- United States

- /

- Banks

- /

- NasdaqGS:NWBI

Is Northwest Bancshares (NWBI) Undervalued? A Fresh Look at Its Current Valuation

Reviewed by Kshitija Bhandaru

See our latest analysis for Northwest Bancshares.

After a period of subdued movement, Northwest Bancshares has started to show some renewed life as the share price has ticked higher in recent days. While short-term share price returns remain modest, the stock has quietly delivered a 2.7% total shareholder return over the past year. This suggests that long-term holders have seen some gradual upside even as near-term momentum builds.

If this steady pace has you curious about other opportunities, now might be the perfect time to broaden your investing horizons and discover fast growing stocks with high insider ownership

This raises an important question: is Northwest Bancshares currently offering investors an attractive entry point, or has the market already accounted for its future growth prospects?

Most Popular Narrative: 6.8% Undervalued

Northwest Bancshares finished the last session at $12.47, while the most widely followed narrative values the shares at $13.38. With the market close trailing the fair value, investors are weighing solid earnings momentum against questions about what could drive the next move.

The successful completion and integration of the Penns Woods acquisition, with cost savings tracking ahead of original expectations and full run-rate efficiencies expected by mid-2026, should materially improve expense ratios and net margins going forward.

Curious what justifies this premium? The fair value calculation hinges on a set of bullish assumptions for profit margins, future revenues, and a carefully chosen earnings multiple. Is the market underestimating how transformative these changes could be for Northwest? Click to uncover the projections behind this narrative’s surprisingly high target.

Result: Fair Value of $13.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower loan growth and ongoing high operating costs could challenge Northwest Bancshares’s ability to deliver on these optimistic expectations.

Find out about the key risks to this Northwest Bancshares narrative.

Another View: Market Ratios Send a Mixed Signal

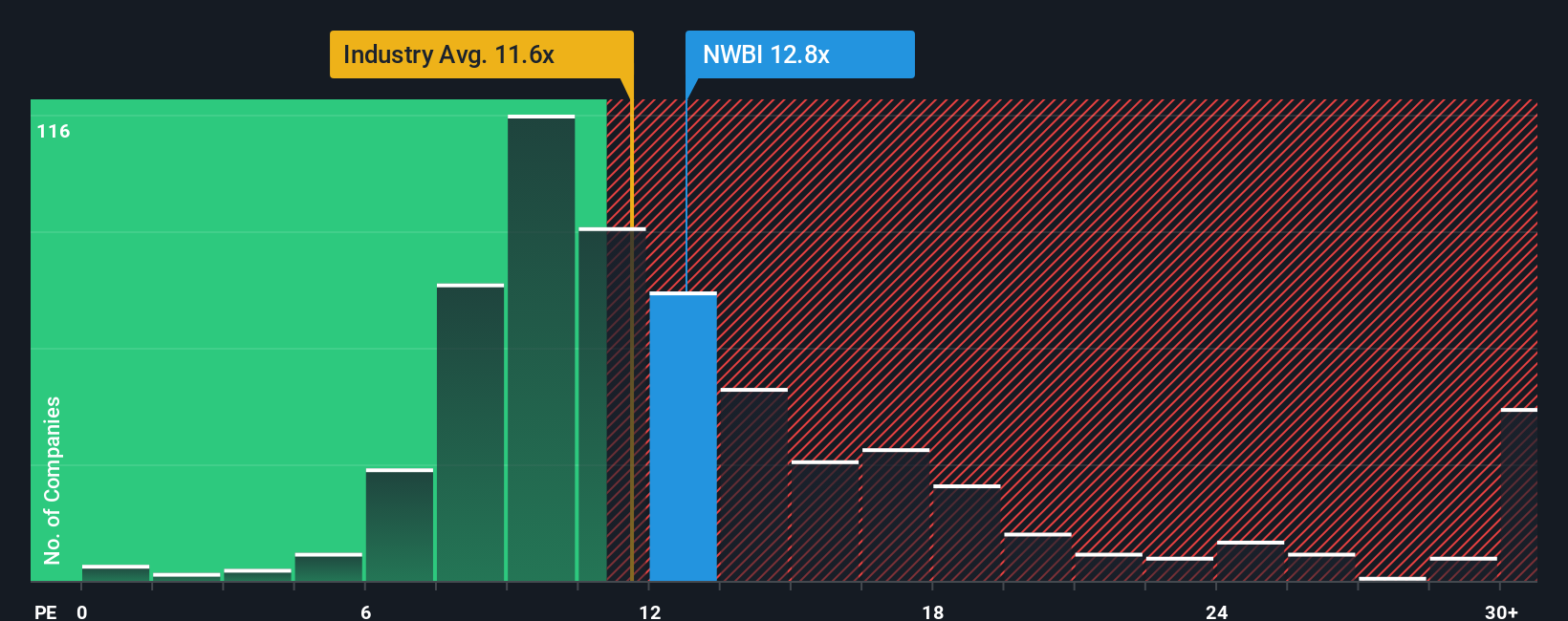

Looking to traditional ratios, Northwest Bancshares trades at 12.7 times earnings, slightly above the US Banks industry average of 11.8, but well below its peer group’s 17.4. Interestingly, our fair ratio estimate comes in higher at 14.6, suggesting the current price might present value. However, this divergence introduces some uncertainty about the possible direction of future movements.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Northwest Bancshares Narrative

If you’re not convinced by these viewpoints or like to draw your own conclusions, dive into the data to quickly craft your personal take in just a few minutes. Do it your way

A great starting point for your Northwest Bancshares research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

If you want to stay ahead and uncover your next winning investment, take charge by using the Simply Wall Street Screener. Your next opportunity might be just a click away.

- Capitalize on steady cash flow with these 19 dividend stocks with yields > 3%, where you will find stocks boasting strong yields and reliable income potential.

- Tap into untapped growth by checking out these 3568 penny stocks with strong financials. This highlights emerging companies poised for big moves and under-the-radar potential.

- Accelerate your portfolio with cutting-edge breakthroughs through these 25 AI penny stocks, focused on game changers transforming industries with artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northwest Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NWBI

Northwest Bancshares

Operates as the bank holding company for Northwest Bank, a state-chartered savings bank that provides personal and business banking solutions in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives