- United States

- /

- Banks

- /

- NasdaqGM:FNWB

Earnings growth of 5.5% over 1 year hasn't been enough to translate into positive returns for First Northwest Bancorp (NASDAQ:FNWB) shareholders

It's easy to match the overall market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. For example, the First Northwest Bancorp (NASDAQ:FNWB) share price is down 47% in the last year. That contrasts poorly with the market decline of 7.3%. On the other hand, the stock is actually up 16% over three years. More recently, the share price has dropped a further 22% in a month.

After losing 14% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for First Northwest Bancorp

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Even though the First Northwest Bancorp share price is down over the year, its EPS actually improved. It's quite possible that growth expectations may have been unreasonable in the past.

The divergence between the EPS and the share price is quite notable, during the year. So it's well worth checking out some other metrics, too.

First Northwest Bancorp's revenue is actually up 8.4% over the last year. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

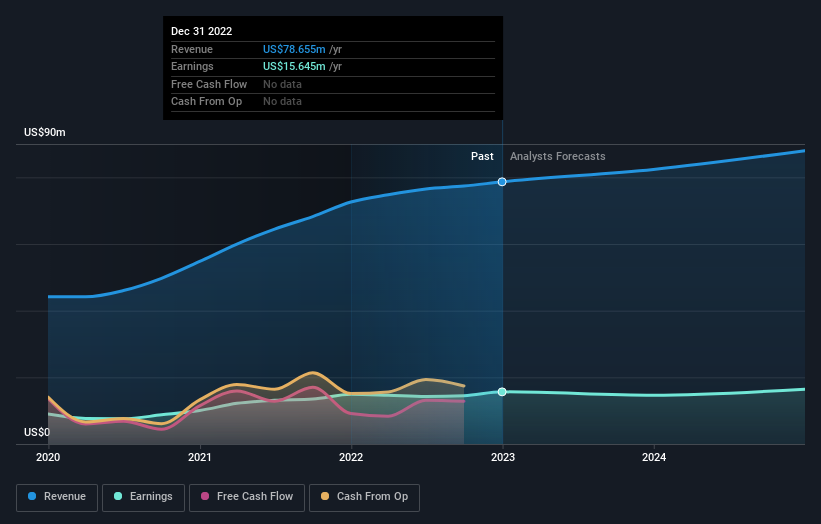

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. If you are thinking of buying or selling First Northwest Bancorp stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

While the broader market lost about 7.3% in the twelve months, First Northwest Bancorp shareholders did even worse, losing 46% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with First Northwest Bancorp , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:FNWB

First Northwest Bancorp

Operates as a bank holding company for First Fed Bank that provides commercial and consumer banking services to individuals, businesses, and nonprofit organizations in western Washington, the United States.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives