- United States

- /

- Banks

- /

- NasdaqGS:FITB

Fifth Third Bancorp (NasdaqGS:FITB) Sees 11% Dip In One Week Despite US$0.37 Cash Dividend Announcement

Reviewed by Simply Wall St

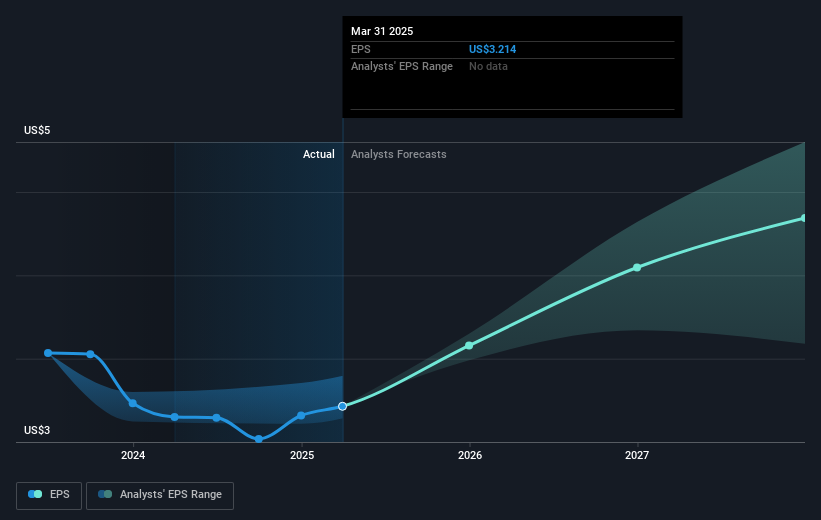

Fifth Third Bancorp (NasdaqGS:FITB) experienced a 10% decline in its share price over the last week. This move occurred despite positive developments like the announcement of a $0.37 cash dividend and the opening of a new full-service banking center in Cincinnati's Avondale neighborhood. The company's reaffirmed earnings guidance and continued investments in community initiatives also failed to buoy its stock during a week marked by market volatility. Broader economic pressures, including significant downdrafts in major market indices resulting from global trade tensions, likely contributed to the banking sector's overall underperformance, impacting FITB along with peers.

Fifth Third Bancorp has realized a substantial total return of 142.23% over the past five years, strengthening the financial position of its shareholders significantly. During this period, the company's expansion strategy into key markets, especially in the high-growth Southeast US, has supported revenue growth. The aggressive approach to opening new banking centers and establishing partnerships with fintech entities has been pivotal, ensuring greater access to low-cost deposits and elevated non-interest income. However, these efforts come amidst challenges like fluctuating interest rates and potential labor market hurdles that could impact revenue stability.

Notably, Fifth Third Bancorp's share repurchase program has showcased robust capital management, positively influencing investor sentiment. The company has also maintained consistent dividend payouts, reinforcing its commitment to shareholder returns. Despite a challenging past year, with the company underperforming against the broader market and banking industry, these strategic initiatives have played a role in its long-term success. However, the stock’s recent price dynamics illustrate the complex interplay of its ambitious growth endeavors and market pressures.

Assess Fifth Third Bancorp's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FITB

Fifth Third Bancorp

Operates as the bank holding company for Fifth Third Bank, National Association that engages in the provision of a range of financial products and services in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives