- United States

- /

- Banks

- /

- OTCPK:OFED

Dividend Investors: Don't Be Too Quick To Buy Oconee Federal Financial Corp. (NASDAQ:OFED) For Its Upcoming Dividend

Readers hoping to buy Oconee Federal Financial Corp. (NASDAQ:OFED) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. Investors can purchase shares before the 10th of February in order to be eligible for this dividend, which will be paid on the 25th of February.

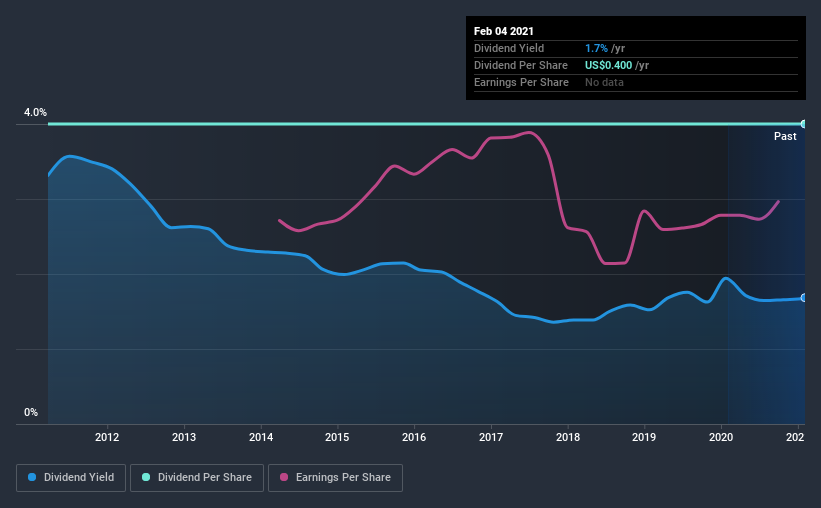

Oconee Federal Financial's next dividend payment will be US$0.10 per share, and in the last 12 months, the company paid a total of US$0.40 per share. Looking at the last 12 months of distributions, Oconee Federal Financial has a trailing yield of approximately 1.7% on its current stock price of $23.75. If you buy this business for its dividend, you should have an idea of whether Oconee Federal Financial's dividend is reliable and sustainable. As a result, readers should always check whether Oconee Federal Financial has been able to grow its dividends, or if the dividend might be cut.

See our latest analysis for Oconee Federal Financial

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Oconee Federal Financial paid out more than half (54%) of its earnings last year, which is a regular payout ratio for most companies.

Generally speaking, the lower a company's payout ratios, the more resilient its dividend usually is.

Click here to see how much of its profit Oconee Federal Financial paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies that aren't growing their earnings can still be valuable, but it is even more important to assess the sustainability of the dividend if it looks like the company will struggle to grow. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. It's not encouraging to see that Oconee Federal Financial's earnings are effectively flat over the past five years. We'd take that over an earnings decline any day, but in the long run, the best dividend stocks all grow their earnings per share.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. It looks like the Oconee Federal Financial dividends are largely the same as they were 10 years ago.

Final Takeaway

Has Oconee Federal Financial got what it takes to maintain its dividend payments? Oconee Federal Financial's earnings per share have been essentially flat, and the company is paying out more than half of its earnings as dividends to shareholders. Oconee Federal Financial doesn't appear to have a lot going for it, and we're not inclined to take a risk on owning it for the dividend.

With that being said, if you're still considering Oconee Federal Financial as an investment, you'll find it beneficial to know what risks this stock is facing. Case in point: We've spotted 1 warning sign for Oconee Federal Financial you should be aware of.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade Oconee Federal Financial, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:OFED

Oconee Federal Financial

Operates as a holding company for Oconee Federal Savings and Loan Association that provides various banking products and services in the Oconee and Pickens County areas of northwestern South Carolina, and the northeast area of Georgia in Stephens County and Rabun County.

Low risk unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives