- United States

- /

- Banks

- /

- NasdaqGS:NWBI

Northwest Bancshares (NWBI) Is Up 5.7% After Powell Signals Potential Fed Rate Cuts at Jackson Hole

Reviewed by Simply Wall St

- On August 23, 2025, Federal Reserve Chair Jerome Powell delivered dovish remarks at the Jackson Hole symposium, indicating the potential for interest rate cuts as inflation risks appeared to ease and unemployment stayed low.

- This improved outlook for borrowing costs prompted increased investor interest in sectors sensitive to monetary policy, including regional banks such as Northwest Bancshares.

- We'll explore how the prospect of lower interest rates could influence Northwest Bancshares' earnings trajectory and regional banking strategy.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Northwest Bancshares Investment Narrative Recap

Shareholders in Northwest Bancshares need confidence in the company's ability to convert its regional strength, deposit base, and merger integrations into sustainable earnings growth, despite operating in slower-growth markets and managing rising branch costs. While Chair Powell’s dovish Jackson Hole remarks fueled optimism around lower borrowing costs, interest rate sensitivity remains the core short-term catalyst, potential future rate cuts could benefit near-term margins, but muted organic loan growth and regional headwinds still pose the main risk to the earnings trajectory. The impact of the recent Fed signals does not materially reduce the risk posed by sluggish market expansion and branch-related expenses.

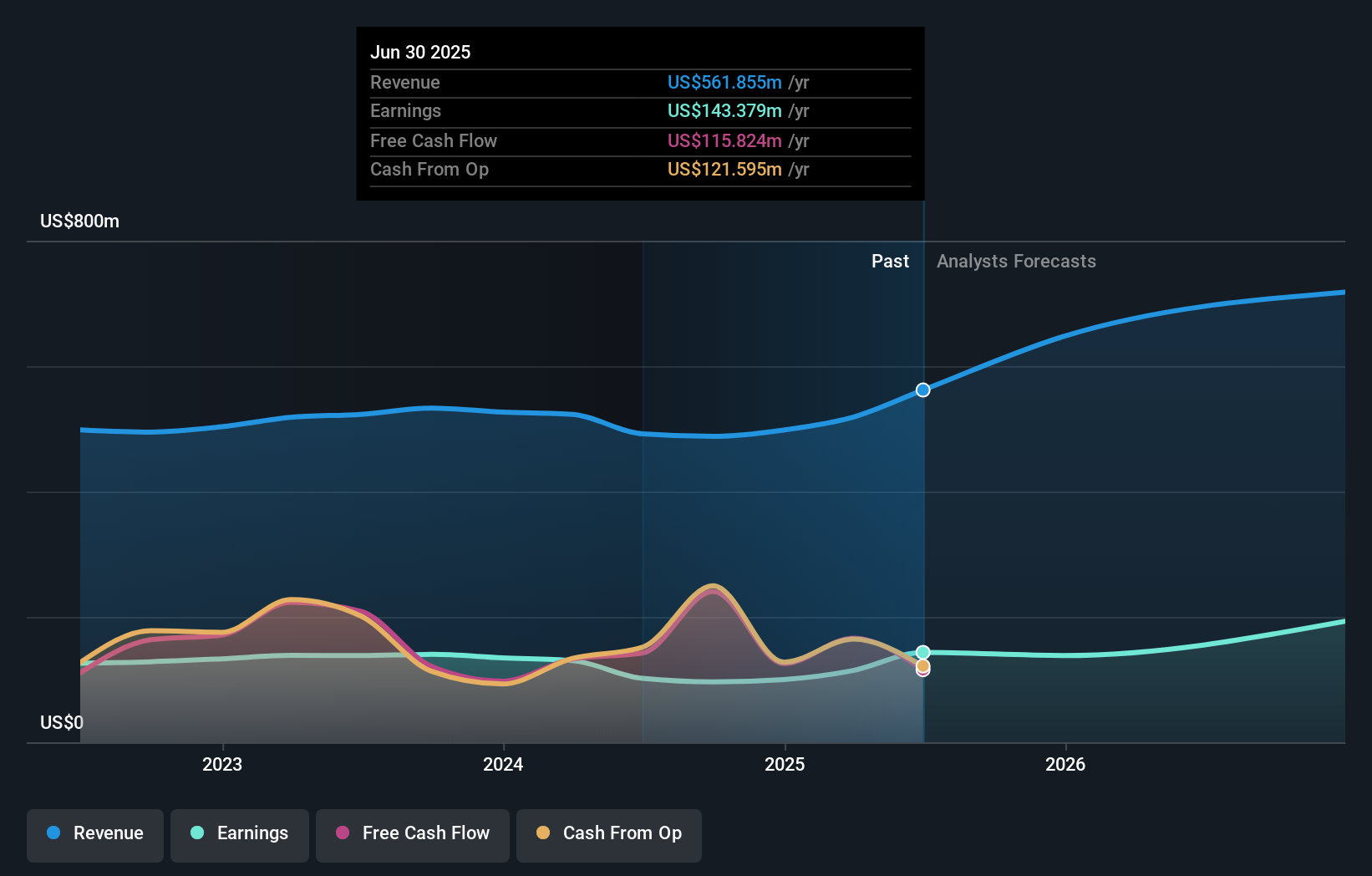

The most relevant recent announcement is Northwest Bancshares’ robust Q2 2025 earnings report, with net interest income rising to US$119.44 million and net income surging to US$33.68 million year over year. These results provide important context for evaluating how lower rates and ongoing integration from the Penns Woods acquisition could interact to affect both the bank’s net interest margin and efficiency ratios in the near term.

In contrast, investors should be aware of ongoing credit risks tied to the Columbus multifamily loan portfolio and the potential for...

Read the full narrative on Northwest Bancshares (it's free!)

Northwest Bancshares' narrative projects $909.9 million revenue and $249.6 million earnings by 2028. This requires 17.4% yearly revenue growth and a $106.2 million earnings increase from $143.4 million today.

Uncover how Northwest Bancshares' forecasts yield a $13.38 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community estimated fair value for Northwest Bancshares between US$13.38 and US$24.41 per share. While some emphasize benefits from merger integration and expansion, opinions differ widely about credit risks tied to certain loan segments, reminding you to compare several viewpoints before making up your mind.

Explore 2 other fair value estimates on Northwest Bancshares - why the stock might be worth just $13.38!

Build Your Own Northwest Bancshares Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northwest Bancshares research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Northwest Bancshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northwest Bancshares' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northwest Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NWBI

Northwest Bancshares

Operates as the bank holding company for Northwest Bank, a state-chartered savings bank that provides personal and business banking solutions in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives