- United States

- /

- Banks

- /

- NasdaqGS:HWC

Hancock Whitney (HWC) Net Margin Beats, Underscoring Value Narrative Despite Slower Forecast Growth

Reviewed by Simply Wall St

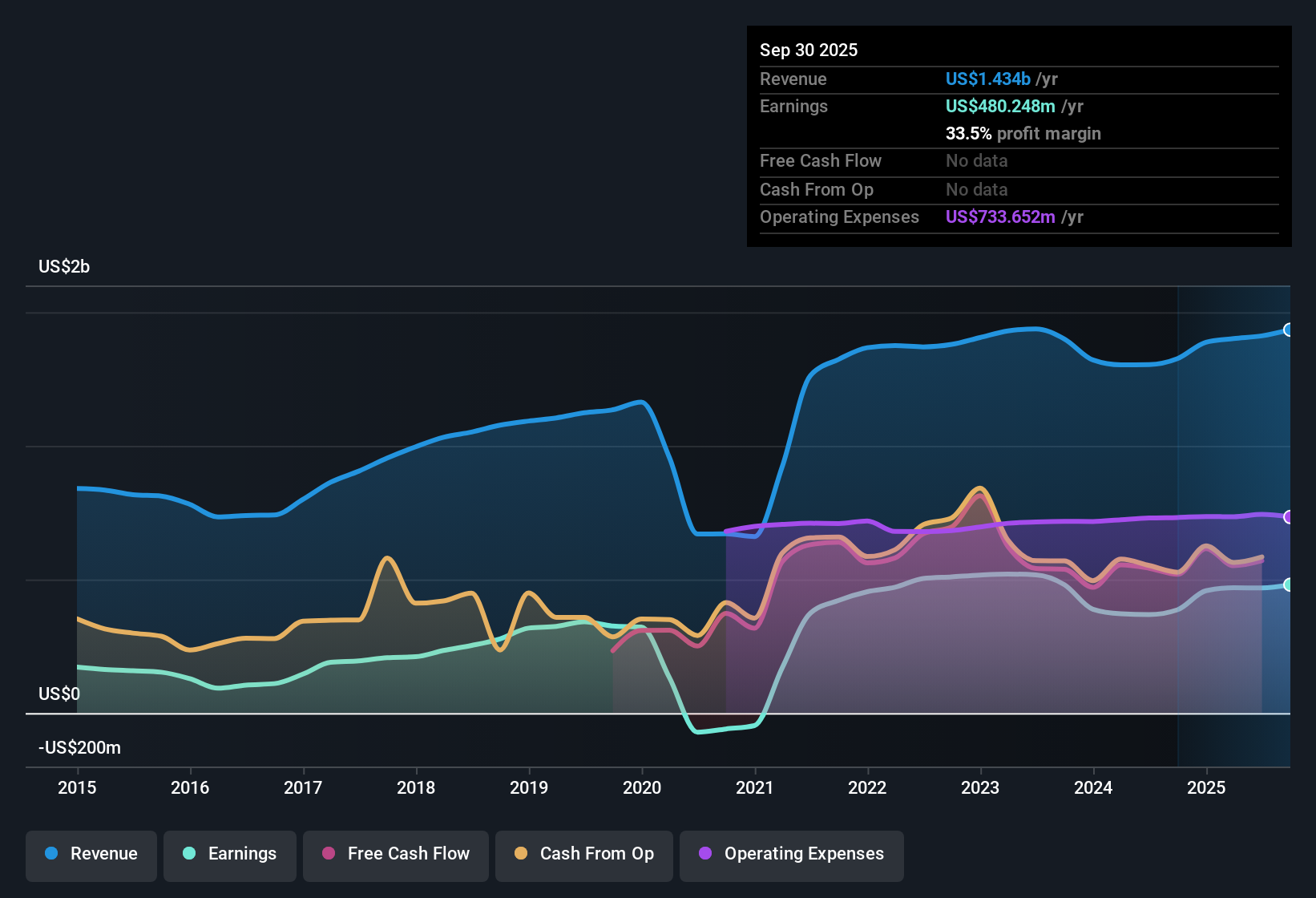

Hancock Whitney (HWC) posted current net profit margins of 33.5%, up from 29.1% a year ago, with EPS advancing 24.2% over the past year. This is well above the company’s five-year average annual earnings growth of 15%. The combination of profitability tracking higher and continued strong earnings history, with no flagged risks, forms the setup for a closely watched earnings season where modest forward growth is expected to shape investor sentiment.

See our full analysis for Hancock Whitney.The next section breaks down how these latest results compare to the most widely discussed narratives around Hancock Whitney. Let’s see where the numbers reinforce the story and where they may challenge it.

See what the community is saying about Hancock Whitney

Loan Growth Plans Drive Analyst Optimism

- Hancock Whitney's acquisition of Sabal Trust Company is projected to boost noninterest income by 9% to 10% year-over-year, helping fuel overall revenue growth.

- Analysts' consensus view highlights that expanding the team with 20 to 30 new revenue producers, mainly in high-growth markets, is seen as a critical catalyst.

- Sabal Trust is expected to close soon and amplify revenue opportunities, which analysts believe can offset slower forecasted earnings growth of 2.2% annually.

- The company’s proactive hiring focus aims to drive loan and deposit growth, supporting stability in profit margins, even as they are projected to edge down from 33.2% to 29.6% over the next three years.

- Given recent strategic actions, the consensus view supports a path toward annual revenue growth of around 6.3% to 7.9%. This represents a more cautious pace compared to the broader US market.

- This measured growth outlook tempers bullish expectations but aligns with analyst targets. Analysts believe the bank’s approach lays the groundwork for steady, rather than rapid, earnings expansion.

- For a closer look at how analysts weigh these new catalysts against moderate growth expectations, see the balanced narrative for Hancock Whitney. 📊 Read the full Hancock Whitney Consensus Narrative.

Profit Margin Guidance Faces Headwinds

- Consensus forecasts expect profit margins to narrow from the current 33.2% to 29.6% in three years, even as absolute earnings are predicted to rise.

- Analysts' consensus narrative identifies several risks that could challenge these margin projections:

- A combination of economic uncertainty, seasonal outflows, and higher integration-related expenses from the Sabal Trust deal could eat into profitability.

- Unpredictable loan growth, reflecting higher payoffs and client hesitancy, adds further risk to the margin outlook by potentially slowing both net interest income and noninterest income momentum.

Discounted Valuation vs. Analyst Targets

- Hancock Whitney trades at a price-to-earnings ratio of 10.4x, below the banking industry average of 11.7x and the peer group’s 14.6x, with the current share price at $58.76 sitting well below the 70.72 analyst price target and a significant gap to a DCF fair value estimate of $121.01.

- Analysts' consensus view notes that this substantial discount positions Hancock Whitney as an attractive value pick, especially given its strong five-year track record of 15% annual earnings growth and a constructive risk profile with no major red flags.

- Even with cautious near-term earnings guidance, the valuation gap reinforced by analyst targets suggests room for price appreciation if revenue and profit initiatives deliver as planned.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Hancock Whitney on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the results? You can highlight your own perspective in just a few minutes and shape the story your way with Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Hancock Whitney.

See What Else Is Out There

Moderating profit margins and uncertain loan growth suggest that Hancock Whitney may face challenges in achieving consistent and reliable earnings expansion in the future.

For investors seeking more predictable performance across economic cycles, use stable growth stocks screener (2096 results) to find companies demonstrating stable growth and resilient earnings regardless of market headwinds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Hancock Whitney might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HWC

Hancock Whitney

Operates as the financial holding company for Hancock Whitney Bank that provides traditional and online banking services to commercial, small business, and retail customers in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)