- United States

- /

- Banks

- /

- NasdaqGS:FULT

Fulton Financial (FULT) Margin Surge Challenges Valuation Concerns with 28.5% Profitability

Reviewed by Simply Wall St

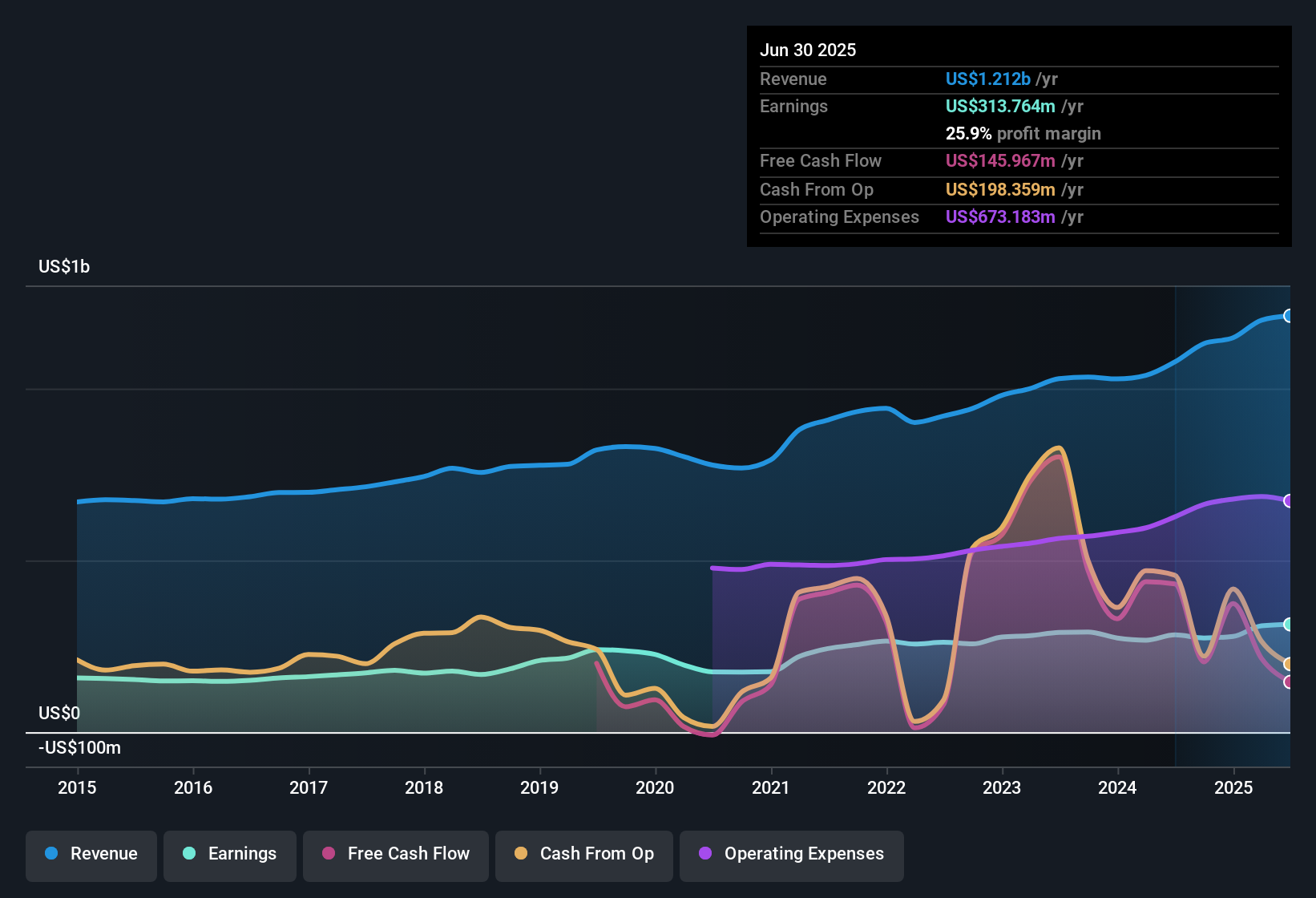

Fulton Financial (FULT) delivered an 8.4% annual earnings growth rate over the past five years, capped by a standout 28% jump in the most recent year, which outpaced its longer-term trend. With revenue forecasted to grow at 6.1% per year and net profit margins rising to 28.5% from last year’s 24.2%, investors are seeing a picture of improved profitability and sustainable progress. Meanwhile, the Price-To-Earnings ratio sits at 9.1x, lower than both peer and industry averages, which complements positive momentum in earnings and margins.

See our full analysis for Fulton Financial.The next section puts these headline figures under the microscope and compares them directly with the narratives shaping investor sentiment around Fulton Financial right now.

See what the community is saying about Fulton Financial

Profit Margins Reach 28.5%, Outpacing Peer Banks

- Fulton Financial's net profit margin is now 28.5%, a marked improvement from last year's 24.2% and well above typical margins for regional banks.

- According to the analysts' consensus view, this margin expansion is tied to tighter operational discipline and strategic investments.

- Consensus narrative notes that the initiative “Fulton First” is driving improved cost management and increased revenue through talent alignment and process simplification.

- Notably, disciplined balance sheet management is enabling more stable return on equity, which directly contributes to margin gains reflected in the results.

- After margins climbed so decisively, consensus observers highlight this as evidence that Fulton’s reinvestment and operational simplification efforts are starting to translate into financial outperformance versus peers. 📊 Read the full Fulton Financial Consensus Narrative.

Dividend Strength and Sustainable Growth Forecast

- Over the past five years, annual earnings grew 8.4% with a standout 28% growth last year, underpinning the company’s reputation for generating high quality and sustainable dividends.

- Consensus narrative finds this consistent performance reinforces confidence in future distributions.

- By projecting a 6.1% annual revenue growth and 3.95% annual earnings growth, analysts suggest Fulton’s current payout levels are likely to be maintained, provided credit trends stay favorable.

- Consensus also points out that attractive dividend characteristics are a key reason investors view Fulton as a stable, income-generating bank amid industry flux.

Valuation Discount Versus Fair Value and Peers

- With a Price-To-Earnings ratio at 9.1x, well below the peer average of 15.1x and US banks’ 11.2x, plus a share price of $17.63 against a DCF fair value of $36.73, Fulton is trading at a deep discount to both intrinsic and comparative valuations.

- Consensus narrative underscores that, despite the recent strong performance and analyst price targets set higher at $21.0, the current valuation suggests further upside potential.

- This discount attracts investors who believe future profit margin improvements and disciplined loan growth could warrant a re-rating closer to fair value.

- Yet, consensus cautions value seekers to monitor how external sector risks might influence credit trends and ultimately impact Fulton’s forecasted growth trajectory.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Fulton Financial on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on these results? Turn that insight into your personalized narrative in just a few minutes and Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Fulton Financial.

See What Else Is Out There

Despite impressive profit margin gains, Fulton Financial’s future growth could be impacted if external sector risks lead to unfavorable credit trends and slower expansion.

If you want to focus on businesses with reliable results across market cycles, use stable growth stocks screener (2092 results) to find companies delivering consistent growth and resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FULT

Fulton Financial

Operates as the bank holding company for Fulton Bank that provides banking and financial products and services in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives