- United States

- /

- Healthcare Services

- /

- NasdaqGS:PRVA

3 US Stocks Estimated To Be Up To 46.6% Below Intrinsic Value

Reviewed by Simply Wall St

In the current U.S. market landscape, investors are navigating a complex environment influenced by recent tariffs on steel and aluminum imports, which have caused fluctuations in stock futures and raised concerns about inflationary pressures. Amidst these challenges, identifying undervalued stocks becomes crucial as they offer potential opportunities for growth despite broader economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| CareTrust REIT (NYSE:CTRE) | $26.11 | $50.40 | 48.2% |

| German American Bancorp (NasdaqGS:GABC) | $39.94 | $77.95 | 48.8% |

| Brookline Bancorp (NasdaqGS:BRKL) | $12.37 | $24.11 | 48.7% |

| First National (NasdaqCM:FXNC) | $26.33 | $50.60 | 48% |

| AGNC Investment (NasdaqGS:AGNC) | $10.14 | $19.39 | 47.7% |

| Midland States Bancorp (NasdaqGS:MSBI) | $19.60 | $37.82 | 48.2% |

| Advanced Energy Industries (NasdaqGS:AEIS) | $112.83 | $217.38 | 48.1% |

| Coastal Financial (NasdaqGS:CCB) | $86.45 | $172.68 | 49.9% |

| Sociedad Química y Minera de Chile (NYSE:SQM) | $38.37 | $73.27 | 47.6% |

| Nutanix (NasdaqGS:NTNX) | $71.75 | $141.36 | 49.2% |

Here we highlight a subset of our preferred stocks from the screener.

Vita Coco Company (NasdaqGS:COCO)

Overview: The Vita Coco Company, Inc. develops, markets, and distributes coconut water products under the Vita Coco brand across various regions including the United States, Canada, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of approximately $2.13 billion.

Operations: The company's revenue is primarily derived from the Americas segment, contributing $424.40 million, with an additional $70.46 million generated internationally.

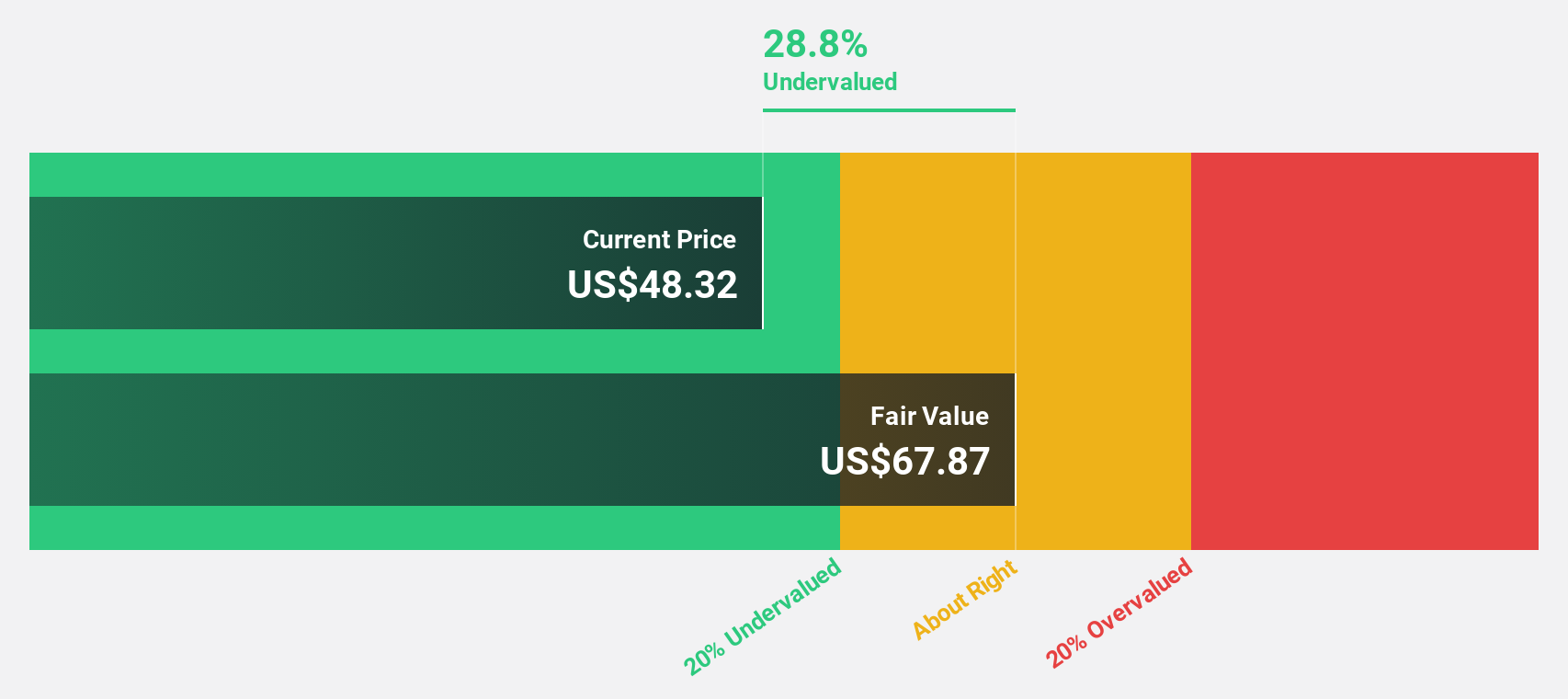

Estimated Discount To Fair Value: 35.2%

Vita Coco Company is trading at US$39.38, significantly below its estimated fair value of US$60.80, indicating potential undervaluation based on cash flows. Despite recent insider selling, the company's earnings are forecast to grow significantly at 20.3% annually, outpacing the broader US market's growth rate of 14.5%. Although revenue growth is slower than desired at 10.9%, it still surpasses the market average of 8.8%.

- According our earnings growth report, there's an indication that Vita Coco Company might be ready to expand.

- Get an in-depth perspective on Vita Coco Company's balance sheet by reading our health report here.

Inter & Co (NasdaqGS:INTR)

Overview: Inter & Co, Inc. operates through its subsidiaries in banking and spending, investments, and insurance brokerage businesses, with a market cap of approximately $2.34 billion.

Operations: The company's revenue segments include Banking & Spending with R$3.85 billion, Inter Shop with R$322.10 million, Investments with R$255.68 million, and Insurance Brokerage with R$188.38 million.

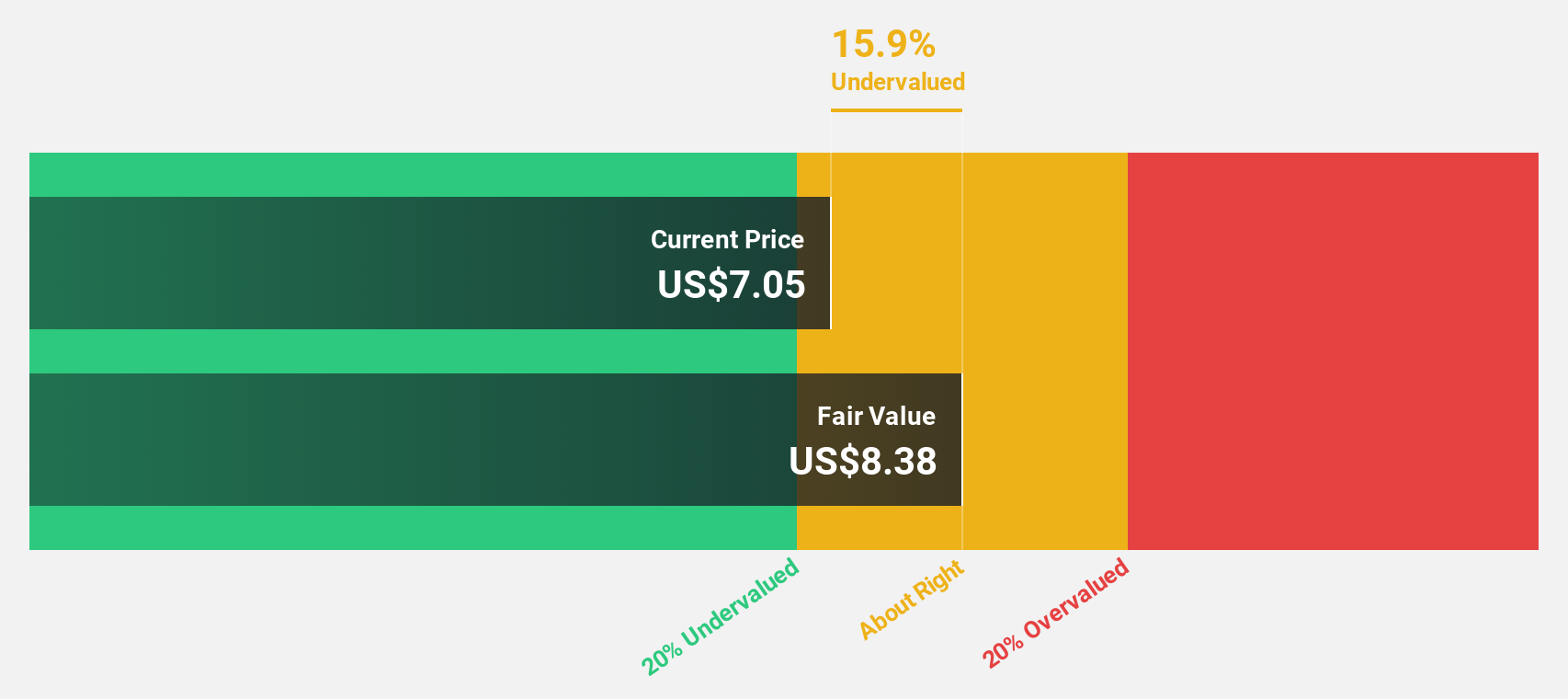

Estimated Discount To Fair Value: 30%

Inter & Co. is trading at $5.51, substantially below its estimated fair value of $7.87, highlighting potential undervaluation based on cash flows. The company's earnings and revenue are forecast to grow significantly at 37.2% and 22.2% annually, respectively, surpassing the broader US market growth rates. Despite a high level of bad loans at 8.4%, Inter & Co.'s recent financial performance shows strong profit growth with net income rising from BRL 302 million to BRL 907 million year-over-year.

- Our expertly prepared growth report on Inter & Co implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Inter & Co.

Privia Health Group (NasdaqGS:PRVA)

Overview: Privia Health Group, Inc. is a national physician-enablement company operating in the United States with a market cap of $27 billion.

Operations: Revenue from Healthcare Facilities & Services amounted to $1.72 billion.

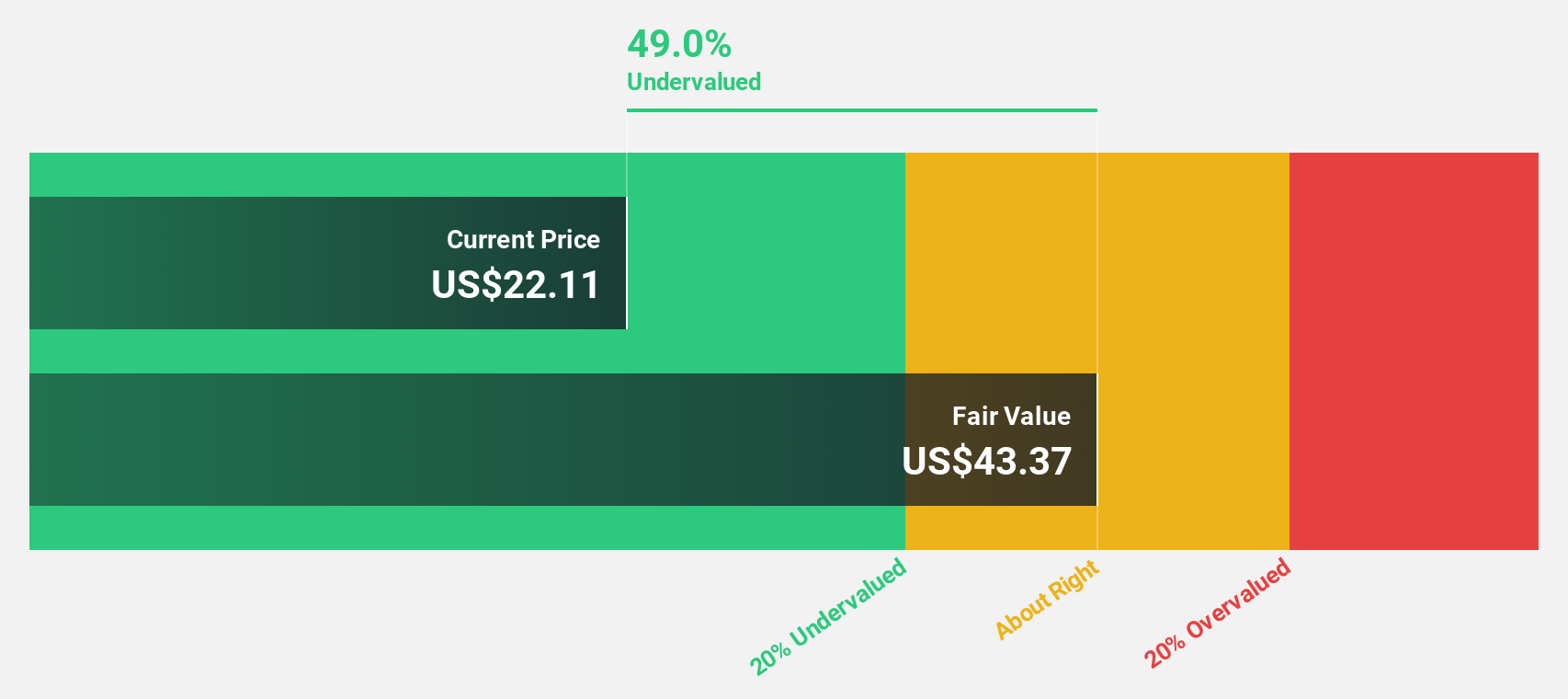

Estimated Discount To Fair Value: 46.6%

Privia Health Group, Inc. is trading at US$23.83, significantly below its estimated fair value of US$44.59, indicating potential undervaluation based on cash flows. The company's earnings are forecast to grow substantially at 34.2% annually, outpacing the broader US market growth rate of 14.5%. However, recent profit margins have decreased from 2.4% to 0.7%, and its return on equity is expected to remain low at 5.4% in three years' time.

- Upon reviewing our latest growth report, Privia Health Group's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Privia Health Group.

Taking Advantage

- Unlock our comprehensive list of 167 Undervalued US Stocks Based On Cash Flows by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PRVA

Privia Health Group

Operates as a national physician-enablement company in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives