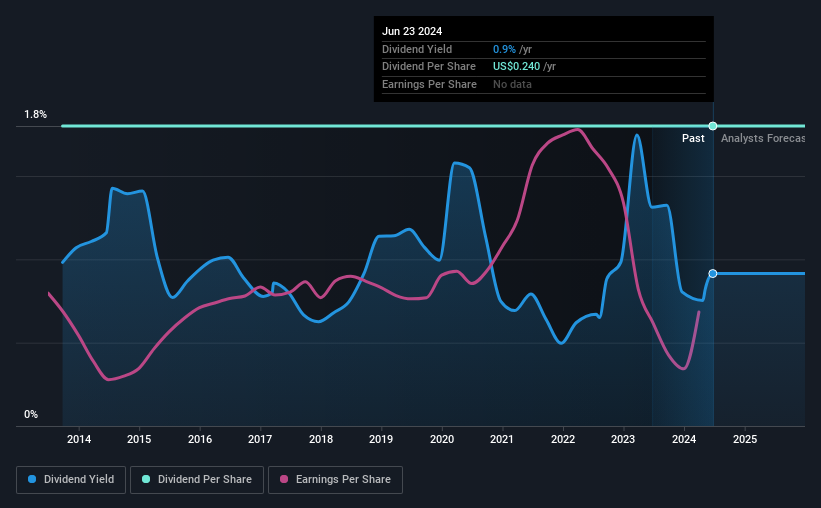

First Internet Bancorp (NASDAQ:INBK) has announced that it will pay a dividend of $0.06 per share on the 15th of July. This means the annual payment will be 0.9% of the current stock price, which is lower than the industry average.

See our latest analysis for First Internet Bancorp

First Internet Bancorp's Payment Expected To Have Solid Earnings Coverage

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock.

First Internet Bancorp has a long history of paying out dividends, with its current track record at a minimum of 10 years. While past records don't necessarily translate into future results, the company's payout ratio of 13% also shows that First Internet Bancorp is able to comfortably pay dividends.

Looking forward, earnings per share is forecast to rise by 39.8% over the next year. If the dividend continues along recent trends, we estimate the future payout ratio will be 9.1%, which is in the range that makes us comfortable with the sustainability of the dividend.

First Internet Bancorp Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The payments haven't really changed that much since 10 years ago. Slow and steady dividend growth might not sound that exciting, but dividends have been stable for ten years, which we think makes this a fairly attractive offer.

Dividend Growth May Be Hard To Achieve

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. However, initial appearances might be deceiving. In the last five years, First Internet Bancorp's earnings per share has shrunk at approximately 2.5% per annum. If earnings continue declining, the company may have to make the difficult choice of reducing the dividend or even stopping it completely - the opposite of dividend growth. Earnings are forecast to grow over the next 12 months and if that happens we could still be a little bit cautious until it becomes a pattern.

Our Thoughts On First Internet Bancorp's Dividend

In summary, we are pleased with the dividend remaining consistent, and we think there is a good chance of this continuing in the future. With shrinking earnings, the company may see some issues maintaining the dividend even though they look pretty sustainable for now. This looks like it could be a good dividend stock going forward, but we would note that the payout ratio has been at higher levels in the past so it could happen again.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Without at least some growth in earnings per share over time, the dividend will eventually come under pressure either from competition or inflation. Businesses can change though, and we think it would make sense to see what analysts are forecasting for the company. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INBK

First Internet Bancorp

Operates as the bank holding company for First Internet Bank of Indiana that provides various commercial, small business, consumer, and municipal banking products and services to individuals and commercial customers in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026