- United States

- /

- Banks

- /

- NasdaqGS:INBK

Is Now The Time To Put First Internet Bancorp (NASDAQ:INBK) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in First Internet Bancorp (NASDAQ:INBK). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for First Internet Bancorp

How Fast Is First Internet Bancorp Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. As a tree reaches steadily for the sky, First Internet Bancorp's EPS has grown 32% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

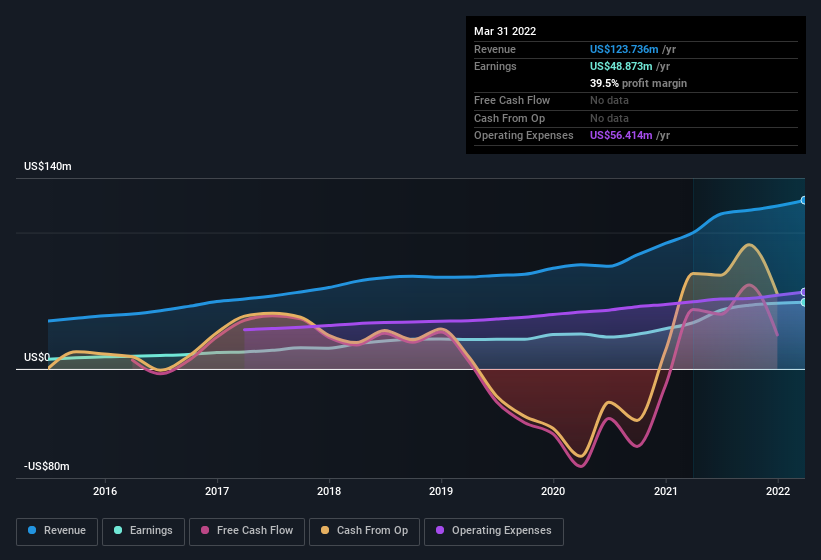

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of First Internet Bancorp's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. While we note First Internet Bancorp's EBIT margins were flat over the last year, revenue grew by a solid 24% to US$124m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future First Internet Bancorp EPS 100% free.

Are First Internet Bancorp Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We did see some selling in the last twelve months, but that's insignificant compared to the whopping US$1.3m that the Chairman & CEO, David Becker spent acquiring shares. We should note the average purchase price was around US$44.14. The quantum of that insider purchase is both rare and a sight to behold, not unlike an endangered Amur Leopard in the wild.

On top of the insider buying, it's good to see that First Internet Bancorp insiders have a valuable investment in the business. Indeed, they hold US$23m worth of its stock. That's a lot of money, and no small incentive to work hard. Those holdings account for over 7.1% of the company; visible skin in the game.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, David Becker, is paid less than the median for similar sized companies. For companies with market capitalizations between US$200m and US$800m, like First Internet Bancorp, the median CEO pay is around US$2.3m.

The First Internet Bancorp CEO received US$1.9m in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Does First Internet Bancorp Deserve A Spot On Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about First Internet Bancorp's strong EPS growth. The cranberry sauce on the turkey is that insiders own a bunch of shares, and one has been buying more. So it's fair to say I think this stock may well deserve a spot on your watchlist. It is worth noting though that we have found 1 warning sign for First Internet Bancorp that you need to take into consideration.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of First Internet Bancorp, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:INBK

First Internet Bancorp

Operates as the bank holding company for First Internet Bank of Indiana that provides various commercial, small business, consumer, and municipal banking products and services to individuals and commercial customers in the United States.

Very undervalued with flawless balance sheet.