- United States

- /

- Banks

- /

- NasdaqCM:PCSB

Shareholders May Be A Little Conservative With PCSB Financial Corporation's (NASDAQ:PCSB) CEO Compensation For Now

CEO Joseph Roberto has done a decent job of delivering relatively good performance at PCSB Financial Corporation (NASDAQ:PCSB) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 27 October 2021. We present our case of why we think CEO compensation looks fair.

View our latest analysis for PCSB Financial

How Does Total Compensation For Joseph Roberto Compare With Other Companies In The Industry?

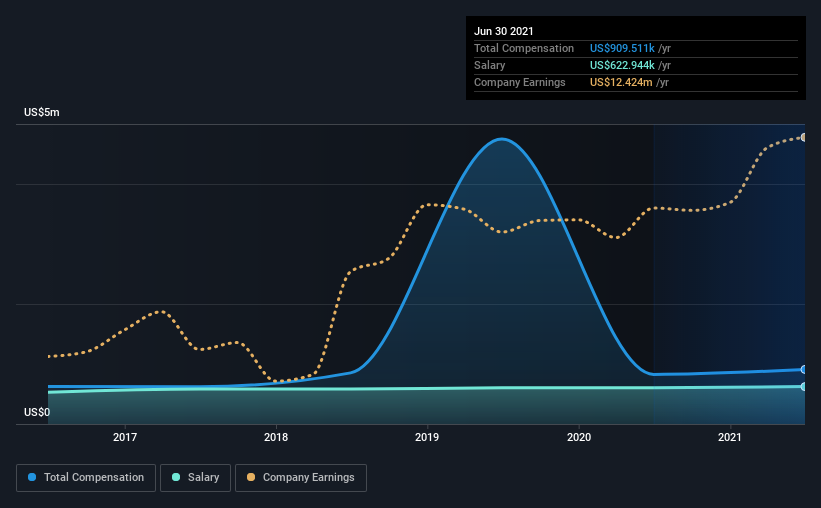

Our data indicates that PCSB Financial Corporation has a market capitalization of US$268m, and total annual CEO compensation was reported as US$910k for the year to June 2021. We note that's an increase of 10% above last year. In particular, the salary of US$622.9k, makes up a huge portion of the total compensation being paid to the CEO.

On examining similar-sized companies in the industry with market capitalizations between US$100m and US$400m, we discovered that the median CEO total compensation of that group was US$890k. This suggests that PCSB Financial remunerates its CEO largely in line with the industry average. Furthermore, Joseph Roberto directly owns US$3.3m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | US$623k | US$605k | 68% |

| Other | US$287k | US$222k | 32% |

| Total Compensation | US$910k | US$827k | 100% |

On an industry level, roughly 51% of total compensation represents salary and 49% is other remuneration. PCSB Financial pays out 68% of remuneration in the form of a salary, significantly higher than the industry average. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

PCSB Financial Corporation's Growth

PCSB Financial Corporation's earnings per share (EPS) grew 29% per year over the last three years. Its revenue is up 8.2% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see modest revenue growth, suggesting the underlying business is healthy. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has PCSB Financial Corporation Been A Good Investment?

PCSB Financial Corporation has generated a total shareholder return of 3.2% over three years, so most shareholders wouldn't be too disappointed. Although, there's always room to improve. In light of that, investors might probably want to see an improvement on their returns before they feel generous about increasing the CEO remuneration.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for PCSB Financial that you should be aware of before investing.

Important note: PCSB Financial is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:PCSB

PCSB Financial

PCSB Financial Corporation operates as the bank holding company for PCSB Bank that provides financial services to individuals and businesses in Putnam, Southern Dutchess, Rockland, and Westchester Counties in New York.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives