- United States

- /

- Software

- /

- NYSE:YEXT

Exploring Three Undervalued Small Caps In US With Insider Action

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it has seen a remarkable 30% increase over the past year, with earnings anticipated to grow by 15% annually in the coming years. In this context of robust growth expectations, exploring small-cap stocks that exhibit potential value and insider activity can be crucial for investors seeking opportunities in a dynamic market environment.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Capital Bancorp | 15.5x | 3.2x | 42.67% | ★★★★☆☆ |

| Hanover Bancorp | 13.7x | 2.8x | 34.46% | ★★★★☆☆ |

| Franklin Financial Services | 10.6x | 2.1x | 35.17% | ★★★★☆☆ |

| ProPetro Holding | NA | 0.6x | 36.09% | ★★★★☆☆ |

| German American Bancorp | 16.4x | 5.5x | 39.32% | ★★★☆☆☆ |

| USCB Financial Holdings | 19.0x | 5.4x | 48.79% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.4x | -227.90% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -74.59% | ★★★☆☆☆ |

| Sabre | NA | 0.5x | -91.22% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Mid Penn Bancorp (NasdaqGM:MPB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Mid Penn Bancorp operates as a full-service commercial banking and trust business with a market capitalization of approximately $0.43 billion.

Operations: The primary revenue stream is from its full-service commercial banking and trust business, generating $173.42 million. Operating expenses have reached $109.54 million, with general and administrative expenses accounting for a significant portion at $87.49 million. The net income margin has shown variability, recorded at 27.85% recently, reflecting the company's profitability dynamics over time.

PE: 12.5x

Mid Penn Bancorp, a smaller player in the financial sector, demonstrates potential for investors seeking value. Despite recent shareholder dilution through a $70 million equity offering, insider confidence is evident with purchases from July to September 2024. Earnings growth is promising, with net interest income rising to US$40.17 million and net income at US$12.3 million for Q3 2024. The company maintains a quarterly dividend of $0.20 per share, reinforcing its commitment to returning value to shareholders amidst ongoing growth prospects.

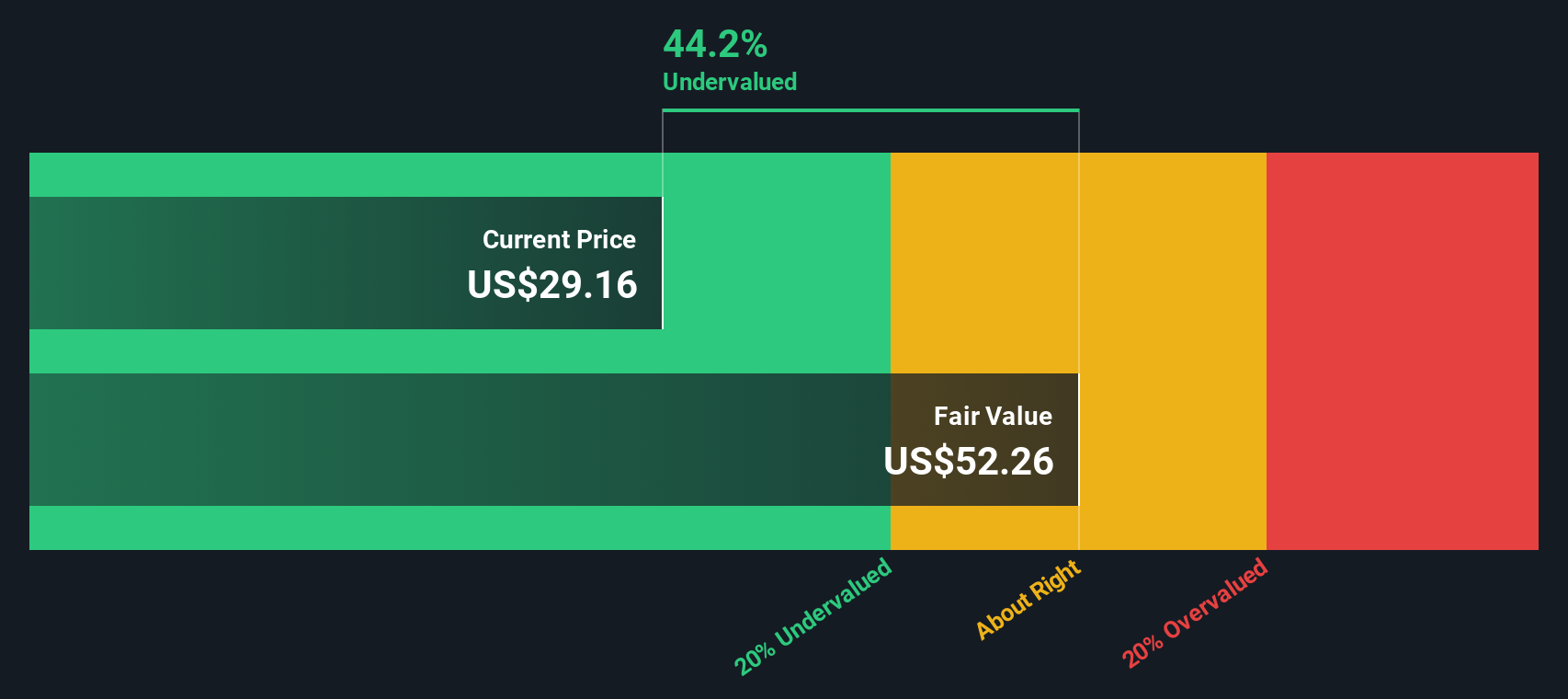

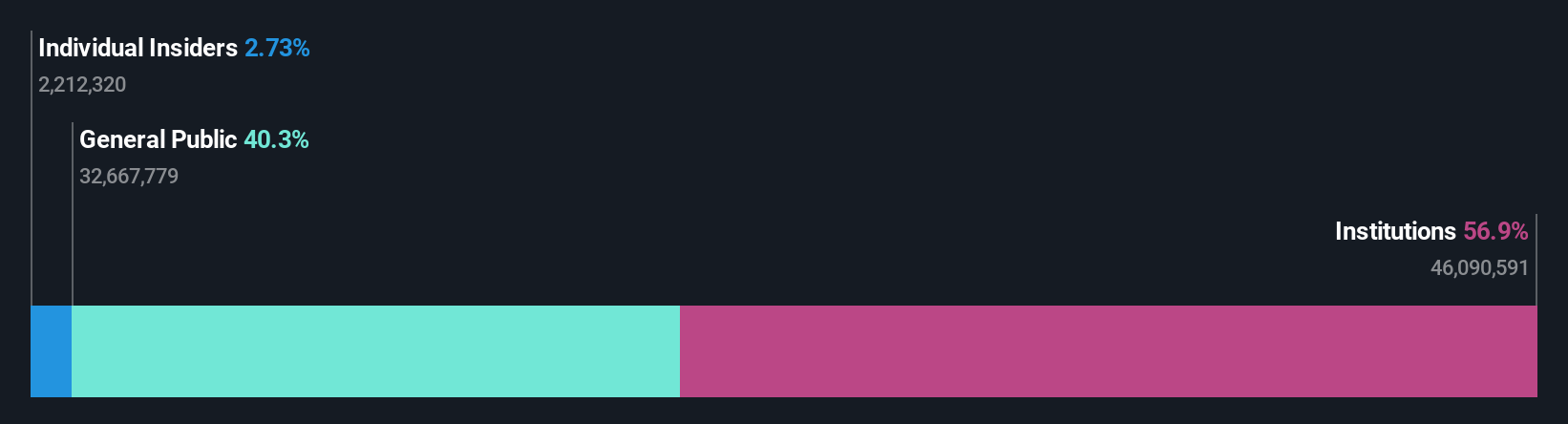

Chimera Investment (NYSE:CIM)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Chimera Investment is a company that invests on a leveraged basis in a diversified portfolio of mortgage assets, with a market capitalization of approximately $1.45 billion.

Operations: The company generates revenue primarily from investing in a diversified portfolio of mortgage assets, with recent data showing a gross profit margin of 93.19%. Operating expenses are consistently present, impacting net income margins which have shown significant fluctuations over the periods observed.

PE: 4.5x

Chimera Investment, a US-based company, showcases potential as an undervalued stock despite challenges. Its recent earnings reveal a significant turnaround with Q3 net income at US$136.46 million compared to just US$2.17 million last year, highlighting improved profitability. However, future earnings are projected to decline by 30.8% annually over the next three years, reflecting potential headwinds. The appointment of Cynthia B. Walsh to the board brings extensive financial industry expertise which could guide strategic decisions amidst reliance on higher-risk external borrowing for funding needs.

- Delve into the full analysis valuation report here for a deeper understanding of Chimera Investment.

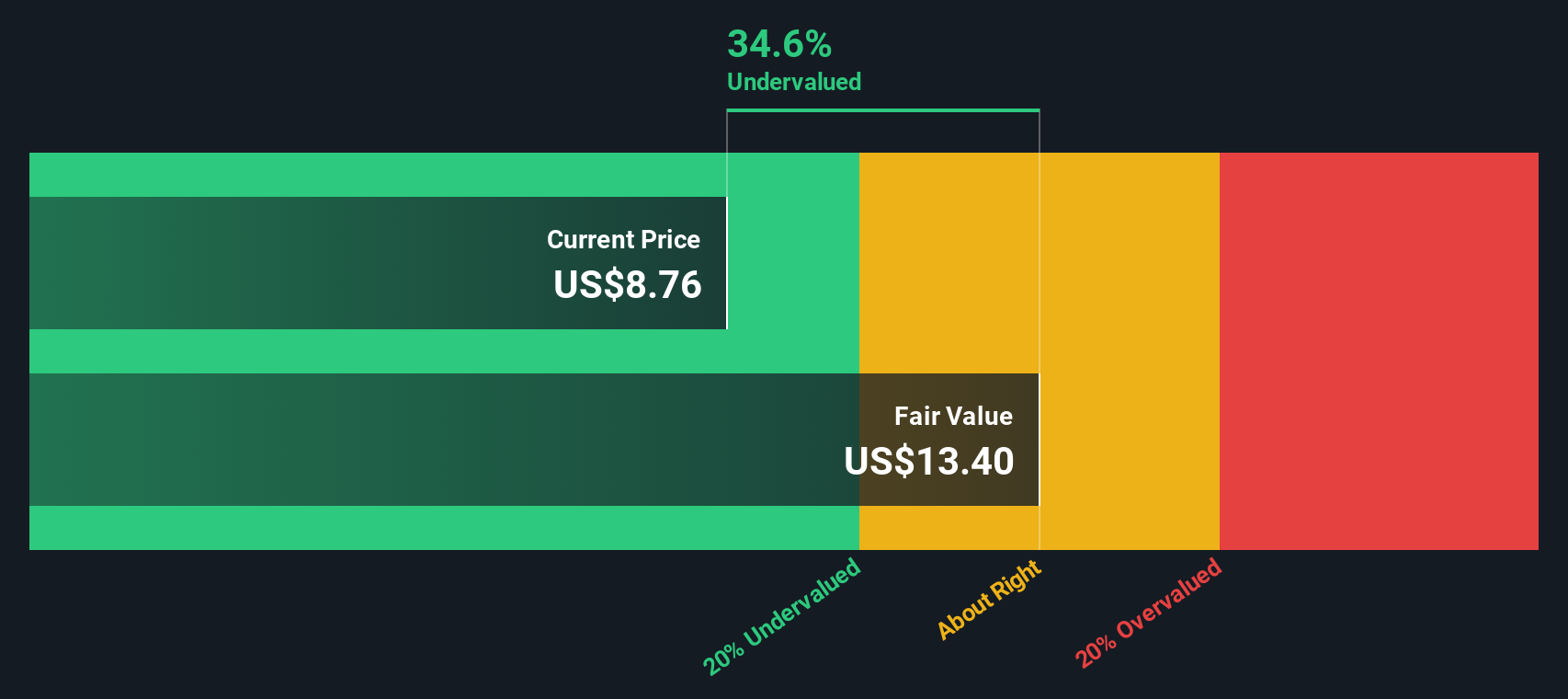

Yext (NYSE:YEXT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yext is a technology company that specializes in digital knowledge management, helping businesses manage their online presence and information across various platforms, with a market cap of approximately $1.02 billion.

Operations: The company primarily generates revenue from its operations, with a gross profit margin reaching 78.37% as of January 2024. Costs predominantly arise from sales and marketing, research and development, and general administrative expenses. Over time, there has been a notable improvement in the net income margin, moving from -28.79% in January 2015 to -0.65% by January 2024.

PE: -47.5x

Yext, a company within the smaller market segment, is navigating financial challenges with a net loss of US$12.8 million for Q3 2024, despite increasing sales to US$113.99 million from the previous year. Their strategic focus on M&A and organic growth reflects their ambition to expand further. The introduction of an AI Review Generation tool enhances their reputation management offerings, potentially boosting customer engagement and brand trust. While insiders haven't shown recent buying confidence, Yext's projected revenue for fiscal 2025 remains between US$420.3 million and US$420.8 million, indicating cautious optimism in its future trajectory amidst higher-risk funding sources.

- Unlock comprehensive insights into our analysis of Yext stock in this valuation report.

Understand Yext's track record by examining our Past report.

Make It Happen

- Click this link to deep-dive into the 47 companies within our Undervalued US Small Caps With Insider Buying screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YEXT

Yext

Provides a platform that offers answers to consumer questions in North America and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success