- United States

- /

- Banks

- /

- NasdaqGS:FSUN

US Growth Companies With High Insider Ownership August 2024

Reviewed by Simply Wall St

As the U.S. stock market shows mixed performance with the S&P 500 and Dow Jones Industrial Average on track for gains in August, investors are keenly watching for signs of economic stability and potential interest rate cuts from the Federal Reserve. In this environment, growth companies with high insider ownership can be particularly attractive, as they often signal strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.6% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.7% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 32.3% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 40.7% |

| On Holding (NYSE:ONON) | 28.4% | 24.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.3% | 60.9% |

| BBB Foods (NYSE:TBBB) | 22.9% | 66.5% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 78.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

Celsius Holdings (NasdaqCM:CELH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Celsius Holdings, Inc. develops, processes, markets, distributes, and sells functional energy drinks and liquid supplements internationally with a market cap of $8.88 billion.

Operations: Revenue from non-alcoholic beverages amounts to $1.49 billion.

Insider Ownership: 12%

Earnings Growth Forecast: 19.5% p.a.

Celsius Holdings has demonstrated significant growth, with its recent earnings report showing a substantial increase in both sales and net income. For Q2 2024, sales reached US$401.98 million, up from US$325.88 million the previous year, while net income rose to US$79.78 million from US$51.51 million. The company is trading below its estimated fair value and boasts high insider ownership, aligning with strong revenue forecasts of 16.9% per year outpacing the broader market's growth rate.

- Click to explore a detailed breakdown of our findings in Celsius Holdings' earnings growth report.

- Our comprehensive valuation report raises the possibility that Celsius Holdings is priced higher than what may be justified by its financials.

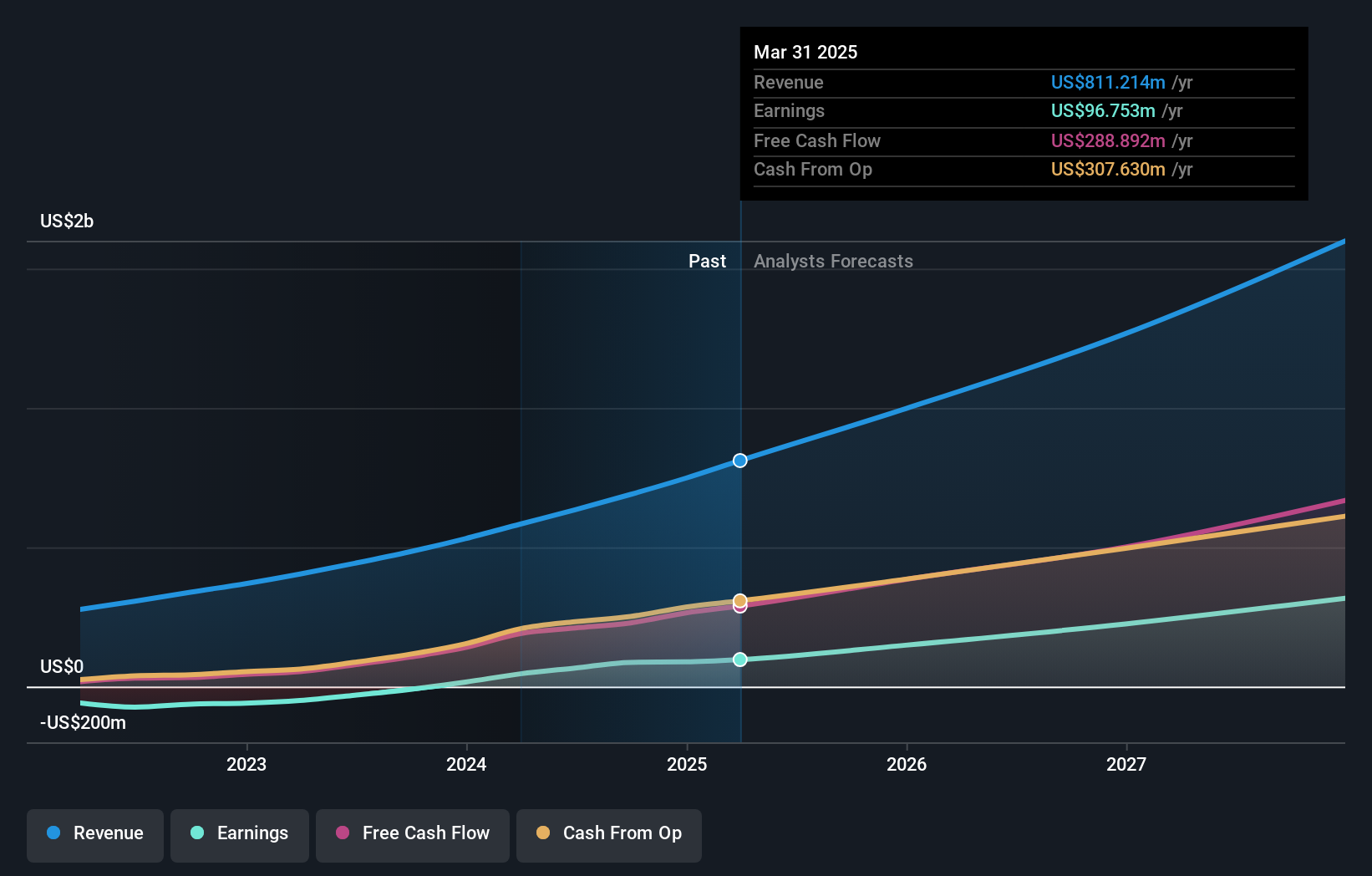

Duolingo (NasdaqGS:DUOL)

Simply Wall St Growth Rating: ★★★★★★

Overview: Duolingo, Inc. operates as a mobile learning platform in the United States, the United Kingdom, and internationally with a market cap of $8.83 billion.

Operations: The company generates $634.49 million from its educational software segment.

Insider Ownership: 14.8%

Earnings Growth Forecast: 41.6% p.a.

Duolingo's recent earnings report for Q2 2024 revealed a significant increase in both sales and net income, with sales reaching US$178.33 million and net income rising to US$24.35 million. The company's revenue is forecast to grow at 24.4% annually, outpacing the broader market's growth rate of 8.8%. Despite some insider selling over the past three months, Duolingo remains a strong growth company with substantial insider ownership and promising future revenue projections.

- Click here and access our complete growth analysis report to understand the dynamics of Duolingo.

- The valuation report we've compiled suggests that Duolingo's current price could be inflated.

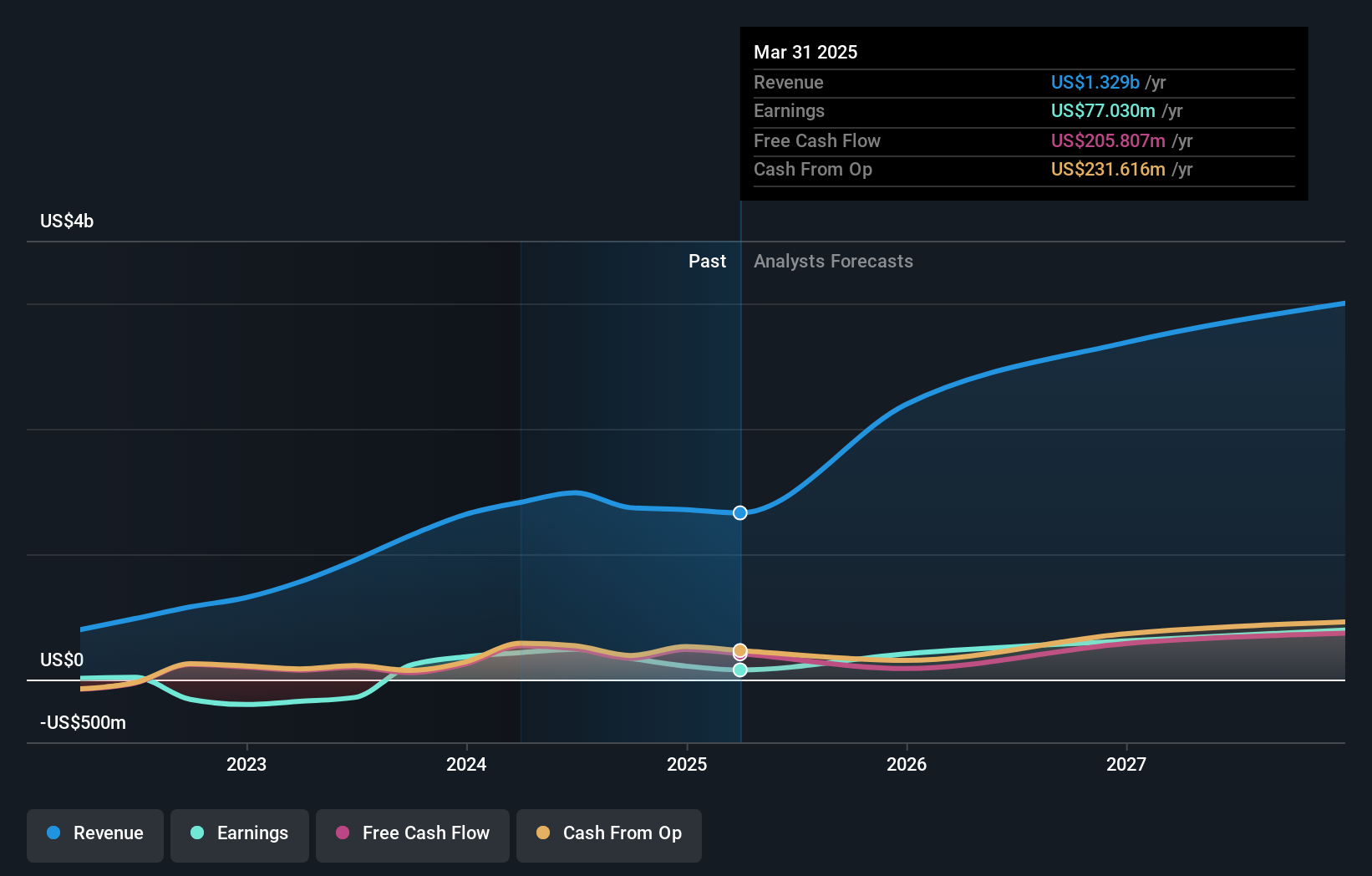

FirstSun Capital Bancorp (NasdaqGS:FSUN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: FirstSun Capital Bancorp, with a market cap of $1.18 billion, operates as a bank holding company for Sunflower Bank, offering commercial and consumer banking and financial services to small and medium-sized companies in Texas, Kansas, Colorado, New Mexico, and Arizona.

Operations: The company's revenue segments include $302.74 million from Banking and $45.19 million from Mortgage Operations.

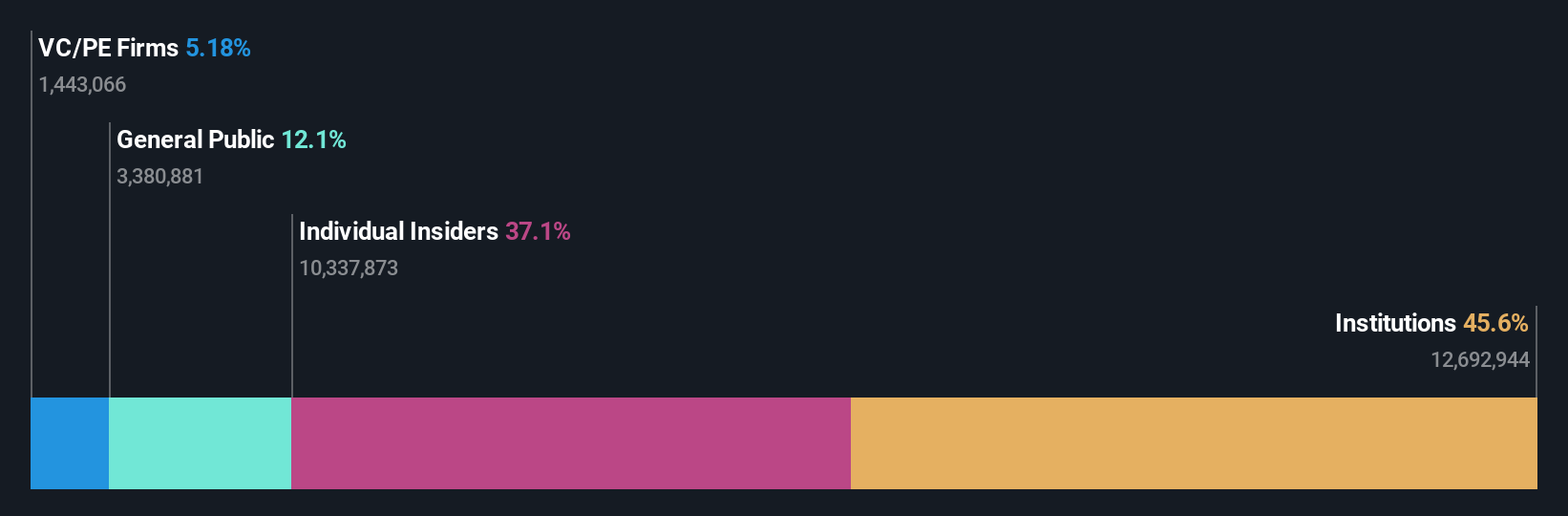

Insider Ownership: 29.9%

Earnings Growth Forecast: 60.5% p.a.

FirstSun Capital Bancorp, recently added to the NASDAQ Composite Index, has shown mixed financial performance. Q2 2024 earnings report indicated a slight decline in net interest income and net income compared to the previous year. Despite this, the company is forecasted to experience significant annual profit growth of 60.5% and revenue growth of 32.5%, outpacing market averages. The stock trades below its estimated fair value, although shareholders faced dilution over the past year.

- Navigate through the intricacies of FirstSun Capital Bancorp with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report FirstSun Capital Bancorp implies its share price may be too high.

Summing It All Up

- Click through to start exploring the rest of the 174 Fast Growing US Companies With High Insider Ownership now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FSUN

FirstSun Capital Bancorp

Operates as a bank holding company for Sunflower Bank that provides commercial and consumer banking and financial services to small and medium-sized companies in Texas, Kansas, Colorado, New Mexico, and Arizona.

Flawless balance sheet with high growth potential.