- United States

- /

- Banks

- /

- NasdaqCM:FRAF

What We Learned About Franklin Financial Services' (NASDAQ:FRAF) CEO Pay

This article will reflect on the compensation paid to Tim Henry who has served as CEO of Franklin Financial Services Corporation (NASDAQ:FRAF) since 2016. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Franklin Financial Services.

View our latest analysis for Franklin Financial Services

Comparing Franklin Financial Services Corporation's CEO Compensation With the industry

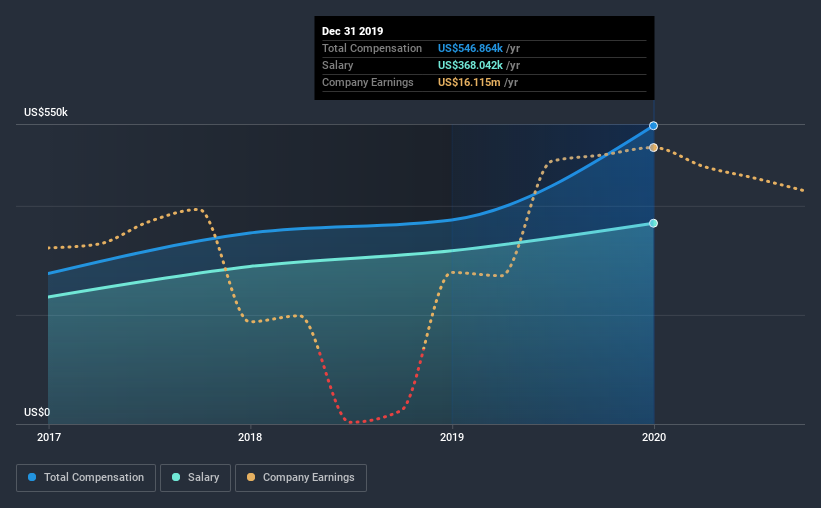

According to our data, Franklin Financial Services Corporation has a market capitalization of US$118m, and paid its CEO total annual compensation worth US$547k over the year to December 2019. Notably, that's an increase of 46% over the year before. Notably, the salary which is US$368.0k, represents most of the total compensation being paid.

For comparison, other companies in the industry with market capitalizations below US$200m, reported a median total CEO compensation of US$629k. So it looks like Franklin Financial Services compensates Tim Henry in line with the median for the industry. Furthermore, Tim Henry directly owns US$225k worth of shares in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | US$368k | US$318k | 67% |

| Other | US$179k | US$57k | 33% |

| Total Compensation | US$547k | US$374k | 100% |

Talking in terms of the industry, salary represented approximately 43% of total compensation out of all the companies we analyzed, while other remuneration made up 57% of the pie. Franklin Financial Services pays out 67% of remuneration in the form of a salary, significantly higher than the industry average. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Franklin Financial Services Corporation's Growth

Over the past three years, Franklin Financial Services Corporation has seen its earnings per share (EPS) grow by 4.0% per year. In the last year, its revenue is down 5.7%.

We would argue that the lack of revenue growth in the last year is less than ideal, but it is good to see a modest EPS growth at least. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Franklin Financial Services Corporation Been A Good Investment?

Since shareholders would have lost about 20% over three years, some Franklin Financial Services Corporation investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

As previously discussed, Tim is compensated close to the median for companies of its size, and which belong to the same industry. But with negative shareholder returns and unimpressive EPS growth, shareholders will surely be disturbed. Although we wouldn't say CEO compensation is exceptionally high, it isn't very low either. Shareholders might want to see substantial improvements in returns before agreeing that Tim deserves a raise.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for Franklin Financial Services that investors should think about before committing capital to this stock.

Important note: Franklin Financial Services is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading Franklin Financial Services or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqCM:FRAF

Franklin Financial Services

Operates as the bank holding company for Farmers and Merchants Trust Company of Chambersburg that provides commercial, retail banking, and trust services to businesses, individuals, governmental entities in Pennsylvania.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives