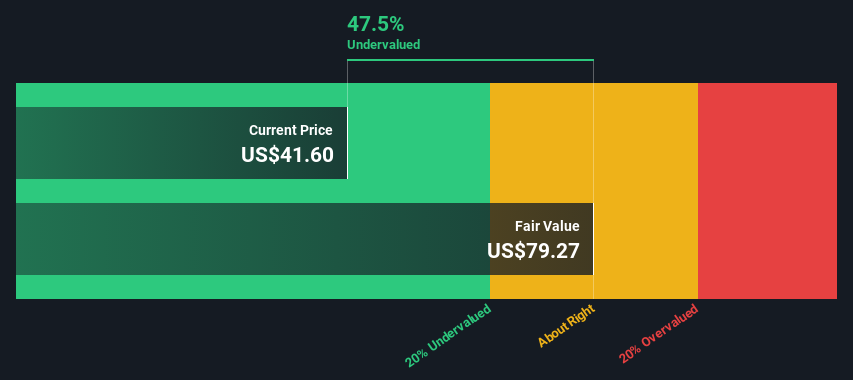

Barrett Business Services (NasdaqGS:BBSI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Barrett Business Services provides staffing and outsourcing services, with a market cap of approximately $0.62 billion.

Operations: The company generates revenue primarily from its Staffing & Outsourcing Services, amounting to $1.17 billion as of the latest period. The cost of goods sold (COGS) is significant, leading to a gross profit margin of 21.88%. Operating expenses include general and administrative costs, which are a major component at $188.29 million for the same period.

PE: 21.0x

Barrett Business Services, a company with a market cap under $1 billion, recently reported Q1 2025 revenue of US$292.57 million, up from US$265.78 million last year, though it faced a net loss of US$1.02 million. Despite this setback, the company anticipates gross billings growth of 7% to 9% for 2025 and maintains insider confidence with recent share purchases by executives. The appointment of experienced leaders like Mark S. Finn and Thomas McGinn strengthens its strategic direction in investment management and insurance operations respectively, while innovations such as the Applicant Tracking System aim to enhance business efficiency and integration with existing products.

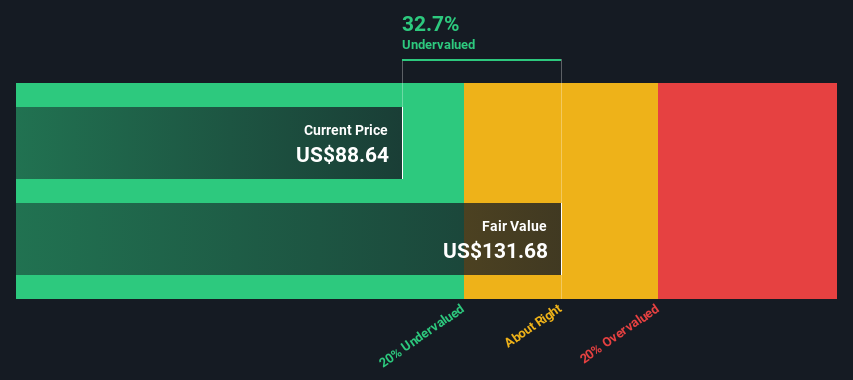

Northrim BanCorp (NasdaqGS:NRIM)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Northrim BanCorp is a financial services company that operates primarily in the banking and mortgage lending sectors, with a market capitalization of approximately $0.26 billion.

Operations: The company's revenue streams include Specialty Finance, Segment Adjustment, and Home Mortgage Lending. Operating expenses are a significant portion of the financial structure, with General & Administrative Expenses consistently being the largest component. The gross profit margin has consistently been 100%, while net income margins have fluctuated over time.

PE: 11.9x

Northrim BanCorp, a small company in the financial sector, has shown promising financial performance. Recent first-quarter results revealed net interest income at US$31.3 million, up from US$26.45 million last year, with net income rising to US$13.32 million from US$8.2 million. Insider confidence is evident as they have been purchasing shares recently. The company filed a shelf registration for US$150 million in April 2025, indicating potential strategic initiatives ahead and positioning itself for future growth opportunities by 2034 with production forecasts reflecting continued expansion.

- Unlock comprehensive insights into our analysis of Northrim BanCorp stock in this valuation report.

Assess Northrim BanCorp's past performance with our detailed historical performance reports.

Summing It All Up

- Explore the 103 names from our Undervalued US Small Caps With Insider Buying screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Northrim BanCorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NRIM

Northrim BanCorp

Operates as the bank holding company for Northrim Bank that provides commercial banking products and services to businesses and professional individuals.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)