- United States

- /

- Banks

- /

- NasdaqGS:FITB

Fifth Third Bancorp (FITB): Assessing Valuation After Recent Share Price Shifts

Reviewed by Kshitija Bhandaru

See our latest analysis for Fifth Third Bancorp.

Looking beyond the recent dip, Fifth Third Bancorp’s share price has steadily rebounded this year, and its 1-year total shareholder return of 7.8% hints at building long-term momentum, especially as sentiment across the banking industry remains sensitive to shifting economic signals.

If the resilience in bank stocks has you curious about other market moves, it could be a good moment to discover fast growing stocks with high insider ownership

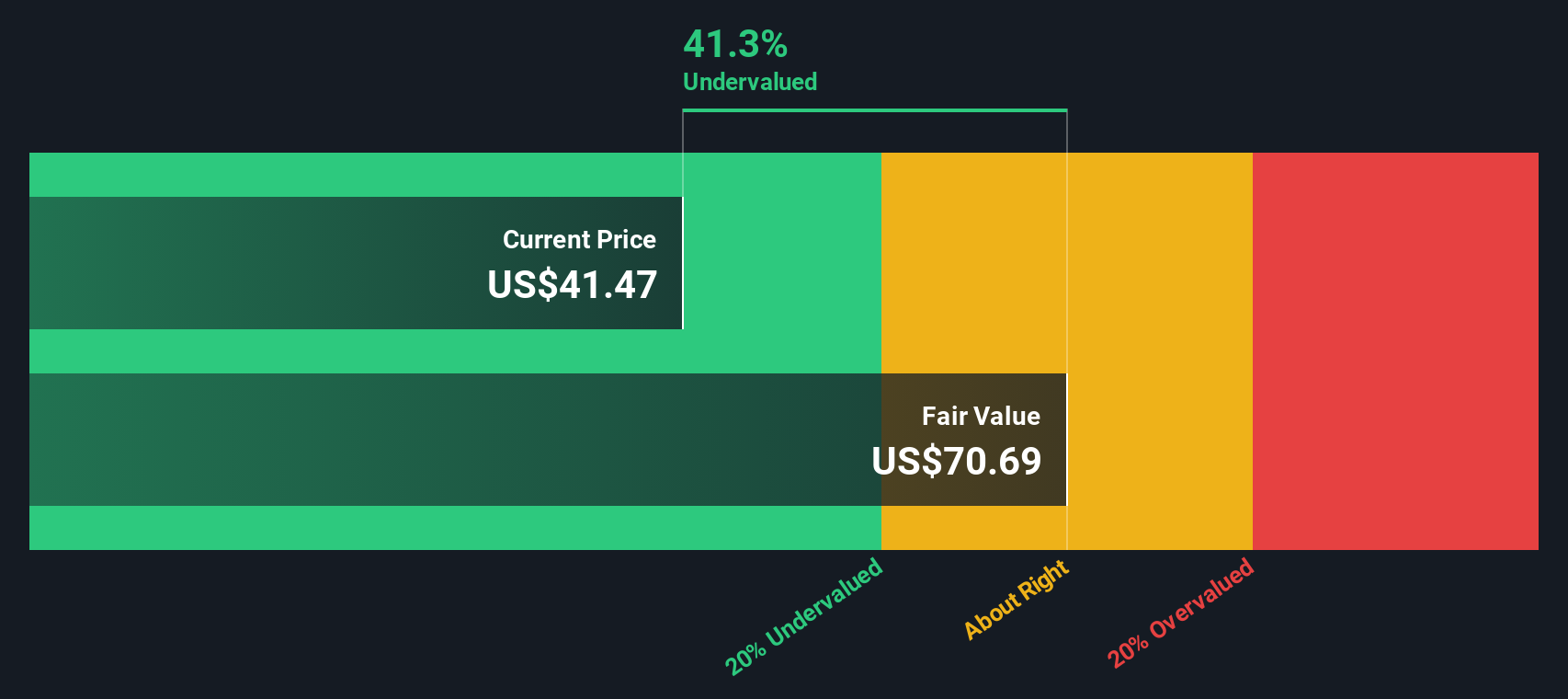

With shares still trading at a meaningful discount to analyst estimates and recent gains not fully erasing earlier declines, the key question is whether Fifth Third Bancorp is genuinely undervalued or if the market has already accounted for its prospects for future growth.

Most Popular Narrative: 10.2% Undervalued

At $43.68, Fifth Third Bancorp’s recent stock price sits below the narrative’s calculated fair value of $48.64, suggesting meaningful upside ahead if expectations hold true for interest margin resilience and strategic growth.

Continued investment in technology, including mobile app enhancements (e.g., AI-enabled features), digital lending platforms, embedded payments (Newline), and fintech partnerships positions Fifth Third to increase operating leverage and efficiency while reducing costs, leading to improved net margins.

Want to know what bold growth assumptions justify this compelling fair value? The narrative is betting on transformative tech investments, ambitious cost-cutting, and a future profit margin shift. Discover the quantitative forecasts that separate this narrative from consensus thinking and see which big projections could move the dial in coming years.

Result: Fair Value of $48.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower commercial loan demand or major fintech competition could quickly challenge the upbeat outlook and put pressure on both revenue growth and margins.

Find out about the key risks to this Fifth Third Bancorp narrative.

Another View: Our DCF Model Suggests Deeper Value

While analyst price targets say Fifth Third Bancorp is close to fairly valued, our SWS DCF model arrives at a much higher fair value of $77.55. This suggests the current price may overlook long-term cash flow potential. Are investors missing a bigger upside, or is caution still warranted?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Fifth Third Bancorp Narrative

If you see the story differently or want to dig into the numbers personally, you can craft your own take in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Fifth Third Bancorp.

Looking for More Investment Ideas?

Expand your portfolio horizons with the Simply Wall Street Screener, which uncovers the markets' hidden gems, fast movers, and lucrative themes you cannot afford to miss.

- Uncover fresh value by targeting these 897 undervalued stocks based on cash flows. See which companies offer compelling upside based on robust fundamentals and overlooked potential.

- Tap into high-yield opportunities by reviewing these 19 dividend stocks with yields > 3% for stocks offering attractive dividend streams, perfect for boosting steady returns.

- Ride the wave of tomorrow’s technology by investigating these 25 AI penny stocks, where innovative automation and intelligent platforms are transforming entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FITB

Fifth Third Bancorp

Operates as the bank holding company for Fifth Third Bank, National Association that engages in the provision of a range of financial products and services in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives