- United States

- /

- Metals and Mining

- /

- NYSE:SXC

Top Dividend Stocks To Consider In October 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates a mixed landscape with interest rate uncertainties and record highs in major indices, investors are increasingly focusing on stable income sources like dividend stocks. In such an environment, selecting companies with consistent dividend payouts can offer a reliable income stream amidst market volatility.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| United Bankshares (UBSI) | 4.14% | ★★★★★☆ |

| Preferred Bank (PFBC) | 3.31% | ★★★★★☆ |

| Peoples Bancorp (PEBO) | 5.71% | ★★★★★★ |

| Heritage Commerce (HTBK) | 4.98% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.85% | ★★★★★★ |

| Farmers National Banc (FMNB) | 5.25% | ★★★★★★ |

| Ennis (EBF) | 6.06% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.46% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.82% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.91% | ★★★★★☆ |

Click here to see the full list of 137 stocks from our Top US Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

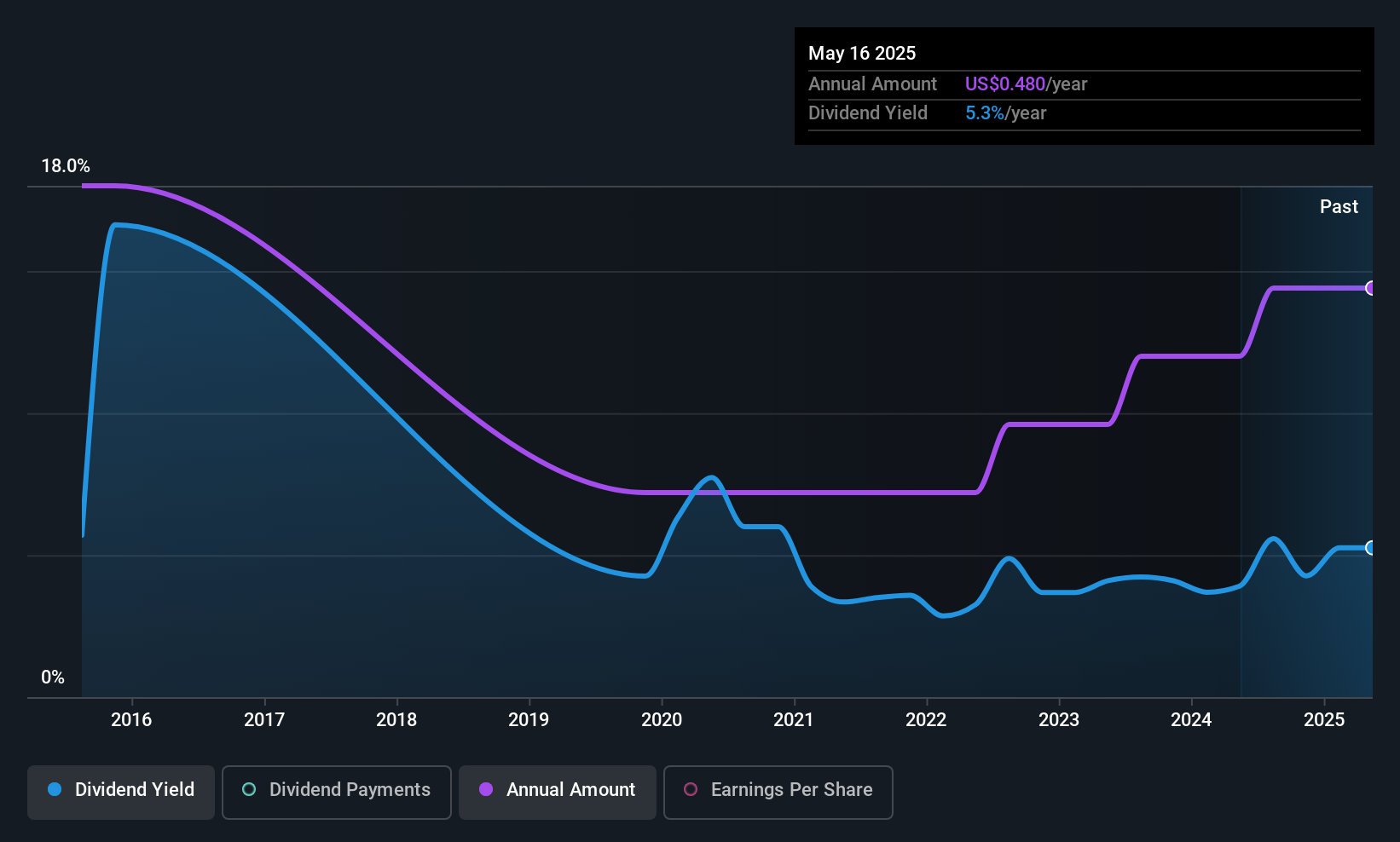

Mid Penn Bancorp (MPB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mid Penn Bancorp, Inc. is the bank holding company for Mid Penn Bank, offering commercial banking services to individuals, partnerships, non-profit organizations, and corporations with a market cap of $690.02 million.

Operations: Mid Penn Bancorp's revenue is primarily derived from its Full-Service Commercial Banking and Trust Business, which generated $208.80 million.

Dividend Yield: 3.1%

Mid Penn Bancorp recently increased its quarterly dividend by 10% to $0.22 per share, indicating a commitment to returning value to shareholders. Despite a volatile dividend history, the current payout ratio of 33.7% suggests dividends are well-covered by earnings and forecasted to remain sustainable with a lower future payout ratio of 20.7%. The company's net income rose significantly in the third quarter, reflecting strong financial performance. However, its dividend yield remains modest compared to top-tier payers in the US market.

- Get an in-depth perspective on Mid Penn Bancorp's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Mid Penn Bancorp is trading behind its estimated value.

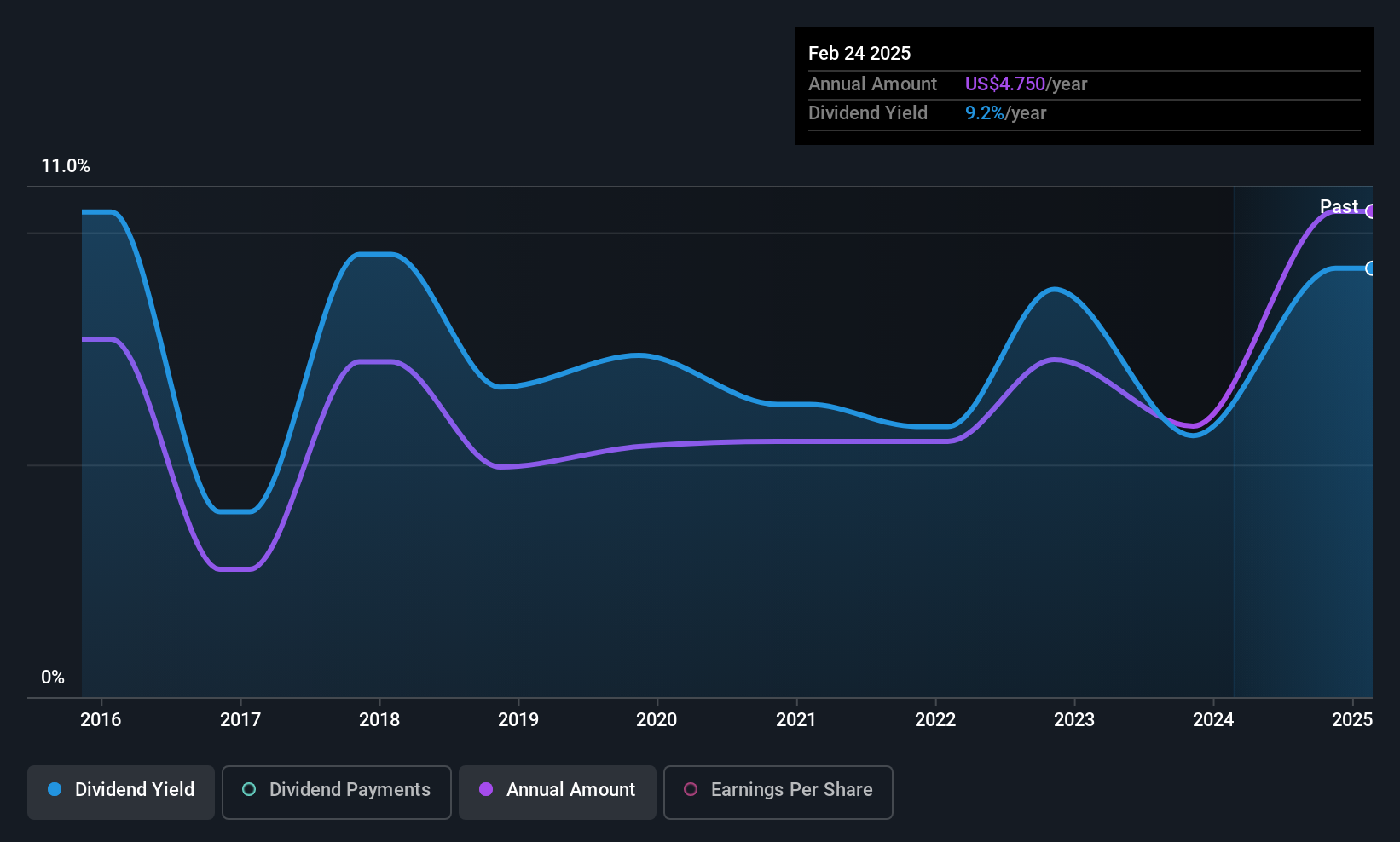

General American Investors Company (GAM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: General American Investors Company, Inc. is a publicly owned investment manager with a market cap of $1.48 billion.

Operations: General American Investors Company, Inc. generates revenue primarily through its financial services segment focused on closed-end funds, amounting to $27.65 million.

Dividend Yield: 7.5%

General American Investors Company has seen dividend payments grow over the past decade, though they have been volatile and unreliable. The current payout ratio of 58% indicates dividends are covered by earnings, yet insufficient data exists to confirm coverage by cash flows. Trading at 39.7% below estimated fair value suggests potential undervaluation. Recent earnings reported a net income of US$150.38 million for the half year ended June 30, 2025, with Sarah M. Ward joining the Board of Directors in August 2025.

- Take a closer look at General American Investors Company's potential here in our dividend report.

- Our expertly prepared valuation report General American Investors Company implies its share price may be lower than expected.

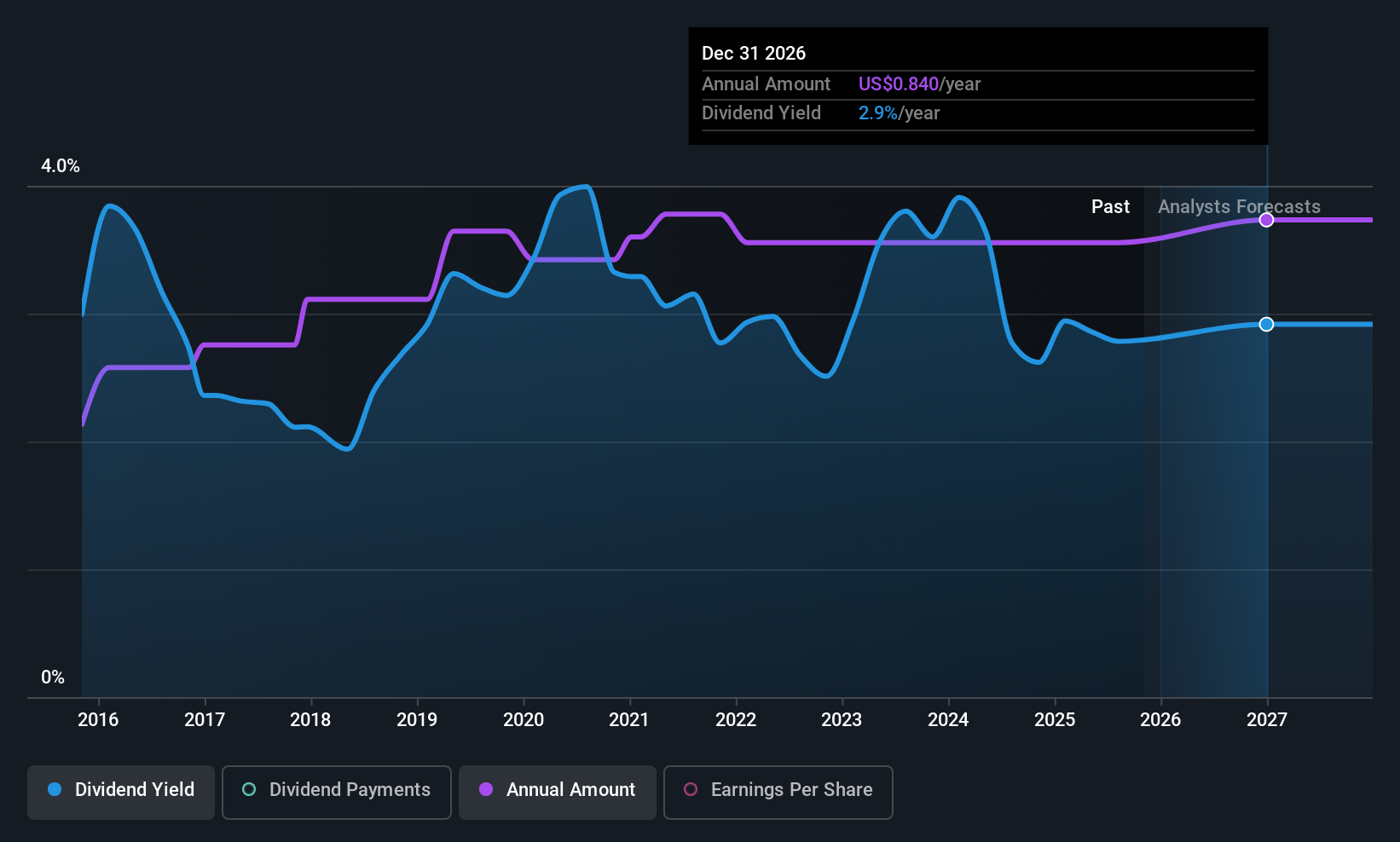

SunCoke Energy (SXC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SunCoke Energy, Inc. is an independent producer of coke operating in the Americas and Brazil, with a market cap of approximately $676.48 million.

Operations: SunCoke Energy's revenue is primarily derived from its Domestic Coke segment at $1.73 billion, followed by Logistics at $102.30 million and Brazil Coke at $34.10 million.

Dividend Yield: 6%

SunCoke Energy's dividend yield of 6.04% ranks in the top 25% of US payers, supported by a payout ratio of 55.7%, indicating coverage by earnings and cash flows. However, dividends have been volatile over the past decade despite recent growth. The company faces challenges with declining earnings forecasts and high debt levels, but its shares trade at a significant discount to estimated fair value, offering potential value for investors seeking income.

- Dive into the specifics of SunCoke Energy here with our thorough dividend report.

- Our valuation report here indicates SunCoke Energy may be undervalued.

Next Steps

- Unlock our comprehensive list of 137 Top US Dividend Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SXC

SunCoke Energy

Operates as an independent producer of coke in the Americas and Brazil.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives