Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In contrast to all that, I prefer to spend time on companies like NBT Bancorp (NASDAQ:NBTB), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for NBT Bancorp

How Fast Is NBT Bancorp Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Over the last three years, NBT Bancorp has grown EPS by 17% per year. That growth rate is fairly good, assuming the company can keep it up.

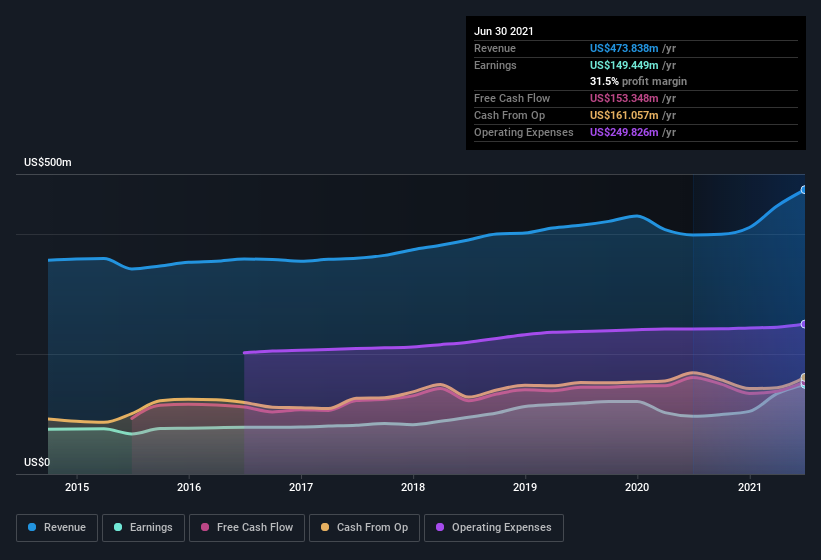

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). I note that NBT Bancorp's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. NBT Bancorp maintained stable EBIT margins over the last year, all while growing revenue 19% to US$474m. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future NBT Bancorp EPS 100% free.

Are NBT Bancorp Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. As a result, I'm encouraged by the fact that insiders own NBT Bancorp shares worth a considerable sum. Indeed, they hold US$38m worth of its stock. That's a lot of money, and no small incentive to work hard. Even though that's only about 2.4% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, I'd say they are indeed. For companies with market capitalizations between US$1.0b and US$3.2b, like NBT Bancorp, the median CEO pay is around US$3.7m.

NBT Bancorp offered total compensation worth US$2.4m to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Is NBT Bancorp Worth Keeping An Eye On?

As I already mentioned, NBT Bancorp is a growing business, which is what I like to see. The fact that EPS is growing is a genuine positive for NBT Bancorp, but the pretty picture gets better than that. Boasting both modest CEO pay and considerable insider ownership, I'd argue this one is worthy of the watchlist, at least. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with NBT Bancorp , and understanding this should be part of your investment process.

Although NBT Bancorp certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if NBT Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:NBTB

NBT Bancorp

A financial holding company, provides commercial banking, retail banking, and wealth management services.

Flawless balance sheet established dividend payer.