- United States

- /

- Banks

- /

- NasdaqGS:OCFC

How OceanFirst Financial’s (OCFC) Maintained Dividend Amid Volatility Shapes Its Income Investor Appeal

Reviewed by Sasha Jovanovic

- In recent days, OceanFirst Financial maintained its quarterly dividend despite a year-over-year decline in Q2 2025 net income, reinforcing its reliable 4.48% yield and payout ratio, even as market conditions remained volatile due to a government shutdown.

- This clear commitment to sustaining dividends has appealed to investors focused on income and stability during periods of broader market uncertainty.

- We'll explore how OceanFirst Financial's steadfast dividend strategy reinforces its appeal to income-seeking investors within its broader investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

OceanFirst Financial Investment Narrative Recap

To be a shareholder in OceanFirst Financial today, you need to believe that the bank’s disciplined approach to dividends and consistent deposit growth will offset near-term earnings pressure and sector headwinds, such as rising funding costs and market volatility. The company’s decision to maintain its quarterly dividend despite a Q2 2025 net income decline does not materially change the most important short-term catalyst: new deposit inflows from Premier Banking teams, nor does it lessen the biggest risk: persistent compression in net interest margins if deposit costs stay high.

Among recent announcements, OceanFirst’s July share buyback of over 1 million shares for US$17.2 million stands out. This move, alongside the confirmed dividend, underscores a priority on returning capital to shareholders, supporting share value and yield, yet not altering the need for improved deposit cost management to drive stronger margins and future earnings growth.

However, investors should be aware that, even with robust capital returns, competition for deposits remains fierce and if OceanFirst’s funding costs do not ease...

Read the full narrative on OceanFirst Financial (it's free!)

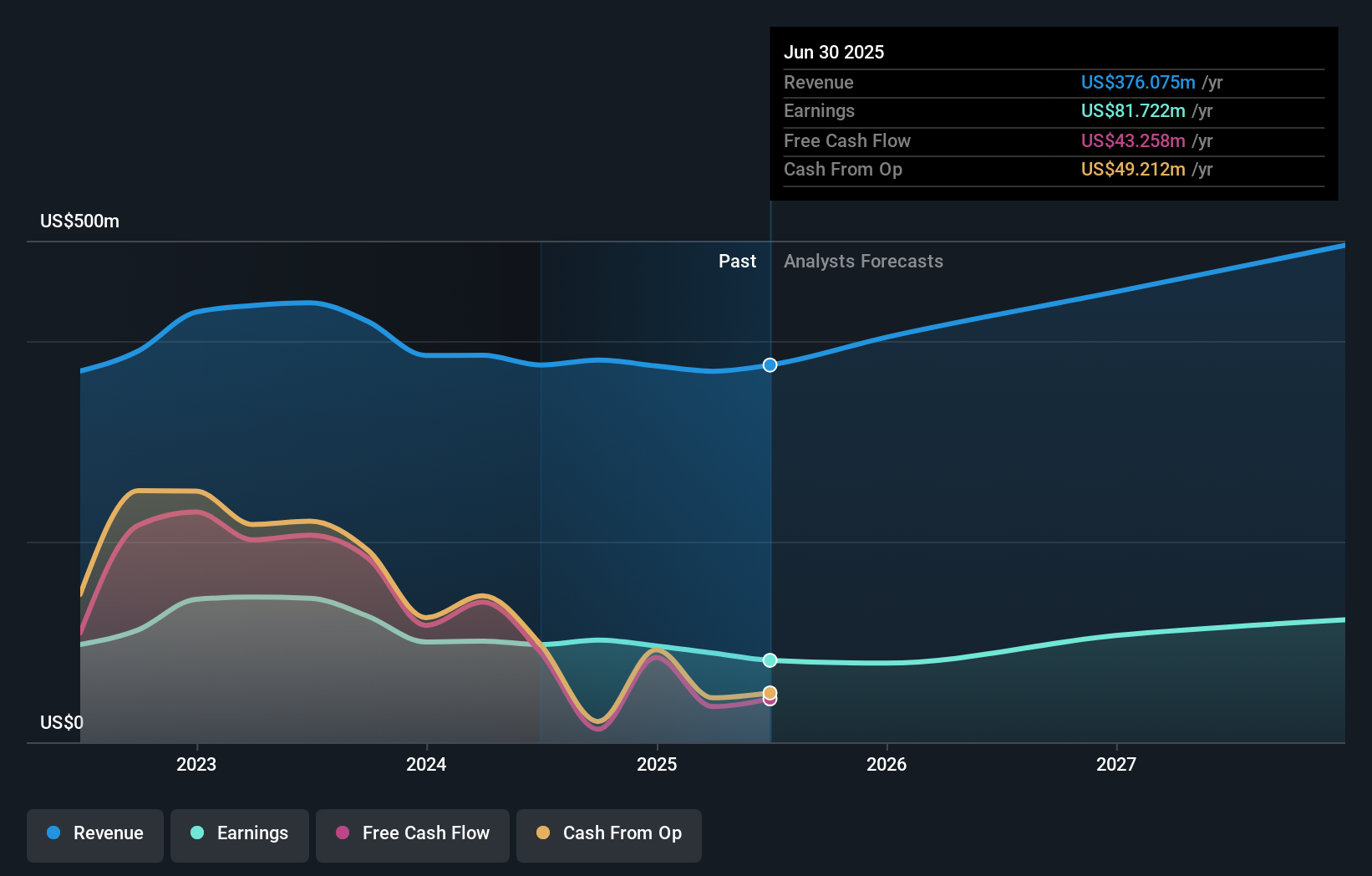

OceanFirst Financial's outlook anticipates $536.1 million in revenue and $124.4 million in earnings by 2028. This is based on 12.5% annual revenue growth and a $42.7 million increase in earnings from the current $81.7 million.

Uncover how OceanFirst Financial's forecasts yield a $20.29 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Four recent fair value estimates from the Simply Wall St Community range from US$12.95 to US$20.29 per share. Such differences may reflect how individual investors assess the risks of rising funding costs and their potential to impact OceanFirst’s future profitability, reminding you to consider multiple viewpoints as you form your opinion.

Explore 4 other fair value estimates on OceanFirst Financial - why the stock might be worth 29% less than the current price!

Build Your Own OceanFirst Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OceanFirst Financial research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free OceanFirst Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OceanFirst Financial's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OCFC

OceanFirst Financial

Operates as the bank holding company for OceanFirst Bank N.A.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives