- United States

- /

- Banks

- /

- NasdaqGS:INTR

Does Inter & Co's Youth Focus and Management Shift Signal a Sustainable Edge in Serie A (INTR)?

Reviewed by Simply Wall St

- In recent days, Inter Milan announced a significant leadership change with Cristian Chivu taking over as manager, alongside a strategic pivot toward recruiting younger players supported by enhanced financial stability under new ownership.

- This transition has not only signaled a long-term vision for talent development, but has also resulted in Inter surpassing Juventus in enterprise value amid ongoing efforts to strengthen its balance sheet and competitiveness in Serie A.

- We'll take a look at how Inter Milan's renewed emphasis on financial restructuring and youth-focused recruitment could influence the company's investment narrative.

Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

Inter & Co Investment Narrative Recap

To own shares in Inter & Co, investors need to believe in the company's ability to scale digital banking in Brazil, capitalize on strong user growth, and expand high-margin financial products amid tough competition. The recent news surrounding Inter Milan does not present a material impact to Inter & Co’s key short-term catalysts, such as continued rapid client acquisition and rising transactional volumes, or to its principal risks tied to bad loan growth and credit quality.

Of the company’s corporate announcements, the most relevant remains Inter & Co’s second quarter result, which highlighted robust earnings and net interest income growth year-on-year. This continued momentum is central to the investment case, reinforcing the main catalyst: delivering high double-digit revenue growth through new products and deeper customer engagement, while carefully balancing loan book risk and operational efficiency.

Yet, despite this progress, investors should also keep in mind that growing exposure to riskier lending segments leaves asset quality sensitive to any deterioration in Brazil’s macro environment or a rise in non-performing loans...

Read the full narrative on Inter & Co (it's free!)

Inter & Co's narrative projects R$13.8 billion revenue and R$2.9 billion earnings by 2028. This requires 37.6% yearly revenue growth and an increase of R$1.8 billion in earnings from the current R$1.1 billion level.

Uncover how Inter & Co's forecasts yield a $8.38 fair value, a 6% downside to its current price.

Exploring Other Perspectives

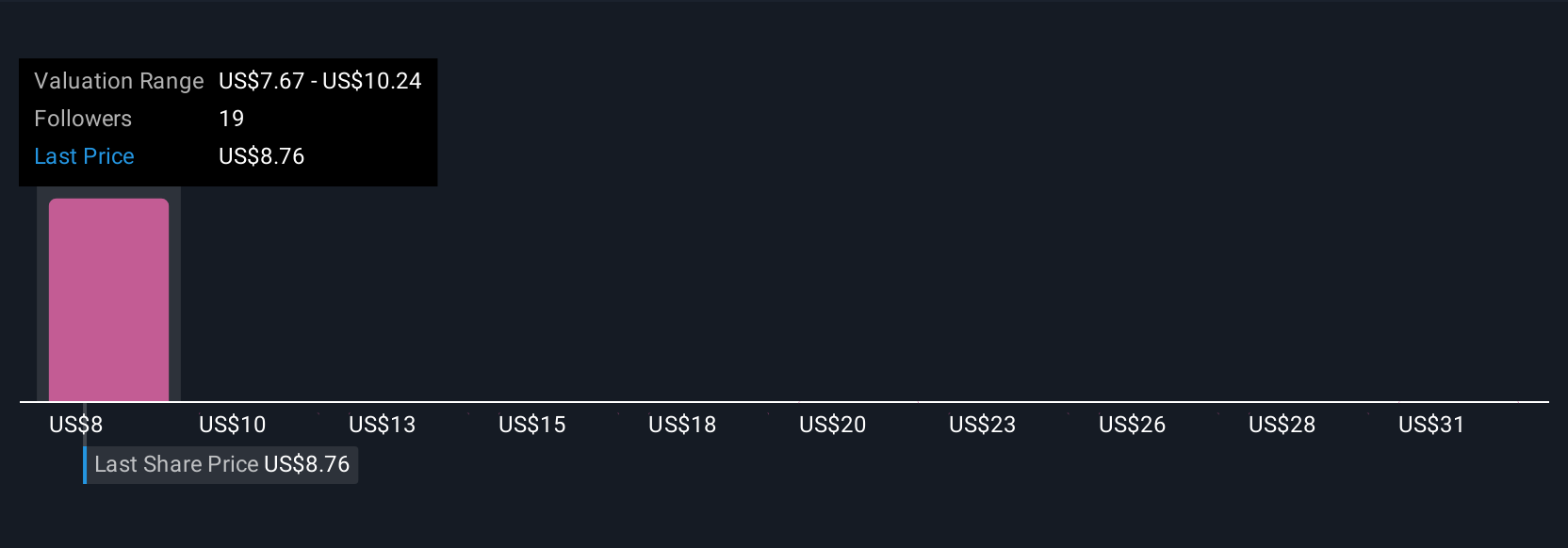

Simply Wall St Community members have set fair value estimates for Inter & Co ranging widely from R$7.68 to R$33.30 across five analyses, reflecting diverse opinions. With credit quality still a headline risk, you can see how participant perspectives often hinge on expectations around loan performance and market share growth.

Explore 5 other fair value estimates on Inter & Co - why the stock might be worth 14% less than the current price!

Build Your Own Inter & Co Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Inter & Co research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Inter & Co research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Inter & Co's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTR

Inter & Co

Through its subsidiaries, engages in the banking and spending, investments, insurance brokerage, and inter shop businesses in Brazil and the United States.

High growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)