- United States

- /

- Banks

- /

- NasdaqGS:HOPE

Stagnant Earnings and Efficiency Issues Might Change The Case For Investing In Hope Bancorp (HOPE)

Reviewed by Sasha Jovanovic

- Recent news highlights that Hope Bancorp has faced ongoing profitability challenges, with flat net interest income over five years, worsening efficiency ratios, and a decline in earnings per share.

- This pattern signals deeper structural issues that may be impacting the bank's ability to improve its core operations and financial results.

- We'll examine how the company’s stagnant net interest income poses challenges for its previously optimistic investment outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Hope Bancorp Investment Narrative Recap

To continue holding shares in Hope Bancorp, an investor would need confidence that the bank can overcome ongoing profitability issues and return to sustainable growth, despite recent declines in net interest income and earnings per share. The news of weakening operational efficiency and flat net interest income has made it tougher for Hope Bancorp to quickly restore its profit outlook, intensifying the importance of improved earnings as the main catalyst, while concerns around credit risk and cost management remain the biggest risks. For now, these developments appear to materially impact both the short-term recovery prospects and longer-term risk profile of the business.

The most relevant recent announcement is the Q2 2025 earnings release, which reported a significant net loss alongside stagnant net interest income, highlighting the near-term pressure on core profitability. This aligns closely with the current pattern of challenges to operational efficiency and underscores that progress on cost controls and earnings stability will be critical for the company's financial performance going forward.

However, investors should be aware that amid these operational headwinds, one of the company’s main vulnerabilities remains its heavy concentration in commercial real estate loans, which ...

Read the full narrative on Hope Bancorp (it's free!)

Hope Bancorp's outlook anticipates $828.8 million in revenue and $392.4 million in earnings by 2028. This targets a 26.2% annual revenue growth rate and a $350.7 million increase in earnings from the current $41.7 million level.

Uncover how Hope Bancorp's forecasts yield a $12.25 fair value, a 17% upside to its current price.

Exploring Other Perspectives

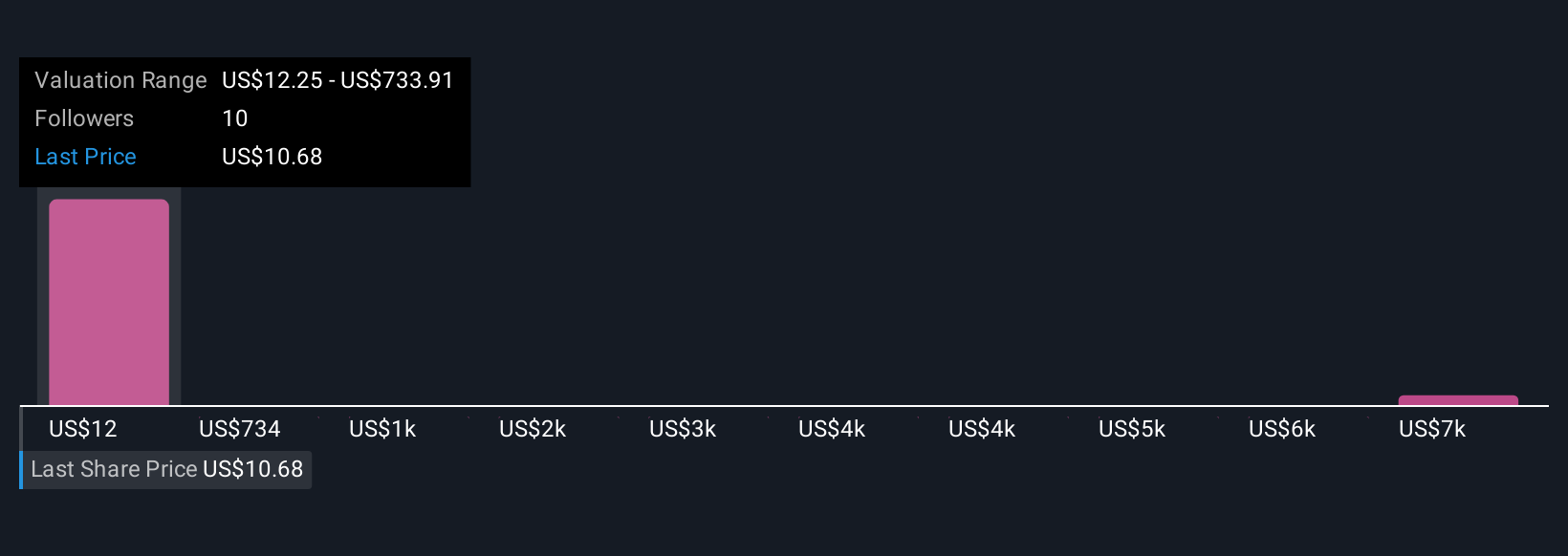

Four Simply Wall St Community members offered fair value estimates for Hope Bancorp ranging from US$12.25 to an outlier of US$7,228.80. While many see upside, unresolved credit risk from the commercial real estate portfolio could weigh heavily on the company’s near-term results, making it important to review a range of views before deciding.

Explore 4 other fair value estimates on Hope Bancorp - why the stock might be a potential multi-bagger!

Build Your Own Hope Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hope Bancorp research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Hope Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hope Bancorp's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hope Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HOPE

Hope Bancorp

Operates as the bank holding company for Bank of Hope that provides retail and commercial banking services for businesses and individuals in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives