- United States

- /

- Banks

- /

- NasdaqCM:NECB

Northeast Community Bancorp First Quarter 2025 Earnings: EPS: US$0.80 (vs US$0.87 in 1Q 2024)

Northeast Community Bancorp (NASDAQ:NECB) First Quarter 2025 Results

Key Financial Results

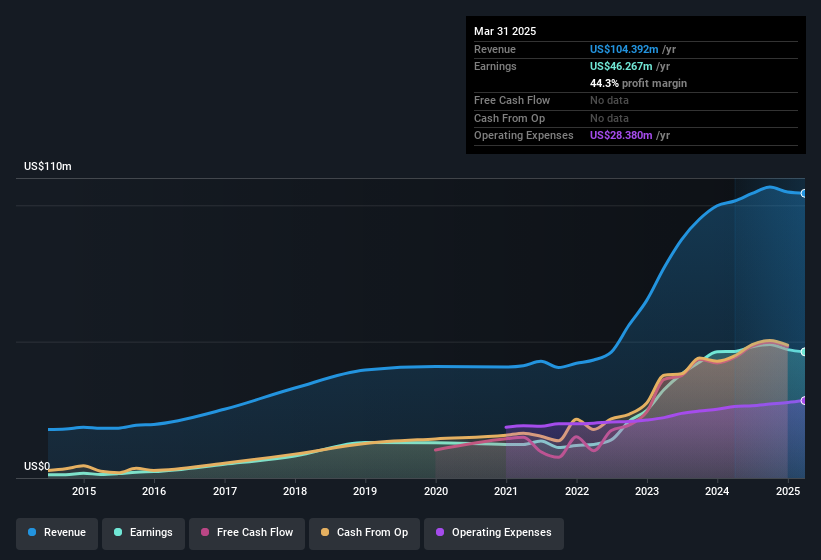

- Revenue: US$25.3m (down 1.7% from 1Q 2024).

- Net income: US$10.6m (down 7.1% from 1Q 2024).

- Profit margin: 42% (down from 44% in 1Q 2024). The decrease in margin was primarily driven by higher expenses.

- EPS: US$0.80 (down from US$0.87 in 1Q 2024).

All figures shown in the chart above are for the trailing 12 month (TTM) period

Northeast Community Bancorp shares are up 2.2% from a week ago.

Balance Sheet Analysis

While it's very important to consider the profit and loss statement, you can also learn a lot about a company by looking at its balance sheet. See our latest analysis on Northeast Community Bancorp's balance sheet health.

If you're looking to trade Northeast Community Bancorp, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Northeast Community Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NECB

Northeast Community Bancorp

Operates as the holding company for NorthEast Community Bank that provides financial services for individuals and businesses.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives