- United States

- /

- Banks

- /

- NasdaqCM:IROQ

Here's What We Like About IF Bancorp's (NASDAQ:IROQ) Upcoming Dividend

IF Bancorp, Inc. (NASDAQ:IROQ) stock is about to trade ex-dividend in four days. If you purchase the stock on or after the 25th of March, you won't be eligible to receive this dividend, when it is paid on the 16th of April.

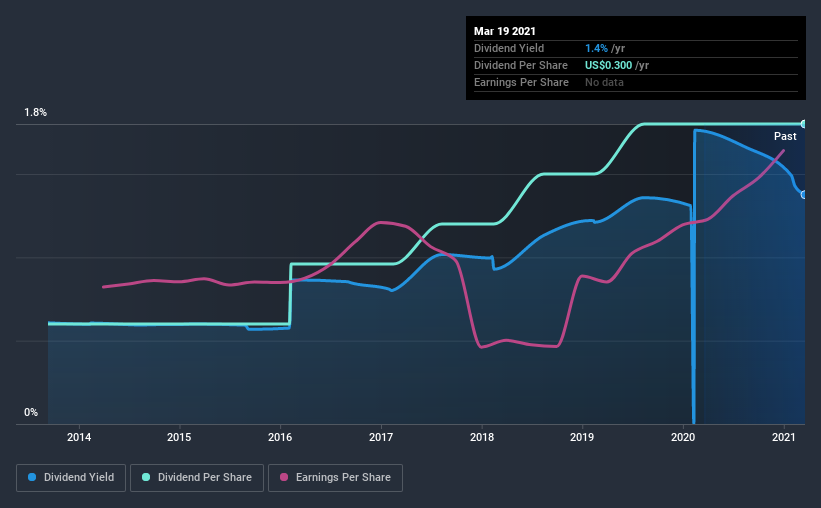

IF Bancorp's next dividend payment will be US$0.15 per share. Last year, in total, the company distributed US$0.30 to shareholders. Based on the last year's worth of payments, IF Bancorp stock has a trailing yield of around 1.4% on the current share price of $21.8. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to investigate whether IF Bancorp can afford its dividend, and if the dividend could grow.

See our latest analysis for IF Bancorp

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. IF Bancorp is paying out just 18% of its profit after tax, which is comfortably low and leaves plenty of breathing room in the case of adverse events.

Generally speaking, the lower a company's payout ratios, the more resilient its dividend usually is.

Click here to see how much of its profit IF Bancorp paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings fall far enough, the company could be forced to cut its dividend. For this reason, we're glad to see IF Bancorp's earnings per share have risen 14% per annum over the last five years.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the last eight years, IF Bancorp has lifted its dividend by approximately 15% a year on average. It's great to see earnings per share growing rapidly over several years, and dividends per share growing right along with it.

Final Takeaway

Should investors buy IF Bancorp for the upcoming dividend? Companies like IF Bancorp that are growing rapidly and paying out a low fraction of earnings, are usually reinvesting heavily in their business. This strategy can add significant value to shareholders over the long term - as long as it's done without issuing too many new shares. IF Bancorp ticks a lot of boxes for us from a dividend perspective, and we think these characteristics should mark the company as deserving of further attention.

While it's tempting to invest in IF Bancorp for the dividends alone, you should always be mindful of the risks involved. Our analysis shows 2 warning signs for IF Bancorp and you should be aware of these before buying any shares.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading IF Bancorp or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:IROQ

IF Bancorp

Operates as the savings and loan holding company for Iroquois Federal Savings and Loan Association that provides a range of banking and financial services to individual and corporate clients.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026