- United States

- /

- Software

- /

- NasdaqCM:GRRR

Undiscovered Gems In The US Featuring Three Promising Small Caps

Reviewed by Simply Wall St

The United States market has experienced a 2.6% drop over the past week, yet it has shown resilience with a 23% rise over the last year and projected annual earnings growth of 15%. In this dynamic environment, identifying promising small-cap stocks can offer unique opportunities for investors seeking to uncover potential long-term value beyond the broader market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Gorilla Technology Group (NasdaqCM:GRRR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Gorilla Technology Group Inc. offers solutions in security, network, business intelligence, and Internet of Things (IoT) technology across the Asia Pacific region, the Americas, Cayman Islands, and internationally with a market cap of $260.21 million.

Operations: Gorilla Technology Group Inc. generates revenue primarily from its Security Convergence segment, which accounts for $88.16 million, while the Video IoT segment contributes $2.91 million. The company has a market cap of $260.21 million and faces financial impacts from unallocated adjustments and write-offs amounting to -$12.13 million.

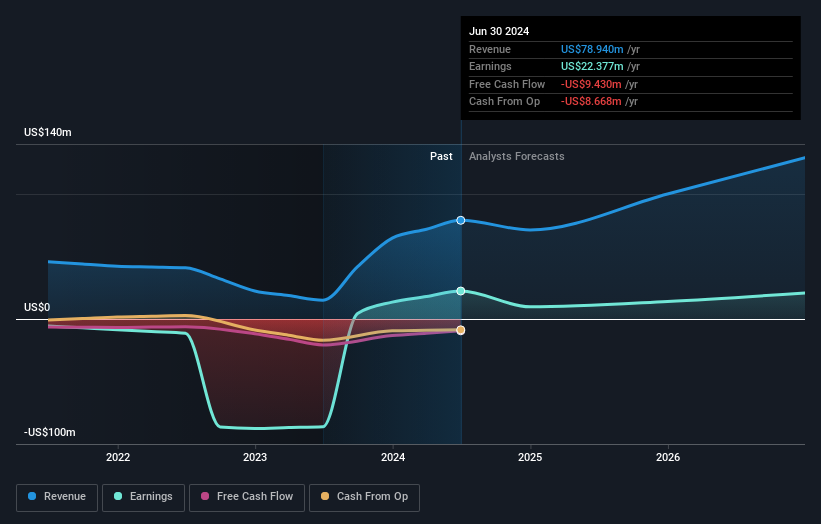

Gorilla Technology Group, a nimble player in the tech sector, recently reported a significant turnaround with half-year sales jumping to US$20.67 million from US$6.43 million the previous year, and net income at US$1.61 million compared to a loss of US$7.27 million. The company boasts a robust net debt to equity ratio of 31%, indicating sound financial health while offering good value with a price-to-earnings ratio of 9.4x against the broader market's 18.2x. Despite its recent profitability and strategic board appointments, future earnings are forecasted to decrease by an average of 8% annually over three years.

Northeast Community Bancorp (NasdaqCM:NECB)

Simply Wall St Value Rating: ★★★★★★

Overview: Northeast Community Bancorp, Inc. serves as the holding company for NorthEast Community Bank, offering financial services to individuals and businesses, with a market cap of $286.10 million.

Operations: Northeast Community Bancorp generates revenue primarily from its thrift and savings and loan institutions, totaling $106.66 million.

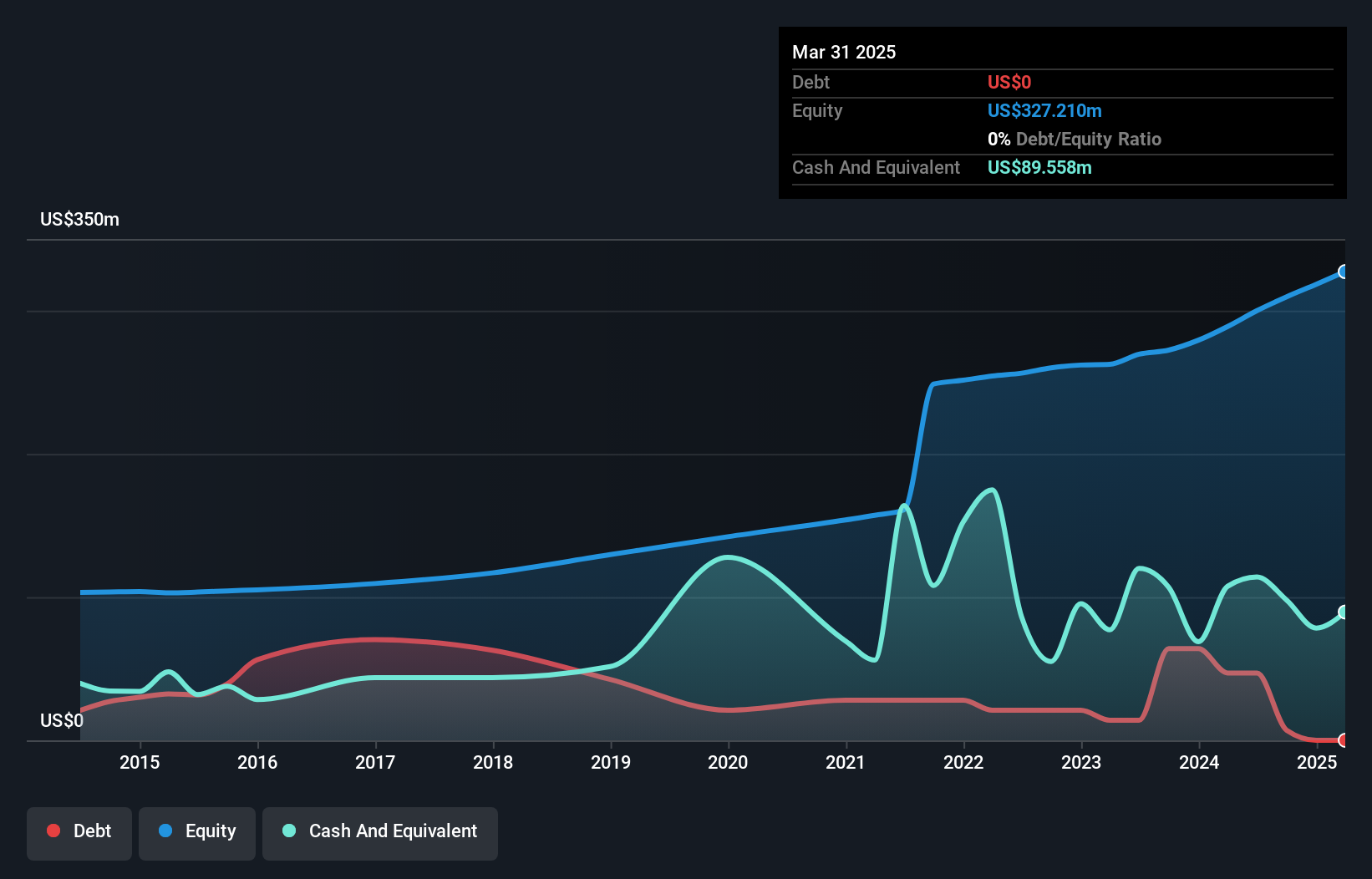

Northeast Community Bancorp, with assets totaling US$2 billion and equity of US$309.6 million, stands out for its robust financial health. The bank's loan portfolio is well-managed, with non-performing loans at a low 0.3% and a solid allowance for bad loans at 110%. Customer deposits form the backbone of its funding strategy, accounting for 98% of liabilities, which reduces risk compared to external borrowing. Despite significant insider selling recently, the company remains undervalued by an estimated 37.2%. Earnings grew by 15.4% last year, outperforming the industry average decline of -11.7%.

Universal Stainless & Alloy Products (NasdaqGS:USAP)

Simply Wall St Value Rating: ★★★★★★

Overview: Universal Stainless & Alloy Products, Inc. manufactures and markets semi-finished and finished specialty steel products both domestically and internationally, with a market cap of $408.71 million.

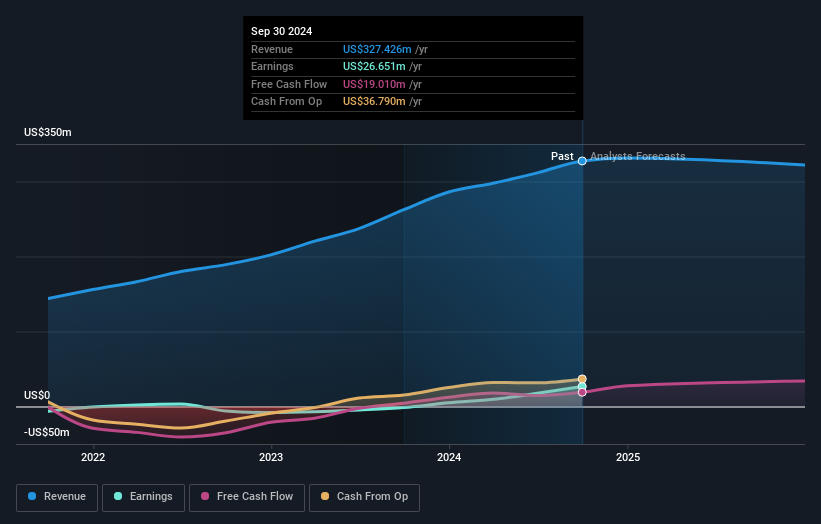

Operations: Universal Stainless & Alloy Products generates revenue primarily from its Metal Processors and Fabrication segment, which accounts for $327.43 million.

Universal Stainless & Alloy Products has shown a strong financial performance, with its debt to equity ratio improving from 26.8% to 24.6% over the last five years, indicating prudent financial management. The company reported earnings of US$11.05 million for Q3 2024, a significant increase from US$1.93 million in the previous year, reflecting its profitability surge and high-quality past earnings. Trading at 73% below estimated fair value suggests potential undervaluation in the market. An acquisition by Aperam S.A., valued at approximately $540 million, is expected to close in early 2025, potentially enhancing strategic positioning within the industry.

- Delve into the full analysis health report here for a deeper understanding of Universal Stainless & Alloy Products.

Learn about Universal Stainless & Alloy Products' historical performance.

Taking Advantage

- Unlock our comprehensive list of 244 US Undiscovered Gems With Strong Fundamentals by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:GRRR

Gorilla Technology Group

Provides solutions in security, network, business intelligence, and Internet of Things (IoT) technology in the Asia Pacific region, the Americas, Cayman Islands, and internationally.

Adequate balance sheet and fair value.

Market Insights

Community Narratives