- United States

- /

- Banks

- /

- NasdaqGS:NWBI

With EPS Growth And More, Northwest Bancshares (NASDAQ:NWBI) Is Interesting

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Northwest Bancshares (NASDAQ:NWBI). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Northwest Bancshares

Northwest Bancshares's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. Northwest Bancshares managed to grow EPS by 8.0% per year, over three years. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

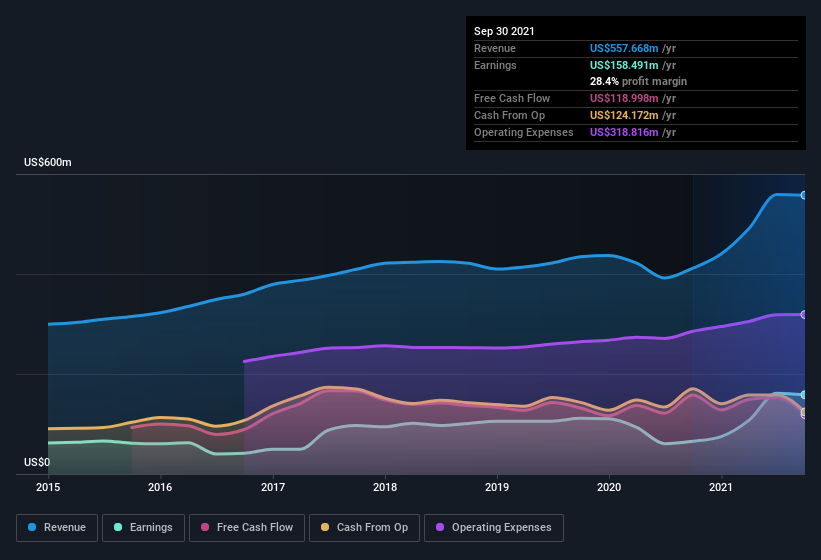

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that Northwest Bancshares's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note Northwest Bancshares's EBIT margins were flat over the last year, revenue grew by a solid 35% to US$558m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Northwest Bancshares's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Northwest Bancshares Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Despite -US$71k worth of sales, Northwest Bancshares insiders have overwhelmingly been buying the stock, spending US$716k on purchases in the last twelve months. You could argue that level of buying implies genuine confidence in the business. We also note that it was the Independent Director, Timothy Hunter, who made the biggest single acquisition, paying US$139k for shares at about US$13.88 each.

Along with the insider buying, another encouraging sign for Northwest Bancshares is that insiders, as a group, have a considerable shareholding. Indeed, they hold US$20m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 1.2% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Ron Seiffert, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like Northwest Bancshares with market caps between US$1.0b and US$3.2b is about US$3.6m.

The Northwest Bancshares CEO received total compensation of just US$1.6m in the year to . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is Northwest Bancshares Worth Keeping An Eye On?

As I already mentioned, Northwest Bancshares is a growing business, which is what I like to see. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for my watchlist - and arguably a research priority. Still, you should learn about the 2 warning signs we've spotted with Northwest Bancshares (including 1 which makes us a bit uncomfortable) .

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Northwest Bancshares, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Northwest Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:NWBI

Northwest Bancshares

Operates as the bank holding company for Northwest Bank, a state-chartered savings bank that provides personal and business banking solutions in the United States.

Flawless balance sheet with reasonable growth potential.