- United States

- /

- Banks

- /

- NasdaqGS:OZK

Does Bank OZK's (OZK) Persistent Dividend Growth Reveal Deeper Strengths in Its Capital Allocation Strategy?

Reviewed by Sasha Jovanovic

- Bank OZK recently increased its quarterly cash dividend to US$0.45 per share, marking the sixty-first consecutive quarter of dividend growth, and declared a separate dividend on its Series A Preferred Stock, both payable to shareholders in October and November 2025, respectively.

- This consistent pattern of dividend hikes highlights the bank's ongoing commitment to shareholder returns and signals management's confidence in the company's financial stability.

- We'll explore how Bank OZK's latest dividend increase reinforces analyst expectations for steady performance and earnings growth.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Bank OZK Investment Narrative Recap

To be a shareholder in Bank OZK, you need to believe in the company's ability to generate consistent earnings from commercial real estate and business lending, especially in fast-growing Sun Belt markets. The recent dividend increase underscores management’s focus on reliable shareholder returns, yet it does little to change the biggest short-term catalyst, upcoming earnings, where steady loan growth and asset quality remain in focus. The primary risk continues to be Bank OZK’s heavy exposure to commercial real estate, which could limit gains if cyclical headwinds emerge.

Among recent announcements, the addition of Bank OZK to the Russell 1000 Defensive and Value-Defensive Indexes stands out. This suggests increased recognition of its stable earnings profile and potential for broader ownership by institutional investors, which may influence trading volumes around key data like earnings and dividend actions.

However, investors should also be aware that, despite these strengths, close attention to risks from concentrated commercial real estate lending is warranted if market conditions shift unexpectedly and...

Read the full narrative on Bank OZK (it's free!)

Bank OZK's narrative projects $2.1 billion in revenue and $815.7 million in earnings by 2028. This requires a 10.6% yearly revenue growth and a $113.6 million increase in earnings from the current $702.1 million.

Uncover how Bank OZK's forecasts yield a $57.50 fair value, a 12% upside to its current price.

Exploring Other Perspectives

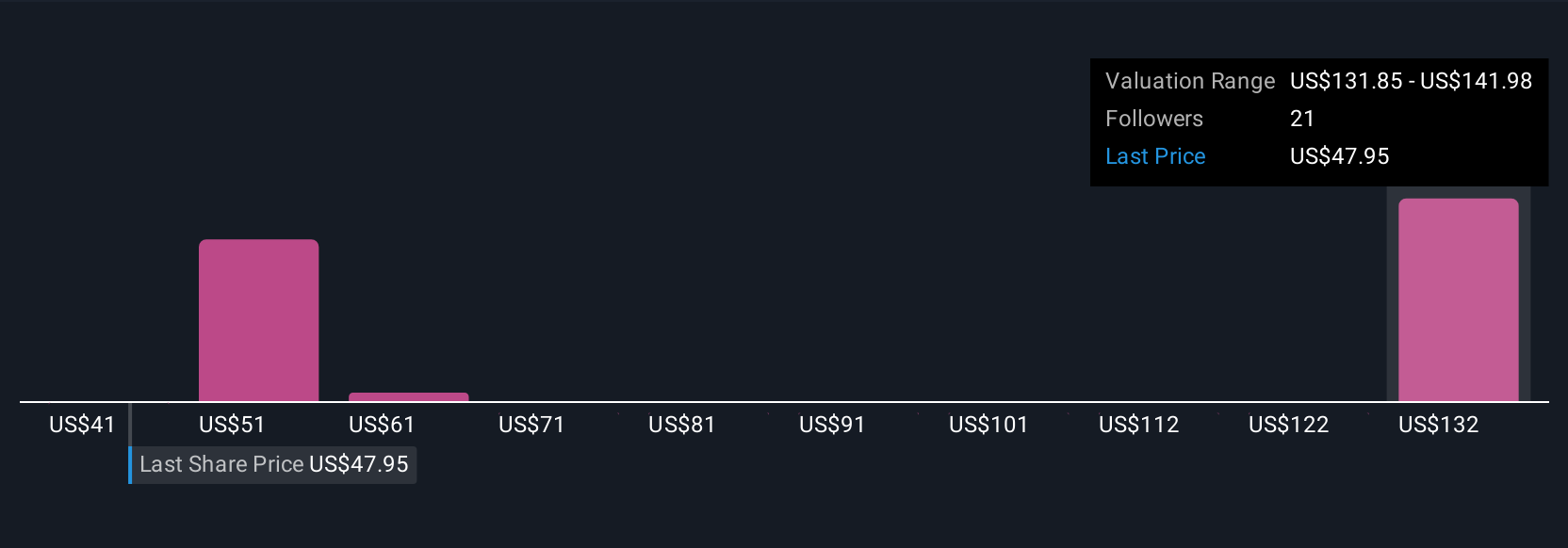

Fair value estimates from six Simply Wall St Community members range from US$40.67 to US$145.37 per share, showing wide variations in outlook. While many see opportunity, the heavy reliance on commercial real estate lending remains a key issue shaping the discussion about future returns.

Explore 6 other fair value estimates on Bank OZK - why the stock might be worth 21% less than the current price!

Build Your Own Bank OZK Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bank OZK research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bank OZK research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bank OZK's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank OZK might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OZK

Bank OZK

Operates as a full-service Arkansas state-chartered bank that provides retail and commercial banking services in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives