- United States

- /

- Oil and Gas

- /

- NYSE:XOM

Top Dividend Stocks To Consider In May 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 2.6% decline, yet it remains up by 9.1% over the past year with earnings expected to grow by 14% annually. In light of these conditions, identifying dividend stocks that offer reliable income and potential for growth can be a prudent strategy for investors seeking stability and returns in a fluctuating market environment.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 6.10% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 7.06% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 6.37% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.37% | ★★★★★★ |

| Chevron (NYSE:CVX) | 5.01% | ★★★★★★ |

| Douglas Dynamics (NYSE:PLOW) | 4.38% | ★★★★★☆ |

| Credicorp (NYSE:BAP) | 5.35% | ★★★★★☆ |

| Southside Bancshares (NYSE:SBSI) | 5.14% | ★★★★★☆ |

| Valley National Bancorp (NasdaqGS:VLY) | 5.06% | ★★★★★☆ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.60% | ★★★★★☆ |

Click here to see the full list of 145 stocks from our Top US Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

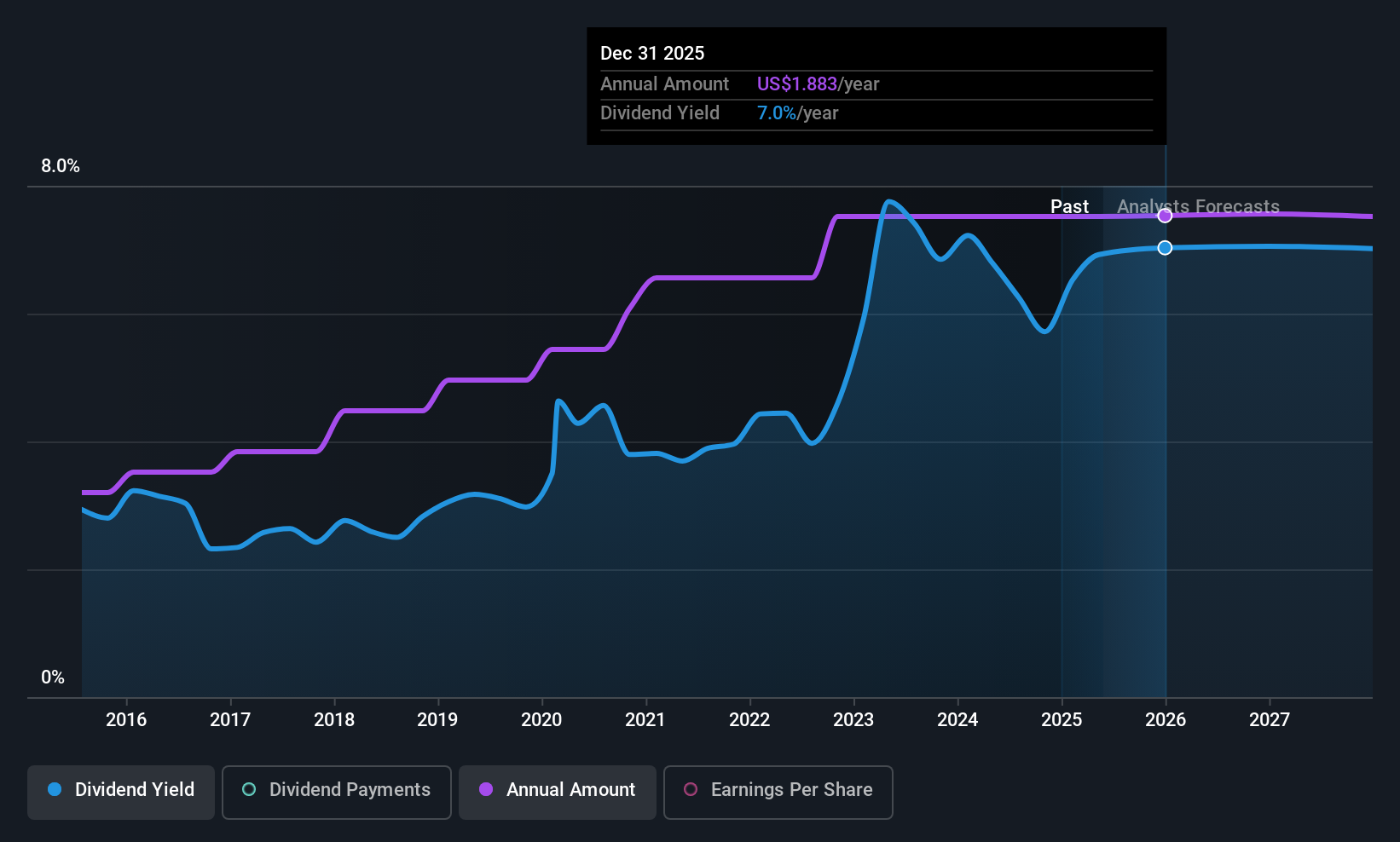

First Interstate BancSystem (NasdaqGS:FIBK)

Simply Wall St Dividend Rating: ★★★★★★

Overview: First Interstate BancSystem, Inc. is a bank holding company for First Interstate Bank, offering various banking products and services across the United States, with a market cap of approximately $2.79 billion.

Operations: First Interstate BancSystem, Inc. generates revenue primarily through its Community Banking segment, which accounts for $922 million.

Dividend Yield: 7.1%

First Interstate BancSystem offers a stable dividend history with payments growing over the past decade. Its current payout ratio is 88.9%, indicating dividends are covered by earnings and forecasted to remain sustainable at 71.3% in three years. The company declared a recent dividend of $0.47 per share, equating to an annualized yield of 6.1%. Despite recent net income decline, its dividend yield remains in the top 25% among US payers, providing attractive returns for investors seeking income stability.

- Click here to discover the nuances of First Interstate BancSystem with our detailed analytical dividend report.

- Our expertly prepared valuation report First Interstate BancSystem implies its share price may be lower than expected.

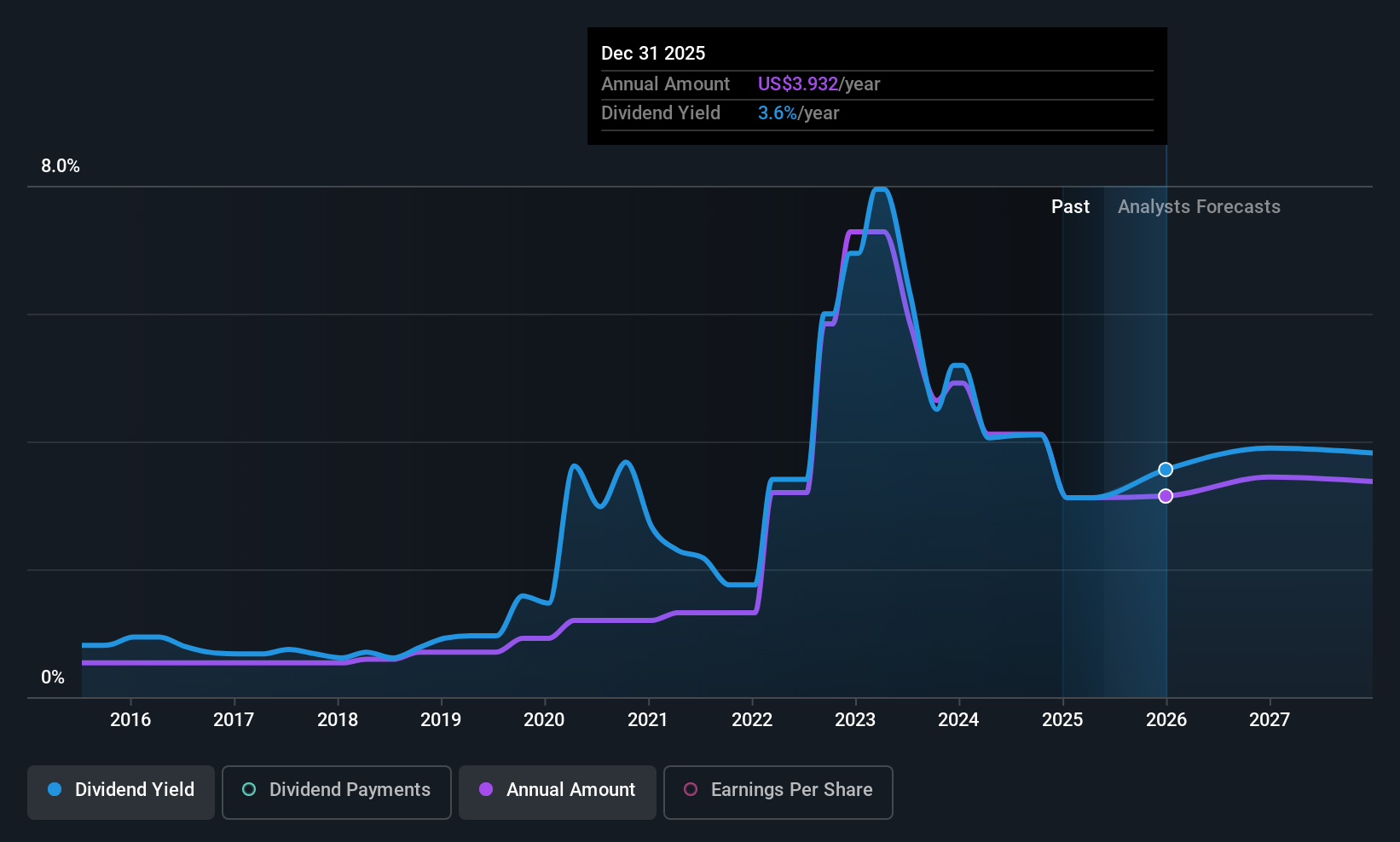

EOG Resources (NYSE:EOG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EOG Resources, Inc. is engaged in the exploration, development, production, and marketing of crude oil, natural gas liquids, and natural gas across various producing basins in the United States and internationally with a market cap of approximately $60.13 billion.

Operations: EOG Resources generates revenue primarily through its crude oil and natural gas exploration and production segment, which accounted for $23.48 billion.

Dividend Yield: 3.5%

EOG Resources maintains a low payout ratio of 34.7%, ensuring dividends are well covered by earnings and cash flows, with a cash payout ratio at 38.6%. Despite an unstable dividend track record, payments have grown over the past decade. The recent annual dividend rate is US$3.90 per share, yet its yield of 3.54% is below top-tier US payers. Recent developments include an Abu Dhabi oil concession and ongoing shareholder activism regarding climate-related disclosures.

- Navigate through the intricacies of EOG Resources with our comprehensive dividend report here.

- Our valuation report unveils the possibility EOG Resources' shares may be trading at a discount.

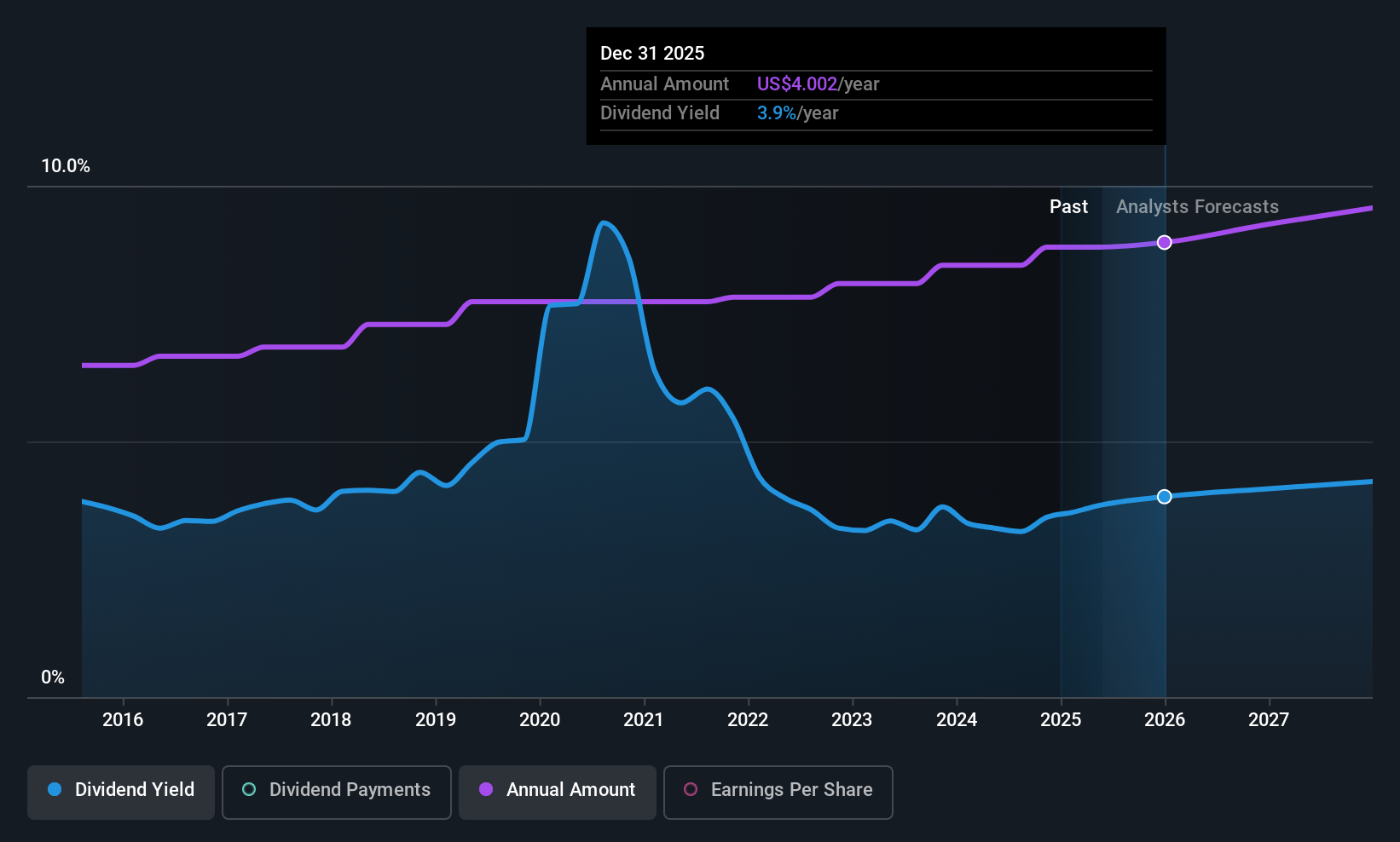

Exxon Mobil (NYSE:XOM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Exxon Mobil Corporation is involved in the exploration and production of crude oil and natural gas across various regions including the United States, Canada, the United Kingdom, Singapore, and France, with a market cap of approximately $444.02 billion.

Operations: Exxon Mobil's revenue segments include Upstream operations in the United States ($53.26 billion) and internationally ($56.32 billion), Energy Products in the United States ($122.10 billion) and internationally ($182.15 billion), Chemical Products in the United States ($15.53 billion) and internationally ($17.68 billion), as well as Specialty Products in the United States ($8.04 billion) and internationally ($12.86 billion).

Dividend Yield: 3.8%

Exxon Mobil's dividend payments are well-supported by earnings and cash flows, with a payout ratio of 51.4% and a cash payout ratio of 60.6%. The company has consistently increased dividends over the past decade, although its yield of 3.84% is lower than top-tier US dividend payers. Recent developments include a $0.99 per share second-quarter dividend declaration and ongoing strategic divestments in Singapore's retail sector as part of broader market alignment efforts.

- Take a closer look at Exxon Mobil's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Exxon Mobil shares in the market.

Turning Ideas Into Actions

- Gain an insight into the universe of 145 Top US Dividend Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exxon Mobil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XOM

Exxon Mobil

Engages in the exploration and production of crude oil and natural gas in the United States, Canada, the United Kingdom, Singapore, France, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives